Crypto analyst Dan Gambardello has reignited bullish sentiment around Cardano (ADA) after pointing to a technical pattern closely resembling the setup before its 2020 rally. According to Gambardello, key indicators on ADA’s monthly chart are aligning once again, signaling the possibility of another major breakout.

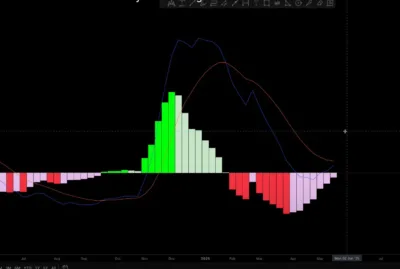

Gambardello, founder of Crypto Capital Venture, emphasized the significance of the Moving Average Convergence Divergence (MACD) on the monthly timeframe. Historically, when the histogram turns green early on, it’s a good sign that an ADA price increase could follow shortly. The current situation, he said, is much like when Cardano rapidly rose from $0.11 to over $1 between November 2020 and January 2021.

Also Read: Binance Founder Backs Dubai for Crypto Boom, Unveils AI School Project

Even though there is still part of the month to go, Gambardello noted how significant this early MACD signal could be. He said that even though events have been repeated in the past, the stock market can still experience ups and downs in the short term.

Source: Dan Gambardello

The Cardano Risk Model, which comes from Crypto Capital Venture, supports his optimism. According to the model, risk is now measured as 42. Before ADA saw a major bull phase in late 2020, this very same level was reached in November 2020. Gambardello said that the current environment is just like the old low-risk one, which suggests that interest rates will likely rise just as before.

ADA Faces Key Resistance as Technical Patterns Point to Breakout Potential

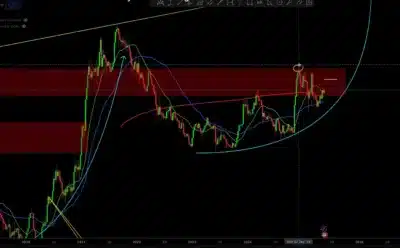

Zooming into the short-term chart, Cardano recently completed an inverse head and shoulders pattern, followed by a bounce from the neckline at the 20-day moving average. However, the next major challenge lies in breaking above the 200-day moving average, which now acts as a strong resistance level.

Gambardello sees $1 as the next significant target if ADA clears that barrier. This corresponds to a psychological achievement and matches with the technical proportion. According to him, the price zone between $1.20 and $1.25 has often acted as a historical resistance, which he called the bull market door.

Source: Dan Gambardello

Even though ADA’s RSI stands at 64.76, indicating it’s approaching overbought territory, the coin may keep going up. He noted that slight corrections don’t change the main direction of the market.

Source: Tradingview

Technicals and risk signs are coming together for Cardano, similar to the time before the 2020 rally. Temporary resistance could halt the upward trend, but the indicators suggest a big move might develop. Now, people in the markets are paying attention to ADA’s struggle with the 200-day moving average as it seeks to break out.

Also Read: Braza’s USDB Stablecoin Debuts on XRP Ledger to Shake Up Regional Finance