While the U.S. CPI brought optimism to the market, the inflation increase spoiled the picture. The altcoin market quickly followed this tendency.

TL;DR

- Bitcoin follows CPI updates with a 1.5% correction. The core rate rose 0.3% against economic forecasts.

- DOGS became the third-largest asset by holder count, ceding the lead only to USDT and Ether.

Bitcoin Followed Inflation Surge, Down to $56K

While the U.S. Consumer Price Index (CPI) came in as expected in August, the core rate exceeded economic forecasts with 0.3% growth. The headline CPI rose 0.2% in August. On a year-over-year basis, CPI was higher by 2.5% against expectations for 2.6% and 2.9% in July. Meanwhile, the core inflation rate year-over-year was 3.2% against an anticipated 3.2% and 3.2% in July.

Ultimately, the rates are likely to establish the outlook for the Federal Reserve to cut its benchmark lending rate by just 25 basis points next week. Amidst a natural decrease due to the CPI rate expectations, the price of Bitcoin (BTC) fell a bit more in the hours following the news, securing a 1.6% decrease to $55,591, however, have now recovered above $58,000.

Read Also: Michael Saylor Predicts Bitcoin to Hit $13 Million, Billy Markus Responds with Humor

BTC/USDT 1D chart. Source: WhiteBIT TradingView

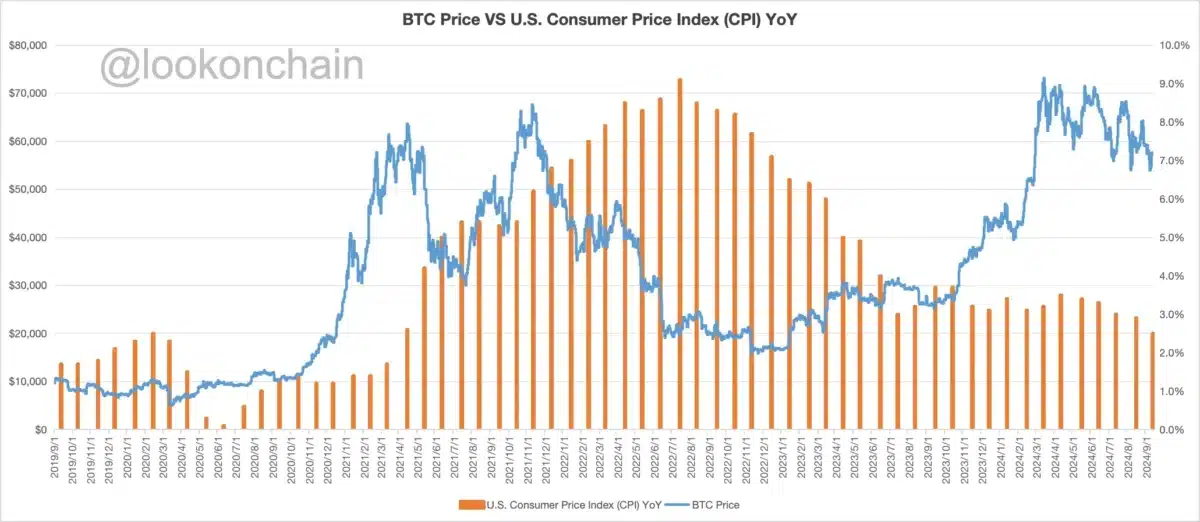

Such correction is natural for the market. Lookonchain analysts revealed a correlation between CPI and Bitcoin price, noting that an inflation rate decrease is followed by a BTC price influx.

Bitcoin price and CPI rate relation. Source: X/Lookonchain

Meanwhile, interest rate traders had priced in a 71% chance for the Fed to cut the rates by 5%-5.25%, according to CME FedWatch.

Altcoin Market Squeezes as DOGS Become the Third by Holder Count

The majority of altcoins responded to Bitcoin correction with southward movements, as per the data of CoinMarketCap. Solana (SOL), Toncoin (TON), and Dogecoin (DOGE) sought roughly a 2%-3% decrease, with a fair share of altcoins following the same trend. Ultimately, the capitalization of the altcoin market has not seen any dramatic changes.

Cryptocurrency market total market capitalization (excluding Bitcoin and Ether). Source: TradingView

Meanwhile, a Telegram-native memecoin DOGS (DOGS) has broken a milestone, with 17 million users claiming tokens shortly after its launch. According to the data from Tonviewer, over five million wallets now hold DOGS on the TON blockchain, while daily active user address numbers have surpassed .1.1 million multiple times. Only Tether’s USDT on the TRON blockchain and Ethereum (ETH) have more holders than DOGS.

This signifies the success of Telegram-based apps, which manage to withstand macroeconomic turbulence – the crucial factors investors should take into account in the following weeks.

Read Also: Metaplanet Buys Additional Bitcoin to Increase its Balance