Investors are eager for large rate cuts as the market hesitates for any sharp moves.

TL;DR

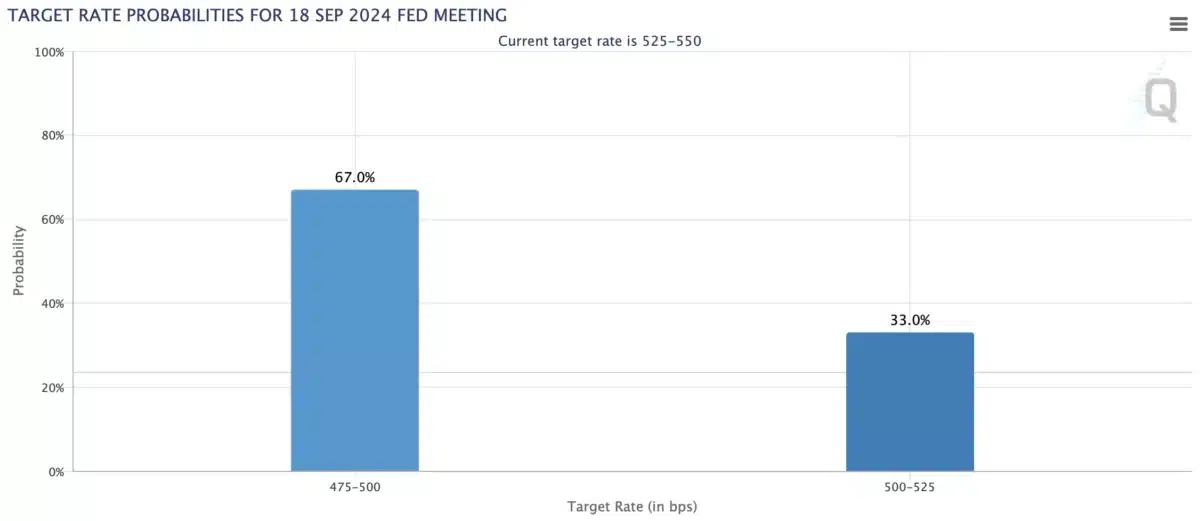

- The probability for 50 bps rate cuts increased to 67%, CME FedWatch reveals. This is a strong uptick compared to Monday’s 50% probability and August’s 25% one.

- Bitcoin, Ether, and a majority of the top 10 coins have been trading sideways.

- Sui (SUI) takes over as a top gainer, with over 23% weekly surge.

Bitcoin and the crypto market overall have been indicating a slight positive momentum for the last 24 hours as investors see a nearly 70% probability of a bigger 50 bps rate cut to the 4.7%-5% range. According to the CME FedWatch tool, traders express hopes for a 67% probability of a sharp rate cut. This is a spike from Monday’s 50% probability and the 25% probability rate in August.

Read Also: Shiba Inu Community Voices Frustration Over Binance’s Exclusion of BONE Amid New Listings

Target rate probabilities for the September 18 Fed meeting. Source: CME FedWatch

Meanwhile, the majority of the market remains flat as investors are looking forward to a Federal Open Market Committee (FOMC) meeting on Wednesday, reluctant to make any sharp moves before the rate cuts are introduced. Bitcoin (BTC) is trading for $58,760, up 2% since hitting local $57,500 bottom on Monday.

BTC/USDT 1h chart. Source: WhiteBIT TradingView

Neiro and Sui on Top

The broader market sentiment indicates a sideways movement. Ether (ETH), which has been demonstrating a strong bearish bias for quite a period, is trading for $2,307. The Bulls are trying to gain momentum after a Monday 6.5% downsurge.

ETH/USDT 1h chart. Source: WhiteBIT TradingView

Read Also: Binance Brings BNSOL to Expand Staking with Solana

The top assets like Solana (SOL) and Ripple (XRP) did not change in price, while Dogecoin (DOGE) and Toncoin (TON) added 5% to their prices. Still, the market interest has been mostly led by new memecoin listings: Neiro Ethereum (NEIRO) and Baby Doge Coin (1MBABYDOGE). While NEIRO down surged over 11% in the last 24 hours, 1MBABYDOGE has skyrocketed over 23% after Binance listing.

1MBABYDOGE/USDT 1h chart. Source: TradingView

However, the investors’ eyes are cast on Sui (SUI). Trading downwards since March, the altcoin managed to recover 23.65% for the recent week, adding over 3% just in the recent 24 hours.

SUI/USDT 1D chart. Source: WhiteBIT TradingView

As SUI broke out from the descending channel, bulls are expecting a $2 rally.

Read Also: Ripple CTO David Schwartz Discusses Blockchain Immutability Amid XRP Ledger and Ethereum Issues