This week, President Donald Trump’s latest tariff measures have intensified global market instability. His newly confirmed trade actions have triggered sharp sell-offs across equities, currencies, and digital assets.

On April 3, foreign car manufacturers will face a 25 percent import tax, whereas on April 5, trading partners must pay at least 10 percent import duties. Beginning on April 9, nations in sixty countries will need to follow new trade policies.

China’s government must confront the most significant trade measures because they implemented a 34 percent import duty, raising its total import tax to 54 percent. White House administrators detailed that new trade regulations were designed to solve enduring U.S. trade deficit problems in the economic framework.

Also Read: All Eyes on Paul Atkins: Will Trump’s SEC Pick Unravel the Future of Crypto Regulation?

Right after its public disclosure, Bitcoin triggered a rapid market reaction through a 7 percent decrease, which began promptly after its launch announcement. At the moment when the dollar faced significant decreases against currency pairings worldwide, U.S. stock prices experienced a major market-wide decline. Market rates of the 10-year Treasury reached their lowest level since October, dropping to 4 percent.

Industry experts attribute declining yield rates to Federal Reserve policies that could stabilize the economy, given their increased likelihood. The crypto market faced overwhelming confusion, which caused professionals to sell away more than $450 million worth of futures contracts.

Arthur Hayes Sees a Bullish Outlook for Bitcoin Amid Global Monetary Pressure

Arthur Hayes dissented from market wisdom when he asserted that Bitcoin could do well in circumstances of economic instability. According to Hayes, economic instability, along with depreciating dollar value, will accelerate the market need for physical assets.

Hayes used a social media post to specify how central bank intervention would generate interest in Bitcoin. Hayes found that the quantitative methods in monetary easing procedures cause investors to buy Bitcoin and gold because these assets maintain their value during inflation.

Source: Arthur Hayes

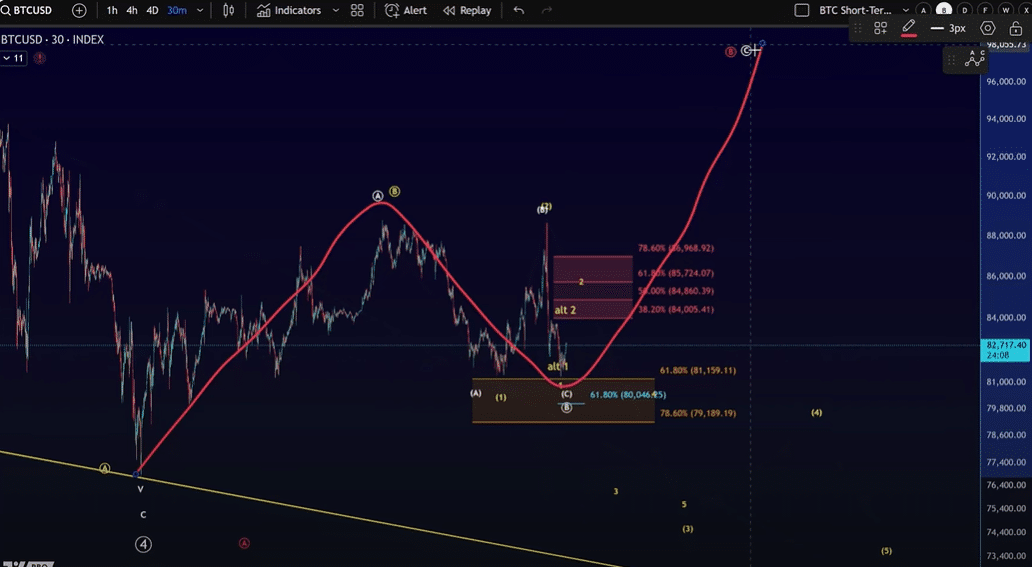

Bitcoin maintained its price volatility on April 4 following recent market decreases while achieving minimal price increases on that day. The analysis team at MoreCryptoOnline anticipates Bitcoin will establish support at $79,900 or $81,160.

Source:MoreCryptoOnline

A price rise of $85,724 could exceed $84,000, but the resistance point remains at $84,860. Market analysts reveal that price recovery attempts will remain temporary unless fresh buying power appears to push prices higher.

Conclusion

Worldwide financial systems became unsure due to Trump’s trade strategy, reducing values across all types of assets, including crypto ratings. Bitcoin’s readiness to outperform analysts agrees because world economic entities are implementing loose money systems despite investor skepticism.

Also Read: Nominated SEC Chair Paul Atkins Comment on Ripple Lawsuit Surfaces – Here is What He Said