Last updated on May 18th, 2024 at 11:41 am

During a recent sale of 1,700 ETH on Uniswap V3, the Ethereum Foundation faced a sandwich attack resulting in a loss of over $9,000. The foundation which is known for its prominent role in the Ethereum ecosystem didn’t have a planned smooth sale as fell victim to the aforementioned form of crypto attack.

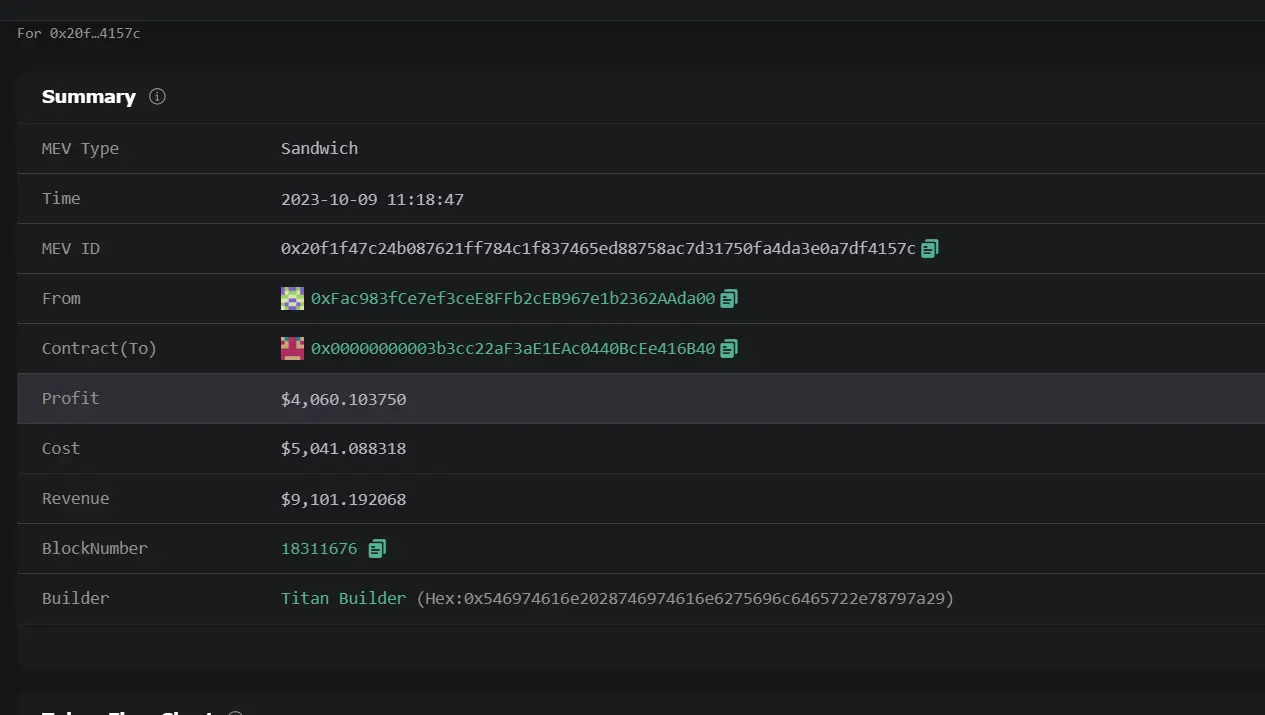

As exposed by EigenPhi – a token flow-oriented data platform, an MEV Bot (0x00…6B40) targeted the Foundation’s transaction on October 9. The attack resulted in exactly $9,101 transaction loss for the Ethereum Foundation. However, the attacker managed to make a profit of $4,060 after covering its cost.

Source: EigenPhi

The Foundation sale which took place on Oct 9 at 16:18 UTC+8 saw an exchange of 1,700 ETH for 2.7 million USDC. A Further look into the Foundation’s wallet shows a balance of 240 ETH, 3.24 million USDC, 10,000 ARB, and 49,700 DAI.

The easy attack of such a prominent organization in the crypto space raises further questions about the security measures in the crypto world and the measures in place to prevent such occurrences.

Crypto sandwich attack

A sandwich attack is a kind of crypto attack that deals with price manipulations. It is a tactic used to attack decentralized exchanges. In this kind of attack, the perpetrator identifies a pending transaction on the Ethereum network, quickly places their own transactions with higher gas fees, and then ensures that it gets processed first.

Following this, they wait for the target transaction to process and thereafter place another transaction effectively “sandwiching” the target transaction by having a transaction before and after. The result of this kind of attack is immediate price manipulation to ensure that they can profit from the victim’s trade.

On the sales made by the Ethereum Foundation, an interesting pattern has been noticed. Frequently, it sells off Ethereum shortly before large sell-offs take place. Although it is speculative to make inferences, astute market watchers have taken note of the timing of its sales in relation to market fluctuations.

Read more: