- Ethereum faces key resistance near $4,600, eyes breakout opportunity.

- Whale activity could trigger major price moves, shaping Ethereum’s direction.

- Ethereum’s $4,200 support zone remains crucial for short-term price action.

As September 5 approached, Ethereum’s price was hovering around $4,505, testing the upper boundary of a significant resistance level at $4,600. Traders were particularly focused on the $4,000–$4,200 support zone, which had previously shown solid liquidity. With Ethereum trapped between these critical levels, the market awaited a clear directional signal, which would likely come from whale activity or a break above or below these zones.

Also Read: Floki (FLOKI) Price Prediction 2025–2030: Will FLOKI Hit $0.00020 Soon?

Ethereum Holds Below Critical Resistance Level

On the daily chart, Ethereum continued to show signs of consolidation below a descending trendline from the late August highs. The price was compressed between the 20-day EMA at $4,327 and the $4,600 resistance, forming a tightening structure that indicated an impending move.

At this stage, momentum indicators like the RSI, sitting at 57, revealed a balanced market sentiment, showing neither strong buying nor selling pressure. Ethereum’s price remained above its 50-day EMA at $4,249, offering some support around the $4,200 zone.

Source: Tradingview

If the price broke above $4,600, Ethereum could quickly test the $4,700–$4,800 resistance range. However, if the price failed to clear this level, a pullback toward the $4,200–$4,000 region seemed likely, as this zone had provided substantial support in recent months.

Whale Activity Could Drive Significant Price Movement

According to market analysts, liquidity heatmaps showed that Ethereum’s price was particularly sensitive to the $4,000–$4,200 and $4,600–$4,700 zones. Large holders were believed to be waiting for the right moment to trigger either a liquidity sweep or a breakout. These liquidity clusters could potentially fuel a sharp move in either direction.

In particular, analysts observed that a minor pullback towards the $4,200 region would allow whales to absorb bids, providing a strong foundation for a potential push toward $4,700. If this scenario played out, Ethereum could regain upward momentum. Conversely, failure to maintain above the $4,200 support level would likely push the price back to the $3,900 range.

Ethereum’s On-Chain Data Signals Accumulation

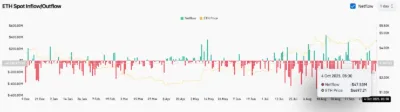

Exchange outflow data from Coinglass revealed a net outflow of $47.53 million on September 5, indicating moderate accumulation among investors. While this level of outflow was not yet substantial enough to signal full institutional commitment, it was a clear sign of positioning for potential price growth. Similar accumulation patterns were observed in August before Ethereum’s price surged above $4,000, adding credibility to the bullish sentiment.

Source: Coinglass

However, with liquidity remaining thin between $4,200 and $4,700, the risk of sharp whipsaws remained, as the price could quickly change direction based on whale actions or sudden shifts in market sentiment.

Short-Term Outlook for Ethereum

As Ethereum’s price navigated between the critical support at $4,200 and resistance at $4,600, the market was waiting for a clear signal from whale activity. If Ethereum held above $4,200, the bulls could continue pushing toward the $4,700–$5,000 range, with a potential breakout above $4,600.

However, if the price failed to sustain its levels, a retreat toward $3,900 would become more likely, indicating a potential correction in the market. As September 5 neared, traders and investors kept a close eye on these key price levels, waiting for the next major move.

Also Read: SKALE (SKL) Price Prediction 2025–2029: Will SKL Reach $0.05 Soon?