Tether blacklisted almost 30 wallets in a single day with billions of dollars flowing through the network, achieving a milestone, crypto security monitor reports.

On December 2, crypto intelligence company Chain Argos stated that Tether broke the record by blocking 28 crypto addresses with turnover counting up to billions of dollars.

🚨 Tether has blacklisted 28 new wallets which may be a record for a single day. Not only that, these wallets collectively have sent and received billions of dollars worth of $USDT over their lifetimes, with $161 million of that having come from a single exchange:

WhiteBIT. pic.twitter.com/yFYcetslt3

— ChainArgos (@ChainArgos) December 2, 2023

In the post on X (formerly Twitter), ChainArgos emphasized the WhiteBIT cryptocurrency exchange, claiming that around $160 million worth of crypto was transferred specifically from it.

The statement by ChainArgos evoked doubt from the community, as most of the addresses showcased did not belong to the WhiteBIT cryptocurrency exchange or were not operating with it.

“As I see these are different wallets, why is only Whitebit mentioned?”, an X user commented under ChainArgos post, clearly hinting at the company’s inaccuracy.

Questions also arose as ChainArgos did not cite any specifics of AML-policy implementation. The company did not comment on the period, for which addresses were involved in unauthorized transactions.

All things combined may sign that ChainArgos could have speculated on the representation, targeting WhiteBIT specifically. To find out, we’ve dived into the case deeper and carried out a small investigation of ChainArgos’ credibility.

ChainArgos Case: Details

The case is quite interesting, and it has something to observe in more detail because the spreading of the insight is full of unverified information.

The essential question is “Why was the only WhiteBIT mentioned?“. To be honest, it looks like FUD, sponsored by competitors, and is similar to the situation the crypto exchange faced within the original Protos edition’s article, which has been debunked by many crypto journalists. I often mention the importance of checking all information that is read by the crypto audience. No proof – no trust.

Well, let’s make a bit of an observation from an analytical standpoint. Looking at the list of addresses more closely, we can see that not all, and not even many, are owned by WhiteBIT.

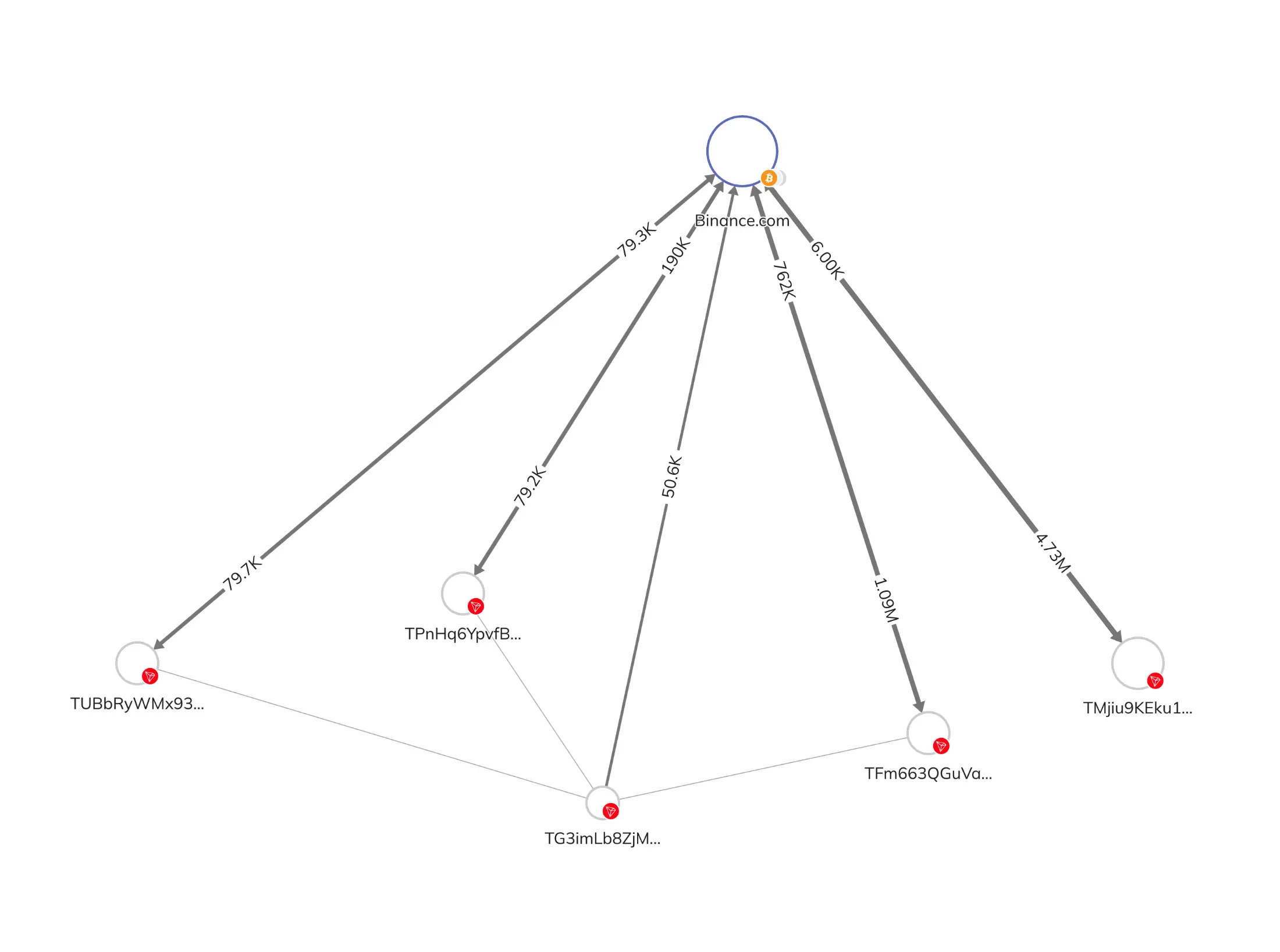

Schematic visualization of crypto funds’ distribution through the wallets, blacklisted by Tether

The next confusing point is the constant mentioning of Justin Sun within the context of WhiteBIT. Last time in the Protos article, which is also supposedly promoted by competitors of the exchange, an unknown author claimed:

“Although that 24.8% is five times the average USD money market rate — a red flag if there ever was one — WhiteBIT has a variety of connections to Justin Sun and his Huobi exchange. Funds flow frequently between WhiteBIT and Huobi. Those connections make that APY figure slightly less remarkable, although no more reassuring.”

Since the last time, the presentation of information has not changed, it still has no other arguments or points of connection. As we’re aware, disinformation is spreading in the blockchain industry, unfortunately.

This is strange for me as a journalist because, unlike political and economic types of disinformation, in the crypto industry, accusing someone of money laundering is not so easy.

The main reasons for the failure to disseminate false information are the lack of evidence, transaction screenshots, translation data, the vulnerability of a company’s system, and many other factors.

To sum up, the previous information I explained about his case, I want to focus on the importance of checking all information related to such topics as AML, hacker attacks, etc. And not relying on data that can be pre-defined as purchased and unverified.

Read more: