Last updated on February 14th, 2023 at 08:39 am

Different recent events have affected the price of the cryptocurrency. The war in Ukraine and economic concerns are a few examples.

When there are tough times such as these, investors tend to look for the safest investments and flock to them. It is no news that the crypto market has been suffering lately because of these circumstances and as a result, people make some big mistakes that they end up regretting.

Cryptocurrency is very volatile and which makes it a very risky investment. We always advise you to DYOR (Do Your Own Research) before making decisions. The industry is quite new and we can only predict what the future holds.

Since late last year, the value of the cryptocurrency market has fallen from $3 trillion to about $1 trillion. It is clear these are issues and it could be giving you issues right now, but it shouldn’t be a reason to give up hope and quit. You should be very careful and make sure not to make this particular cryptocurrency mistake.

What is this mistake?

There is a particular mistake people are likely to make and that mistake is “selling off all your cryptocurrency holdings during a bear market.”

Let’s examine it. According to history, bear markets don’t last forever, they are always temporary and the market usually bounces back and becomes better. Cryptocurrency is still in its early stage. Bitcoin was first launched in 2009. When comparing it to the stock market, the New York stock exchange came to exist way back in 1792.

Just like companies and their shares, there are always ups and downs and we have seen them before. We have also seen some reputable companies suffer in the past and then recover. Following this path, cryptocurrency is still young and might reshape the way business is done in the future.

Because of its volatility, cryptocurrency is a risky investment even before the bear market. Bitcoin, Ethereum, and other strong cryptocurrencies still have strong investments case, even though the price is declining.

Taking Ethereum for example, this year alone has seen it lose over 60%, but the investors are still the second strongest in the game after Bitcoin. And it is also a major in decentralized apps and NFTs.

Related: CRYPTO FEAR AND GREED INDEX

What happens when you sell during difficult times?

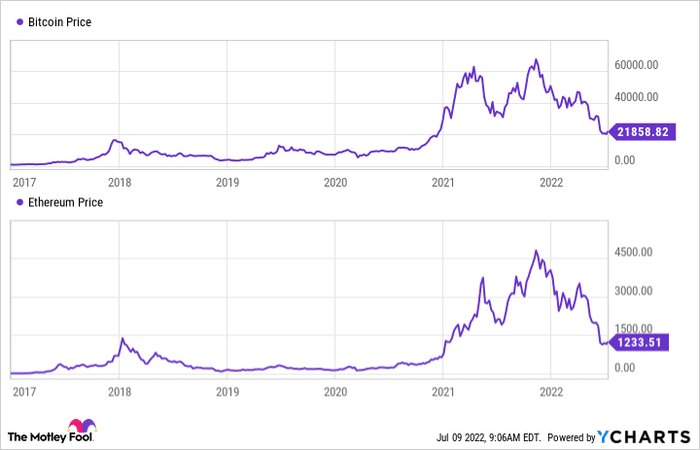

Let’s take a look at the past performance of top cryptos like Bitcoin and Ethereum and analyze what will happen if you sold during the crash. Take for example, if you sold your crypto in 2019 or 2020 after a bear market, then you would have missed out on the breakthrough opportunity in 2021 when Bitcoin rose 60% and then Ethereum gained over 400%.

According to the charts from Motely Fool below, it shows that cryptocurrency has declined in the past and then went on to gain.

You might look at your portfolio right now and get worried, but then the fact is that you haven’t lost until you sell.

But like we always say, crypto investment is a personal decision and should be done only at one’s discretion. If you look at your portfolio and you have lost faith in a particular asset and you think the dip will only continue to deepen, then you should sell and exit that position.

However, if you still believe in the future of a particular coin, you should hold on to it and not allow the overall performance of the market to make you take a move you will regret.

Instead, think of your investment with a long-term plan and you will be able to avoid these mistakes.

Please help share this post on your social media and also with friends who you think might be interested in it.