- XRP drops as tariffs and economic signals shake crypto confidence.

- Increased liquidations pressure XRP despite rising 24-hour trading volume.

- Tariff impact and Fed caution drive XRP’s 6.36% plunge.

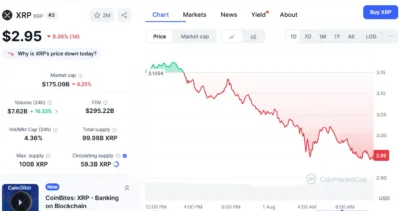

XRP has recorded a steep decline in value today, sliding by 6.36 percent to $2.95 as of August 1. The drop reflects broader concerns in the financial markets triggered by new U.S. trade tariffs and weakening investor sentiment across digital assets.

The fall started early, as XRP traded up to $3.15, only to be met by steady pressure that saw XRP drop. As per CoinMarketCap data, the price did not manage to recoup after dropping below the $3.00 mark in the pre-dawn hours. XRP reached a daily low of $2.95, marking its weakest performance in the past 24 hours.

The sell-off is taking place amid rising economic tension following the U.S. government’s new tariff policy. Tariffs, which are raised between 15 and 40 percent, have affected more than 70 countries.

Copper is considered a critical material, and it is currently being taxed at 50 percent, compared to 25 percent in India. As calculated by the U.S. Trade Office, this will raise consumer prices by up to 3 percent.

Also Read: Solana ETF Filings Updated as SEC Signals Shift Toward Crypto Approval

Tariff Tensions and Market Liquidity Weigh on XRP

As trade disruptions unfold, industries that rely on hardware components and raw materials, including cryptocurrency operations, are feeling the impact. XRP is particularly exposed due to its role in payment infrastructure and blockchain services, which require technological resources and are subject to new trade costs.

Meanwhile, the announcement by the Federal Reserve that it did not change the interest rates did not help calm the markets. The plummeting growth, which the central bank cautioned, has also put investors on edge by pulling the exposure to risk-based financial assets like altcoins.

The trading volume of XRP shot to $7.62 billion, or an 18.33 percent increase, in the same period. Nevertheless, the expansion of volume is linked to liquidation and not new inflow, while the XRP market cap simultaneously fell by 6.25 percent to $175.09 billion.

Overall, the liquidations in the crypto market totaled almost $632 million, and the loss was more severe for altcoins than for Bitcoin. The fall in the price of XRP is in consonance with the trend and proves again that altcoins are highly susceptible to exogenous shocks.

XRP’s price decline today is directly tied to mounting trade-related uncertainty and increased market volatility. The combined effects of new U.S. tariffs, economic caution, and high liquidation levels have created downward pressure, pushing XRP to its lowest point of the day.

Also Read: Bitcoin, Ethereum, XRP Tumble as These Altcoins Skyrocket Over 60% Today