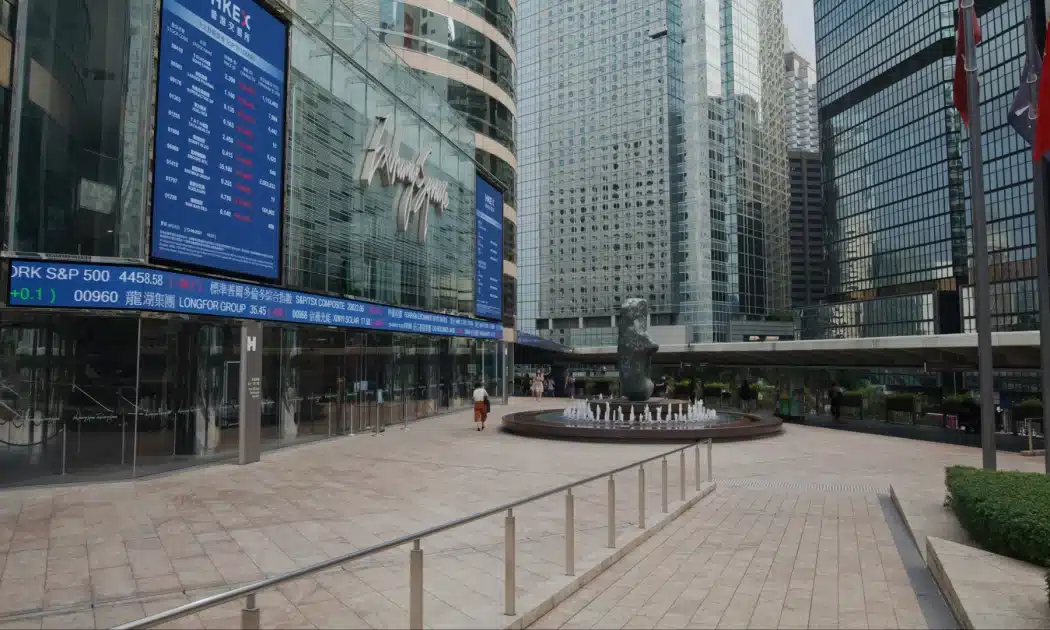

How Hong Kong’s move is seen as a better standing point compared to the SEC’s. The Securities and Futures Commission, the Hong Kong market regulator, has followed the US steps by approving Bitcoin and Ethereum-tied exchange-traded funds (ETFs).

At least three Chinese asset managers – ChinaAMC (HK), Bosera, and Harvest Fund – have posted on the social media platform WeChat (Weixin) that they had been approved to list spot Bitcoin and Ether ETFs in Hong Kong.

The announcement seems to have outpaced an official statement from the Securities and Futures Commission that has not commented on the ETF approval yet.

How Significant an Approval Is

Hong Kong’s preliminary approval of spot ether exchange-traded funds could give the region a competitive edge over the U.S. in the retail spot ETF market. In the latest interview for The Block, Gary Tiu, executive director at Hong Kong-based OSL Securities, noted:

“Right now, the U.S. has not approved any spot products. So, the Hong Kong managers are certainly standing in a very good position when they launch the ETH products in Hong Kong for sure.”

OSL was approved as the first sub-custodian partner for ChinaAMC’s BTC and ETH ETFs. The same outlook is shared by Angel Ang, a former regulator at the Monetary Authority of Singapore and senior policy advisor at blockchain intelligence firm TRM Labs. He exclusively commented for The Block:

“Hong Kong’s approval of the spot ether ETFs comes ahead of a US decision and is a significant milestone in Hong Kong’s journey to become a leading crypto hub. “With fewer alternatives for Ethereum exposure, we might see the ether ETFs attract more investor interest.”

The Hong Kong approval came amidst the SEC’s scrutiny of the Ethereum Foundation, which seems to halt the process of allowing Ether ETFs to be listed.

Read Also: Is SEC Halting the Ethereum ETF?

SFC’s ETF approval marks the global trend for crypto’s institutional adoption, accelerated this year. Simultaneously, Ukraine released its first stablecoin UAHg, which has already been used by WhiteBIT to introduce fostering activities for the users. The ones also include a pre-halving contest, set to highlight the significance of the event.

Meanwhile, Singapore-based digital assets trading house QCP Capital said in a message to CoinDesk that it believes the ETFs, when approved, will unlock some institutional demand during trading hours.

“Participants who wanted exposure have always been limited to US hours, but this now gives institutional investors an Asia-based alternative,” QCP wrote. “We believe this will be bullish short term, but there are more important narratives and drivers such as macro events.”

A Competition Ahead?

While SFC’s ETFs have been seen more favorably compared to the US ones due to the Ether exchange-traded funds listing, Hong Kong pivots with the key investment features: in-kind subscription and redemption options.

According to Gary Tiu, the upcoming spot Bitcoin and Ether ETFs are expected to allow investors to subscribe for ETF shares using BTC and ETH directly.

“The fund can accept in-kind subscriptions,” explained Tiu. “What it means is if you have an investor who has long BTC. But they don’t want to exit the BTC position. But they want to swap it for another type of instrument — for example, for an ETF instrument or for an interest in the fund that tracks the performance of BTC — this now gives them the channel to do so.”

Tiu added that the feature is significant as it hasn’t been done in other markets, “certainly not in the retail fund space.” What Gary Tiu also sees is a potential war in costs and fees in the Hong Kong market. A similar competition took place after the US SEC spot BTC ETFs approval.

Macroeconomic Objectives

Samson Mow, investor and crypto market commentator, highlighted that SFC’s approval of Bitcoin ETFs is an opportunity for Asia to accumulate more BTC.

“The Hong Kong Bitcoin ETFs will feature in-kind creation and redemption. This is a move to one-up the U.S. ETFs. The race is on to accumulate BTC in Asia,” he wrote in the post on X.

A similar tendency was noted by the VanEck analysts. Patrick Bush, crypto research analyst at the asset manager, wrote that Chinese investors were behind the recent gold accumulation and price surge:

“Our gold team at VanEck, S-tier, believes that gold’s parabolic rise is due in large part to Chinese buying. Chinese investors want hard assets as their real estate market and stock market have proven flimsy.”

Market Reaction

The effect of the SFC’s moves has not been reflected in the market yet. Antony Scarramucci, Bitcoin maxi and former White House executive, noted that the post-ETF price development has not been priced yet: “Hong Kong has approved Bitcoin and Ethereum ETFs. Not priced in.”

At the writing time, Bitcoin (BTC) is trading for $63,125, following the 9.13% weekly decrease, which heavily intensified due to Iran’s attack on Israel.

Read Also: Bitcoin Endless Rebounds: Pre-Halving Volatility Hallmark?

BTC/USDT 4h chart. Source: WhiteBIT Trading View

Ethereum (ETH) is trapped in bearish momentum as well. The coin has been indicating a 15% downtick for the recent 7 days, pricing for $3012.66 as of writing time.

ETH/USDT 4h chart. Source: WhiteBIT Trading View

Notably, the launch day of Hong Kong spot Bitcoin and Ethereum ETFs hasn’t been disclosed, leaving a seat for a prospective potential. Even so, Gary Tiu affirmed that the approvals show that the launch day is “very soon.”

The approval of spot Ether ETFs makes Asia a pioneer, heating the ongoing financial competition between the USA and the “tigers”.