Last updated on May 18th, 2024 at 12:45 pm

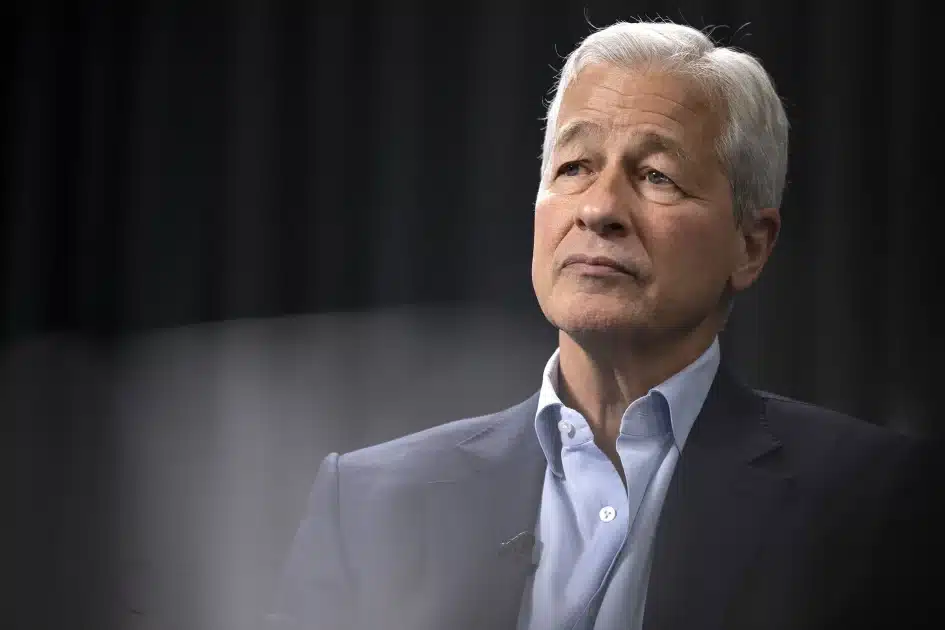

Jamie Dimon, CEO at JPMorgan Chase, reiterates his criticism of Bitcoin as a “Ponzi scheme” while bank analysts scrutinize the crypto market.

CEO of JPMorgan Chase, Jamie Dimon, has stressed another strong denouncement of Bitcoin (BTC). In a recent interview with Bloomberg, Dimon labeled the leading cryptocurrency “a public decentralized Ponzi scheme”, implying the fraudulent nature of the asset.

“If you mean crypto like Bitcoin, I’ve always said it’s a fraud,” he stated during the interview, marking the long-standing skepticism against Bitcoin.

Dimon’s Controversial Stem on Bitcoin

Jamie Dimon has been expressing his harsh criticism towards Bitcoin since 2017, citing that the asset doesn’t hold intrinsic value and hence incapable of functioning as a viable currency.

The first criticism was brought on the face in a New York investor conference, during which Jamie Dimon stated that if any of his brokers were found trading Bitcoins, he would “fire them in a second”. He also said the cryptocurrency was “worse than tulips bulbs”, referring to a famous market bubble from the 1600s.

The critical rush struck again as Dimon argued he would “close down” crypto if he were the government. “It should have immediately been put in some kind of regulatory framework so that there’s some investor protection,” he later said in an interview for Fox Business, adding that regulators were starting to come up with safeguards, but now “the barn door has opened” for them to do so.

Read Also: Hong Kong Approves Bitcoin and Ethereum ETFs, Market Reaction

Moreover, amidst 2023 Davos Economic Forum, Dimon told CNBC, “Bitcoin itself is a hyped-up fraud, it’s a pet rock,” making it clear once again that the top executive doesn’t care about Bitcoin and questioning its 21 million coin capitalisation.

“How do you know it’s gonna stop at 21 million?” he added. “Everyone says that well, maybe it’s gonna get to 21 million and Satoshi’s picture is going to come up and laugh at you all.”

While Jamie Dimon is heavily criticising Bitcoin, he acknowledges potential of the blockchain technology, citing it to revolutionise transactions and data operation.

“Blockchain is real. It’s a technology. We use it. It’s going to move money. It’s going to move data. It’s efficient. We’ve been talking about that for 12 years,” Dimon said.

His endorsement of blockchain is grounded in its practical utility, a view that aligns with JPMorgan’s innovative approach toward financial technology.

JPMorgan Warns About Crypto Market’s Downside Risks

By contrast to Jamie Dimon’s stance, JPMorgan Chase puts the cryptocurrency market in the spotlight. Just a couple of days before CEOs resounding statement, JPMorgan published a report, raising concerns about cryptocurrency markets.

According to JPMorgan analysis led by Nikolaos Panigirtzoglou, the relative tepid flow of venture capital funding into the crypto industry this year presents a downside risk, despite the recent crypto market resurgence.

“Our various proxies for crypto VC flows look rather subdued YTD (year to date) relative to previous years,” as stated in the research. “We had previously argued that a recovery in crypto VC flows is a necessary condition for a sustained recovery in crypto markets, so in our minds, the subdued VC flows YTD pose a downside risk.”

Venture capital funding in the crypto sector has picked up momentum so far this year, yet it continues to lag behind previous years. The Block’s data shows that the crypto industry has attracted $3.2 billion in VC investment year-to-date, compared to over $4 billion in the first four months of last year.

Meanwhile, JP Morgan’s analysts detailed that crypto hedge funds have emerged as a more dynamic force this year. Their assets under management have seen a significant surge over the past six months, reaching an estimated $20 billion.

Crucially, in March, JPMorgan reported that Bitcoin still looks overbought despite the recent correction. Panigirtzoglou also stated that it would be “unrealistic to expect Bitcoin to match gold within investors’ portfolios in notional amounts.”

The report was released shortly before Bitcoin’s halving took place. Being slightly spurred by the investment interest and halving activities by WhiteBIT and Coinbase, the asset recovered by 7.60% in the last 7 days.

BTC/USDT 12h chart. Source: WhiteBIT TradingView

ETH ETF Reluctance

JPMorgan’s analysts also heed the perspectives of Ethereum ETF approval, possibility of which is perceived with a sceptical view.

“Following the SEC investigation of the Ethereum Foundation, the optimism for spot ethereum ETF approval by May 23rd appears to be also fading in market pricing as seen by the discount to NAV (net asset value) for the Grayscale Ethereum trust, which widened from 8% to 22% over the past month,” the analysts described.

Nonetheless, the JPMorgan analysts seem to be optimistic about the long-term perspective of Ether ETF approval. The report indicates their confidence that the US SEC will eventually greenlight ETH ETFs, anticipating a similar Bitcoin-ETF-like scenario.

Notably, while Jamie Dimon’s personal attitude to the cryptocurrencies remains controversial, JPMorgan Chase highlights the pivot they created to the modern finance dimension.

Read Also: Is SEC Halting the Ethereum ETF?