- Chainlink leads DeFi rankings as LINK nears key $23 resistance.

- Developer activity surges while LINK price consolidates amid volatility.

- Analysts anticipate breakout as Chainlink strengthens its DeFi dominance.

Chainlink has reaffirmed its dominance in decentralized finance development, maintaining its lead in Santiment’s latest October ranking. Over the past 30 days, the network recorded a development activity score of 491.67, securing the top position once again. According to Santiment, DeepBook Protocol followed with 214.6 points, while DeFiChain came in third with 156.3.

Also Read: XRP Secures Big Institutional Investment, Pro Crypto Lawyer Reacts

Mid-Tier Projects Gain Ground in Developer Activity

The latest rankings also reflect growing competition among mid-tier projects. FOX Token and Lido DAO secured fourth and fifth positions, showing steady developer engagement. Babylon, however, slipped slightly to sixth place with a score of 62.3. Injective, Centrifuge, dYdX, and Curve have also joined the top ten, signaling increased diversity in active DeFi development.

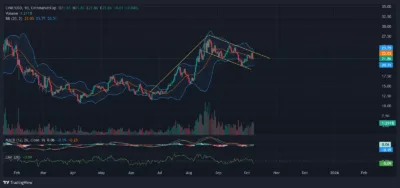

Amid this dominance in developer metrics, LINK’s market performance has shown heightened volatility. The token dropped 7 % in the past 24 hours, while trading volume grew by 5%, indicating strong market participation. Analysts point out that LINK is consolidating within a descending channel on the daily chart. Resistance lies near $23.7, while support is forming around $20.3.

A breakout above $23 could ignite a strong bullish wave, potentially targeting $26 and $30 levels. However, a dip below $20 might open the door for a deeper correction toward $17.5. Bollinger Bands show tightening movement, suggesting that a significant price swing could occur soon.

While the MACD shows mild bearish pressure, signs of convergence are emerging, hinting that bullish momentum could return if market sentiment improves. The Chaikin Money Flow remains slightly negative, confirming mild outflows but no major capital flight.

Source: Tradingview

Developers’ Confidence Reinforces Chainlink’s Strength

Santiment’s data continues to highlight Chainlink’s consistent leadership in the DeFi landscape. Its position reflects strong developer confidence and an expanding ecosystem that remains crucial for blockchain data infrastructure.

The rise of competing protocols like FOX and LDO, along with the resurgence of INJ and DYDX, demonstrates a maturing DeFi sector with growing innovation.

Chainlink’s dominance in development activity continues to set it apart in the DeFi space. With LINK’s price hovering between $20 and $23, analysts are closely watching the resistance level for a possible breakout that could define its next major move.

Also Read: Pundit: ETF Liquidity Surge Could Drive XRP 30–50% Upside