Marathon Digital has made another significant investment in Bitcoin, acquiring approximately 4,144 BTC for $249 million. The purchase, announced on August 14, was funded by part of the proceeds from a recent senior note offering. The average price per Bitcoin in this transaction was around $59,500, which means that Marathon now holds more than 25,000 BTC in its reserve.

The Company offered a convertible senior note of $300 million, of which the gross proceeds amounted to about $ 292.5 million. These notes, due in September 2031, carry an annual interest rate of 2.125% and can be converted into cash, Marathon stock, or a combination of both. Marathon has revealed that more cash from the note sale would be employed to purchase more Bitcoin and for other working needs, which may involve business purchases, including procuring more Bitcoin.

Also Read: BlackRock’s iShares Bitcoin Trust Achieves Top Position in Spot Bitcoin ETF Market

Marathon’s Strategy Amid Market Challenges

Despite current obstacles, Marathon’s newest Bitcoin acquisition is part of a larger attempt to increase its market position. In July, the business purchased 2,282 BTC, worth $124 million, as part of what CEO Fred Thiel termed a “hodl strategy.” This term, which began as a typo of “hold,” has become a well-known expression in cryptocurrency, representing a long-term strategy for Bitcoin investing.

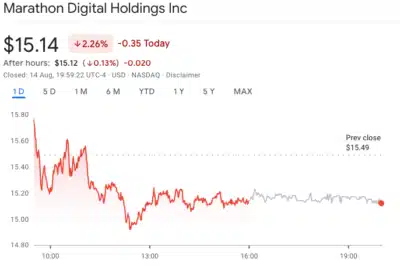

Marathon has been experiencing declining financial performance even with these significant investments. The shares of the Company declined 2.26% on the day of the announcement, trading at $15.14. Year-to-date, Marathon’s share price has dropped nearly 34%, reflecting broader challenges in the crypto mining sector. The firm also posted second-quarter profits earlier this month, which fell short of Wall Street projections, with revenues of $145.1 million, 9% below predictions, but still representing a 78% rise over the same time in 2023.

Source: Google Finance

The margins of generating crypto coins remain low, especially recently due to the latest bitcoin mining shrinkage that cut the amount of newly minted bitcoins by half. Marathon also has one of the highest all-in mining costs. This decline in profitability and other factors indicates that the Company can not sustain these revenues and profits in today’s market environment.

Conclusion

Marathon Digital’s continued investment in Bitcoin highlights its commitment to a long-term strategy, even as the Company navigates a challenging market landscape. With a growing Bitcoin reserve and a clear focus on acquisition, Marathon is positioning itself for potential future gains despite its immediate hurdles in the volatile cryptocurrency market.

Read Also: Today in Crypto: Bitcoin Hovers Above $60,000 As TON Gaining Momentum