Nasdaq (an American multinational financial services corporation) goes ahead to convert almost all its cash reserve into Bitcoin not minding the present state of the crypto market.

After the bitcoin price dropped nearly 60% in the first half of 2022, CEO Michael Saylor still finds the move right and the company keeps buying more digital coins. Could this strategy be a good one — or was it a bad idea?

MicroStrategy (Nasdaq) bought about 480 Bitcoin between May and June 28 as seen in the official filings to the Securities and Exchange Commission (SEC). The total investment totaled $9.9million with the average price per coin being $20,817.

The company now holds bitcoin worth $2.50 billion at today’s prices in its coffers (which is about 129,699 Bitcoins). This shows that MicroStrategy and Saylor expect the bitcoin price to shoot up and investment to turn profitable again after adding 480 coins to its wallet.

Saylor is a big Bitcoin influencer

Michael Saylor is very positive about Bitcoin’s long-term prospects and also believes it to be the currency of the future. Saylor has been spreading his belief in bitcoin, so this is exactly news. It was known that Nasdaq played a big part when Elon Musk’s Tesla bought over $1.5 billion worth of bitcoin last year.

Grayscale Bitcoin Trust, The cryptocurrency investment fund manages a portfolio of about 655,000 Bitcoins, still, no other company compares to MicroStrategy’s large bitcoin investment.

With these said, maybe we shouldn’t see too much of a big deal in MicroStrategy’s little increase in their bitcoin holding. This huge investment by the company is enough to inspire anyone and to assure themselves that the crash wouldn’t last forever. CEO Saylor looks like he is prepared for whatever outcome, if the price goes to zero, he is ready to take the consequences.

Related: What is Bitcoin and Why is it Valuable?

Still, don’t get carried away by the Bitcoin trend

The cryptocurrency market is still growing, and it is still at its early stage. It still doesn’t have a proper regulatory framework yet and some countries around the world are still battling with the acceptance of the digital asset and others are wrestling with specific approaches to take with these assets.

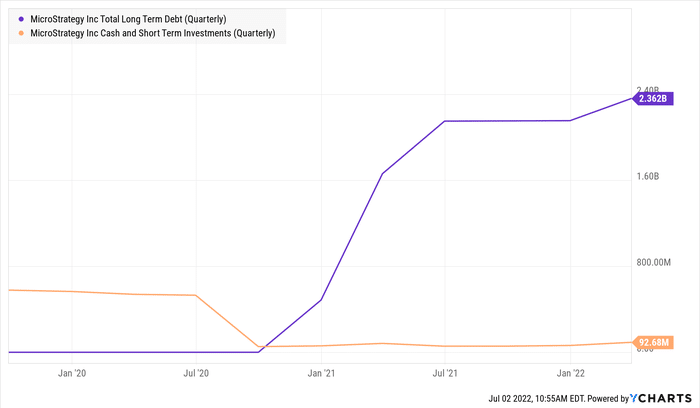

It cost the company about $3.98 billion to gather its bitcoin assets which are now worth just $2.5 billion. You can see the loss and difference in price, this shows the risk is real. The company has posted a huge loss in the last two quarters. If the price of Bitcoin drops even further, creditors would want the company to repay some of the loans they took to acquire some of its bitcoin.

source: Nasdaq

So it won’t be strange if Saylor’s conviction and vision of Bitcoin as a long-term investment lead you to invest some portion of your portfolio in the worlds leading digital currency. It is a risk, and anything could still go wrong, so I advise you to DYOR (Do Your Own Research) before venturing and not just go ahead because MicroStrategy did.

In volatile and risky markets such as this, patience is a virtue and it would be best to keep your bitcoin investment minimum for now before jumping into the exciting but dangerous investment vehicle.

Please help share this article on your social media and also with friends whom you think might be interested in content like this.