SEC finally approves Ethereum ETF while the market reacts with green charts piling.

The cryptocurrency market enters a green rally for the second time in the year as Ethereum ETF gains its seat on Wall Street. While the approval has stolen the spotlight from other cases of positive price dynamics, the significance of the latter remains a topic for the week.

Below – handpicked updates, which hint at the continuation of a bullish sentiment.

Ethereum ETF Finally Cracks Approval

On May 23, the U.S. Securities and Exchange Commission (SEC) approved eight applications for spot Ethereum (ETH) exchange-traded funds (ETFs). The regulator approved 19b-4 forms from the ETF applications filed by Fidelity, BlackRock, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

The approval and preceding optimism took investors aback, as the SEC implicitly stood against approving Ether ETF. The tides turned on May 20, when a senior Bloomberg analyst Eric Balchunas cited a positive change in SEC’s stance on the approval. Around the same period, Reuters revealed that the watchdog asked Nasdaq, CBOE, and NYSE to fine-tune their application to list spot Ether ETFs.

The positive developments fuelled Ether’s market performance, as the asset’s price surged 18% on May 20 and registered another 8.6% uptick on May 21. Since the Ethereum ETF approval had been officially confirmed, Ether (ETH) has registered an 11.48% uptick, ending in the $3900 range at the writing time.

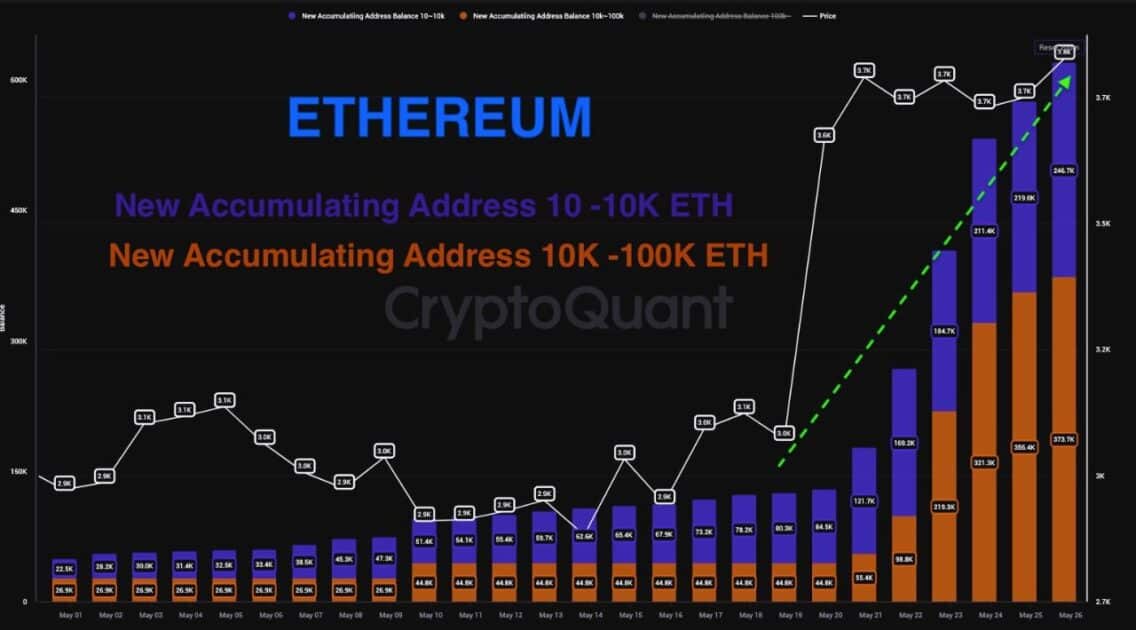

The proximity to the coveted $4,000 milestone once again encouraged the market participants to hold the assets, as can be proved by the latest CryptoQuant data. According to the user behind elcryptotavo nickname, 10k-100k Ethereum accumulating addresses sought a surge in number.

Read Also: SEC Approves 8 Spot Ethereum ETFs, Including BlackRock and Fidelity Offerings

Ethereum: new accumulating address momentum. Source: elcryptotavo | CryptoQuant

Ether’s daily chart explains the tendency. The bullish reversal from the $2850 market formed a falling wedge breakout and completed a rounding bottom. These graphic indicators mark a long-term bullish sentiment.

ETH/USDT 1D chart. Source: WhiteBIT TradingView

The bullish crossover in the moving average convergence divergence (MACD) and signal lines reflect a minor pause as the histograms decline. At the same time, the daily RSI line turns flat near the overbought zone, reflecting the minor consolidation below the $3900 range.

With buyers asserting dominance and whales keeping a firm grip, the Ethereum (ETH) price could aim for the $4698 level, as per Fibonacci levels.

Still, Ethereum ETFs are not becoming immediately tradable. In a post for X, Bloomberg senior analyst James Seyffart noted that ETF issuers might get their S-1 forms approved first.

“Typically this process takes months. Like up to 5 months in some examples but Erich Balchunas (senior Bloomberg analyst – author’s note) and I think this will be somewhat accelerated. Bitcoin ETFs were at least 90 days,” wrote Seyffart.

Bitcoin’s Back to $70K, Drowned by Mt. Gox Awakened Activity

After scoring the local milestone of $70,000, Bitcoin retested to the four-day lows into the May 28 Wall Street open after the Memorial Day holiday in the US. Despite rapidly gaining momentum throughout the two last weeks, Bitcoin’s latest rally failed to endure, while investor’s confidence in the asset dwindled.

The downtick followed a new movement of at least 42,380 BTC (ca. $7 billion at press time) from cold wallets linked to defunct exchange Mt. Gox, according to data from Arkham Intelligence. The move marked the first time in five years that Mt. Gox transferred assets out of its wallets. Mt. Gox still holds about $9.42 billion worth of Bitcoin in its identified wallets tracked by Arkham.

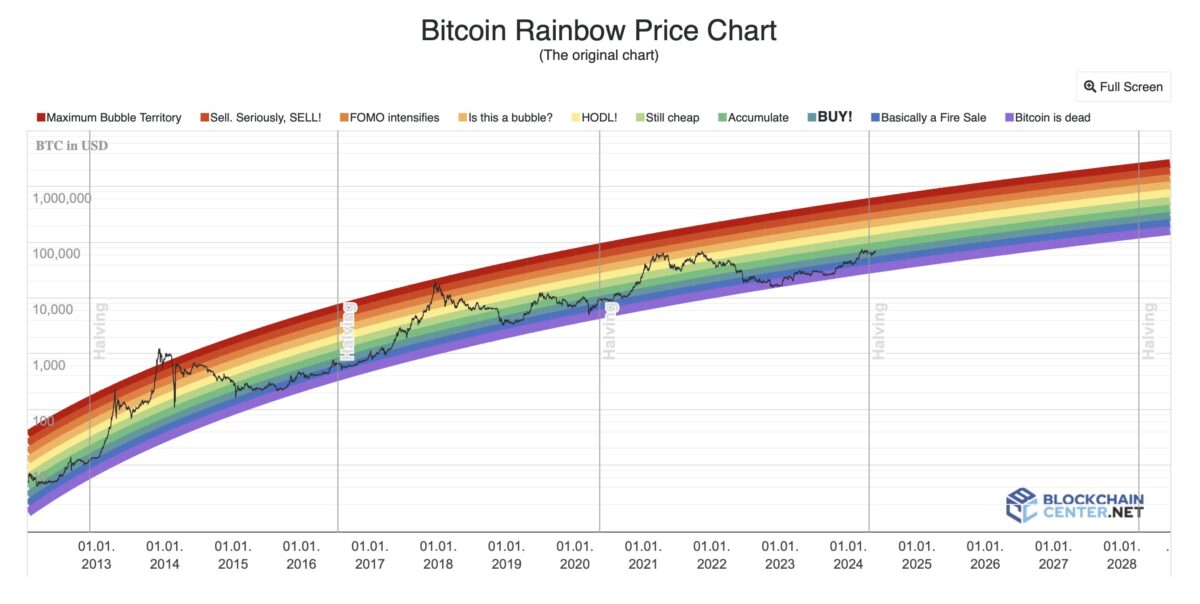

Still, the investors’ optimism remains, as the Bitcoin Rainbow chart revealed that the coin entered the “buy” zone. A similar trend was observed amidst BTC’s third halving, which eventually resulted in achieving the milestone. If that is to be considered, then this might just be the last opportunity for investors to buy BTC at a lower price before it moves up and enters the accumulate and HODL zones.

Read Also: Mark Karpeles Confirms: No Bitcoin Sales by Mt.Gox

Bitcoin Rainbow price chart. Source: Blockchaincenter

What is more, a reputable analyst Jelle shared the positive outlook for Bitcoin while referring to the price history and citing BTC to achieve a “6-figure” milestone.

“Bitcoin has spent the past 6.5 years inside this rising channel, and I don’t expect that to change anytime soon. If history is any indication, it’s time for another trip towards the highs of the channel. 6-figure Bitcoin is coming,” he wrote in a post for X.

Bitcoin historical dynamics chart. Source: X/@CryptoJelleNL

Still, a closer look at Bitcoin’s daily chart reveals a neutral trend. While MACD displays a risk of a bearish crossover, CMF and RSI indicate slight upticks.

BTC/USDT 1D chart. Source: WhiteBIT TradingView

If buyers manage to take over, Bitcoin may overcome the $71,489 zone to get poised for a bullish rally. However, seeing the Fear&Greed index standing at 72 at the writing time, a price correction could take over due to a sellout at profit.

Notcoin (NOT) Scores Weekly 113% While BounceBit Reaches ATH

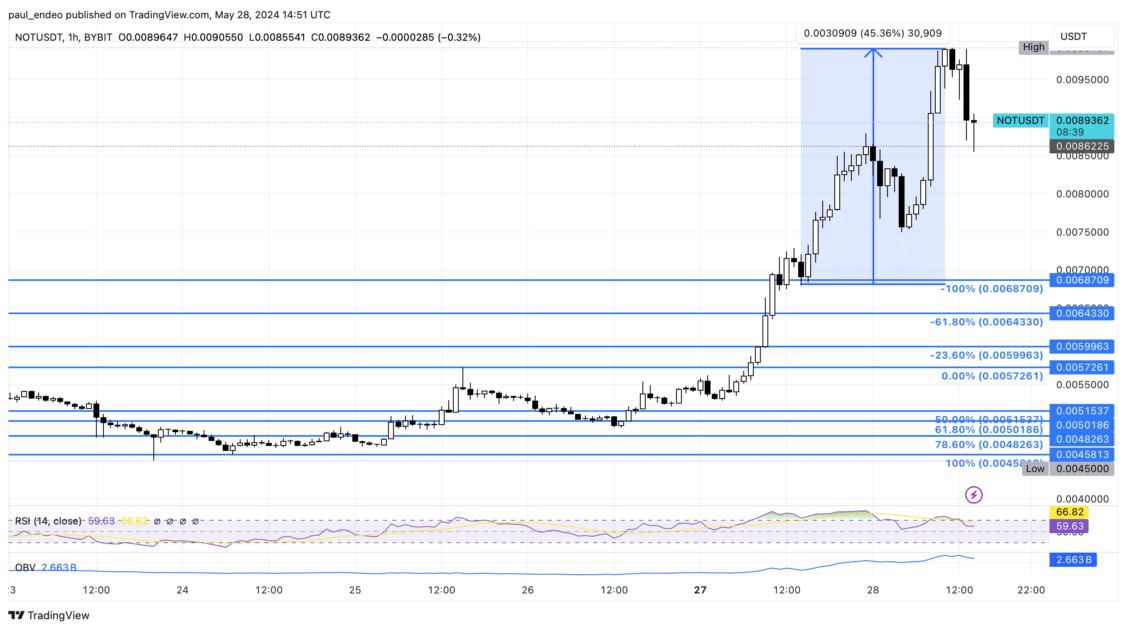

Ethereum ETF approval was positively reflected in the altcoin market. Notcoin (NOT), a Telegram Open Network (TON) token, entered the center stage with a staggering 113% for less than a week, scoring the local high of $0.0099.

NOT/USDT 1h chart. Source: TradingView

Specifically, on May 25, Notcoin breached the downtrend lower high of $0.00544 and formed a higher low at $0.00493. Since that higher low, NOT has surged over 113%, fuelled by a listing on the WhiteBIT exchange, till May 28 13% retest. OBV and RSI noted slight downticks.

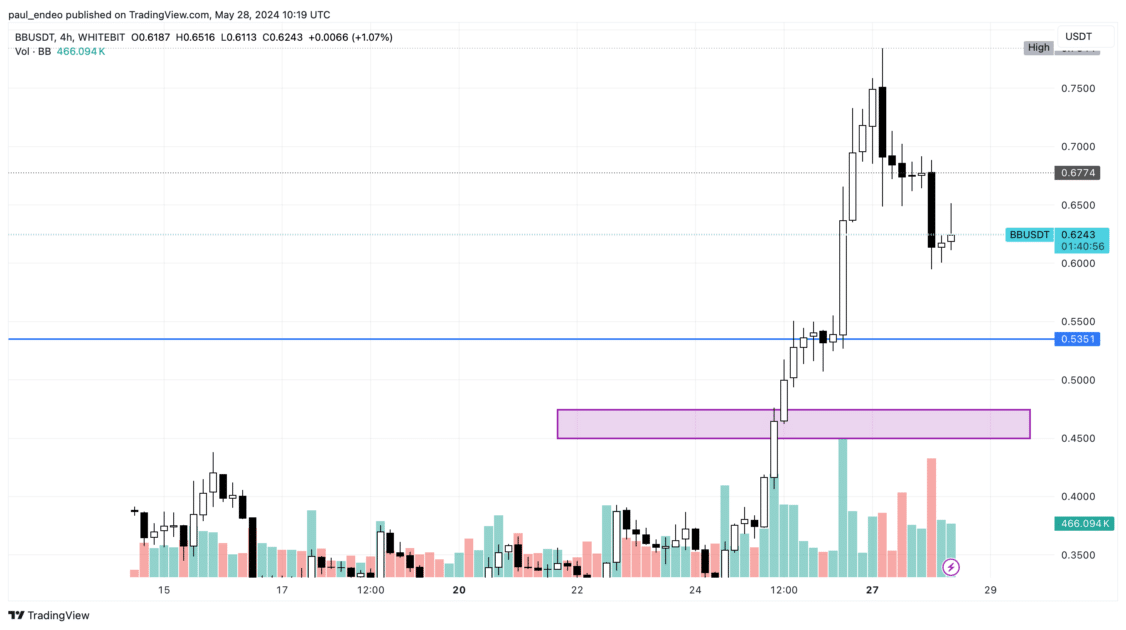

Among the top performers, BounceBit (BB) sought its place. The coin has surged by 30% in recent days, following the project’s newly released ecosystem roadmap and listings on Binance, OKX, WhiteBIT, and other top exchanges. While BounceBit is a relatively new project, its price action has already shown promising signs. On May 26, the coin broke out of a crucial resistance level at around $0.45, reaching a high of approximately $0.55.

Read Also: Binance Announces 54th Launchpool Project: Notcoin (NOT)

BB/USDT 4h chart. Source: WhiteBIT TradingView

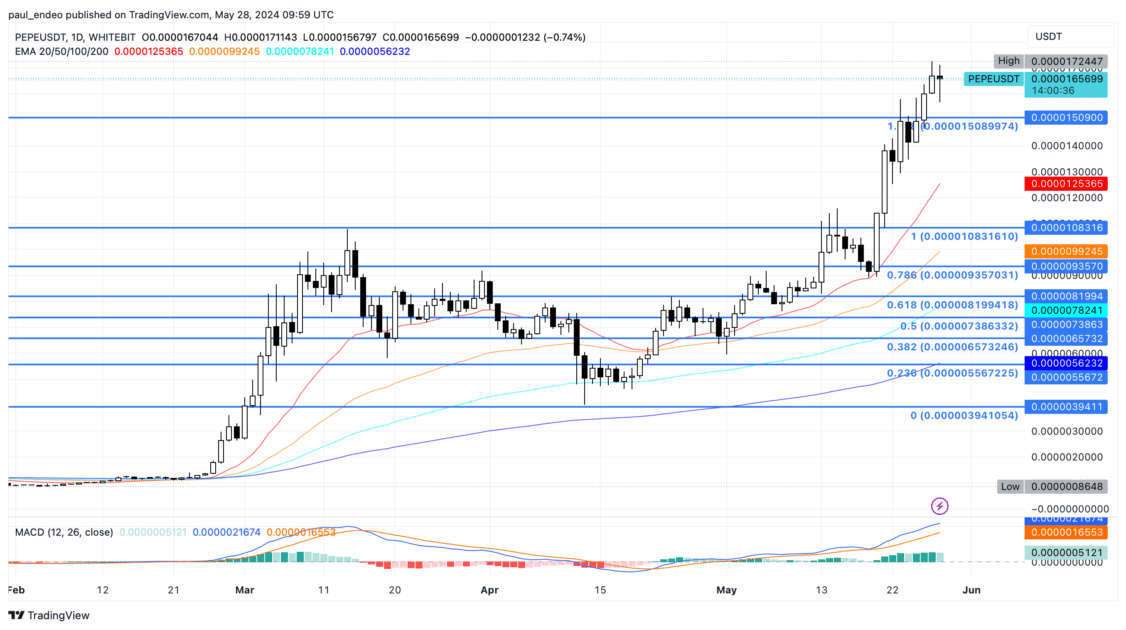

Despite the retracement today, the overall sentiment remains bullish, with traders and investors anticipating further upside potential as the project executes its ambitious roadmap. The memecoin market has also demonstrated a positive market sentiment. Namely, Pepe (PEPE) indicated a rounding bottom reversal in the daily chart, hinting at the potential long-term bull run.

PEPE/USDT 1D chart. Source: WhiteBIT TradingView

Nevertheless, a slight pullback undermines yesterday’s jump and warns of a correction spree in the coming days. As per the Fibonacci retracement levels, the memecoin is well established above the 1.618 level and is ready for a retest. If the bulls come back with a successful retest, the PEPE price could propel to the $0.000021 mark or the 2.618 Fibonacci level.

While the previous week’s market was dressed in green, and long-term optimism prevailed among the investors, the charts hint at the potential consolidation phase that will result in increased volatility and assets’ downtick.

Read Also: Smart Whale Profits $3.49 Million From PEPE, Spreads Gain to SHIB and SAND