Notcoin (NOT) achieving milestones and memecoins updating the capitalization mark community-driven tokens as the ruling tendency in the market

As Bitcoin struggles to overcome the $70,000 barrier, community-driven altcoins enter the market spotlight with a continuous surge in trend momentum. How The Open Network’s token rallying through the market, and what is awaiting BTC in the nearest future – below.

Notcoin Adds 289% to Price; TON Poised for a Breakout

Leading through May and following the listing on the WhiteBIT exchange, TON-based Notcoin (NOT) demonstrated an uprising performance on the first day of June, surging 89% at the weekend and securing almost 3x growth in the 7-day timeframe.

During European trading hours on June 3, NOT extended previous gains by a 22.3% increase, taking it to $0.029349 amid the day. The slight increase followed a 33% dump to $0.019892 support, triggered by a local selloff and ongoing liquidations.

Read Also: Beam (BEAM) Trading Volumes Peak on Upbit, Awaits Web3 Game Builders

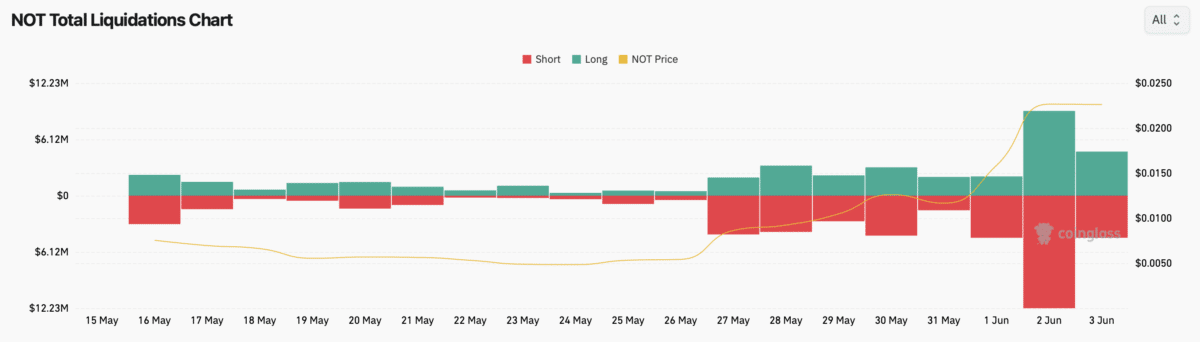

Notcoin (NOT) total liquidations chart. Source: Coinglass

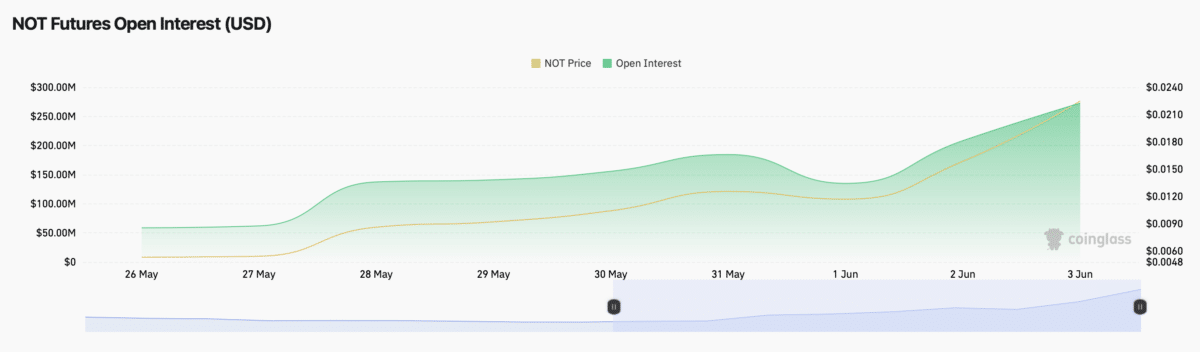

Despite the correction, the market remains optimistic about NOT, as evidenced by the coin’s Open Interest (OI) rates steady uptick.

Notcoin (NOT) futures open interest (USD). Source: Coinglass

By contrast, Tryrex, a crypto trader and market analyst, shares controversy on the Notcoin dynamics. In his post on X, he cited the end of NOT’s pump while expecting a bounceback,

“The pump on $NOT is now over. Price made a blow-off top at 0.0294, indicating the end of the uptrend. I am looking for a possible short when the price bounces a bit.”

Conversely, a closer look at the 4-hour chart reveals a bullish perspective for NOT, revealing that the price is trending far above the 50-day simple moving average (SMA). In the meantime, the price has retraced to the 0.382 Fibonacci retracement level which coincides with the $0.021.

NOT/USDT 4h chart. Source: TradingView

A bounce from the level could move NOT to the 0.236 Fibonacci extension around $0.034. On the way, the altcoin may experience some resistance around $0.032, $0.043, and $0.057. By contrast, strong support may be evidenced around the 50-day SMA ($0.014).

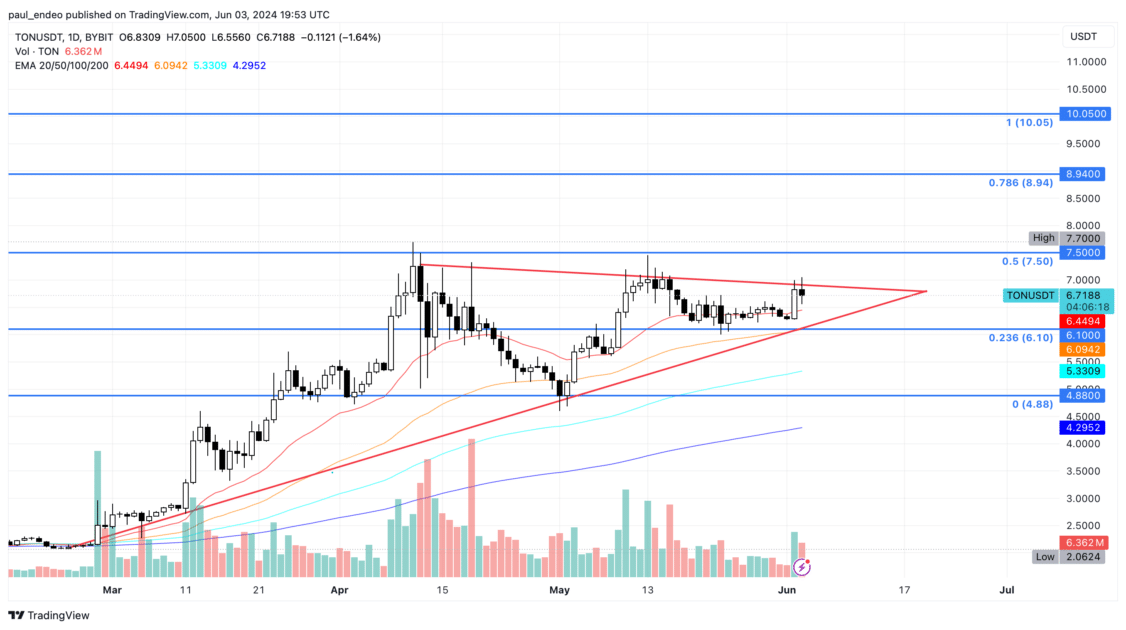

While Notcoin keeps on achieving local milestones, its predecessor – Toncoin (TON) – demonstrates a more modest performance, yet indicates a strong bullish outlook. Overnight, the token sprang 8%, boosting the price to $6.7 with an intraday pullback of 0.73% at the writing time.

As per the 1-day chart, the bullish recovery aims to conclude the lower high formation with a trendline breakout. However, the intraday pullback warns of a bear cycle to test the long-coming support trendline. The bullish engulfing candle bolsters the uptrend continuation yet fails to surpass the overhead trendline. Thus, the sideline traders wait for the price action confirmation in the daily chart.

Read Also: Bitcoin Price Breakout Bullish Pattern Targets $74,000

TON/USDT 1D chart. Source: TradingView

Still, the fundamental expansion of The Open Network and the staggering interest in Notcoin may become the points in favor of TON’s bullish continuation. As per the trend-based Fibonacci levels, the bullish trend in the TON price could aim for the $10 milestone with the $7.50 breakout.

Bitcoin Faces Struggles While Memecoins Take Advantage

Contrary to the investors’ hopes, Bitcoin’s bullish strength turned out to remain bearish. The first cryptocurrency retraced almost all of its gains after breaking past the $67,000 resistance point on May 20. It extended upwards to $71,900 but fell to test $67k again on May 23. Nevertheless, the 1-day chart reveals a bullish perspective for Bitcoin, revealing a distinct bullish triangle. A close above the triangle will suggest that the uncertainty turned the tables to the bulls’ advantage. Bitcoin may eventually attempt a rally to the strong overhead resistance at $73,777.

BTC/USDT 1D chart. Source: WhiteBIT TradingView

If the bears take over, BTC may see a possible drop to the critical support at $59,600. Still, data from Santiment reveals that the Bitcoin ETF inflows have been positive lately, hinting at the bullish impact on BTC.

Read Also: Australia’s First Spot Bitcoin ETF Set to Begin Trading Tomorrow

Bitcoin ETF net inflows. Source: Santiment Insights

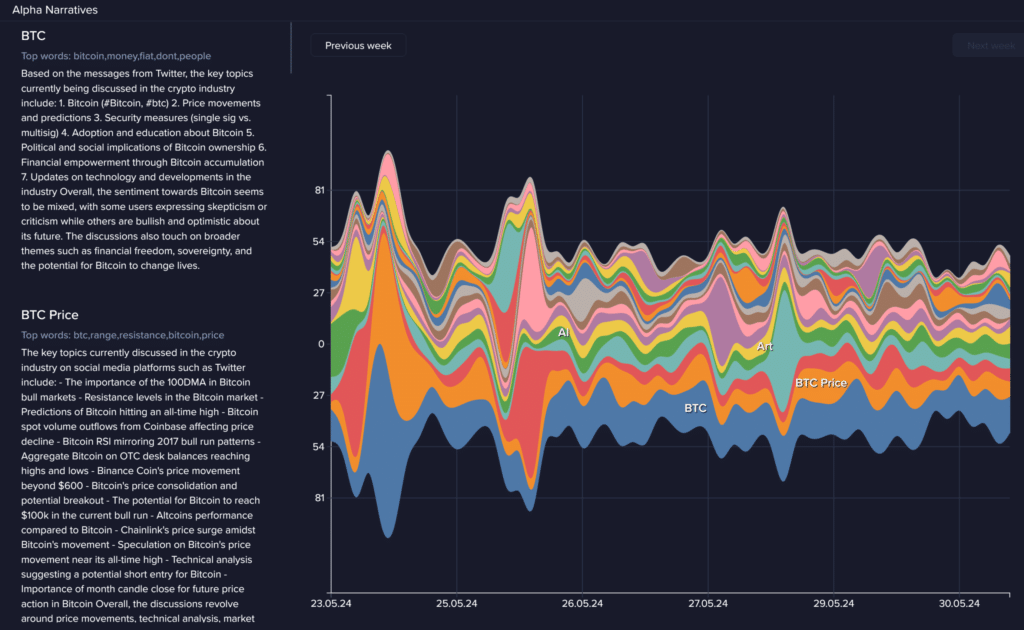

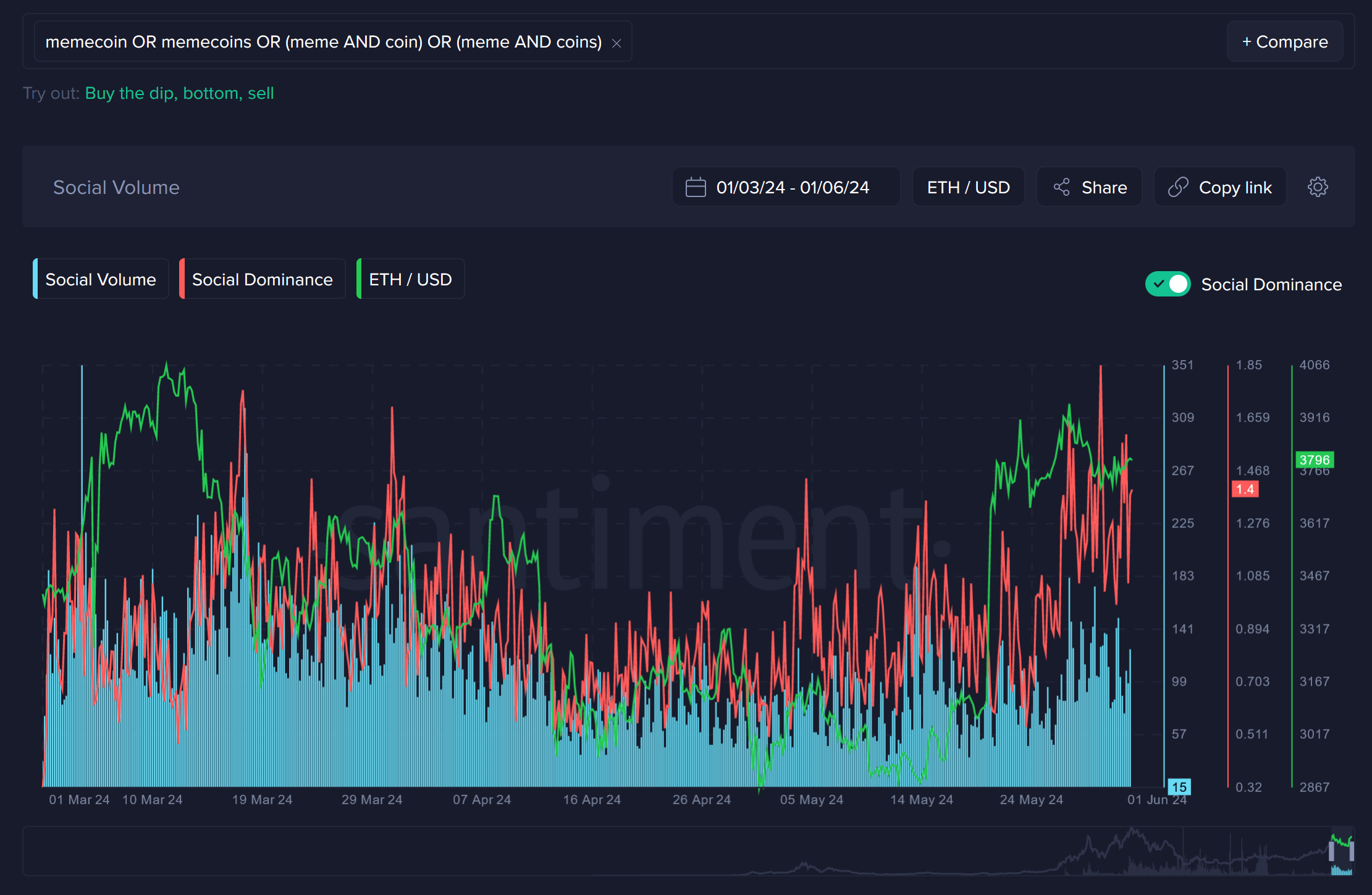

Regardless of the data-supported optimism, market narratives quickly switched to the memecoins. As per Santiment data, memecoins have captured more of the public’s attention since mid-April due to their superior performance as a sector.

Memecoin market’s social volume. Source: Santiment Insights

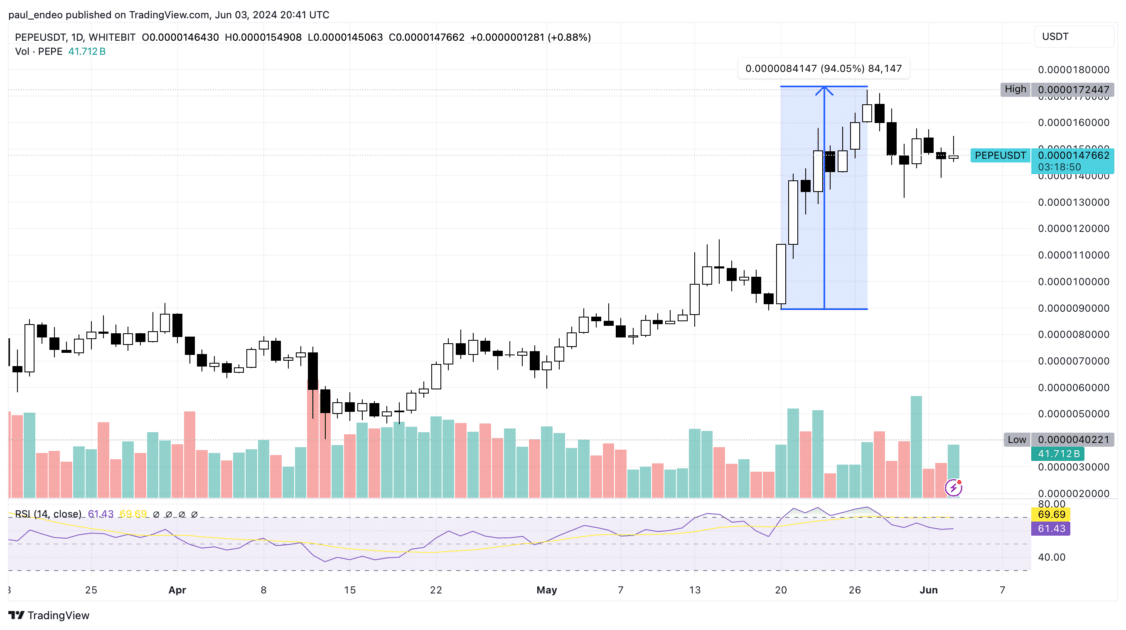

Top memecoins registered decent performances over the past week. Pepe (PEPE) saw remarkable gains, reaching another milestone of $0.000017 in 94% 7-day momentum.

PEPE/USDT 1D chart. Source: WhiteBIT TradingView

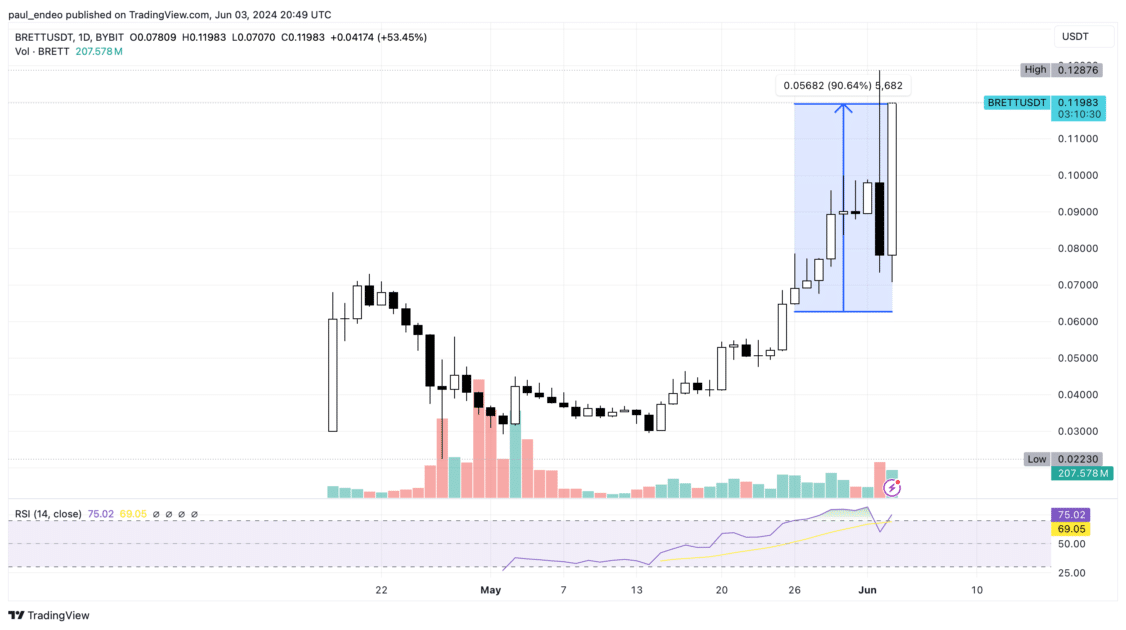

Shiba Inu (SHIB), Dogwifight (WIF), and Floki (FLOKI) indicated 23%, 41%, and 40% growth over the past week respectively. The memecoin mania brought Base into the spotlight. Thus, its meme-inspired token Brett (BRETT) crossed $1 billion market capitalization over the recent week and achieved an all-time high of $0.128.

BRETT/USDT 1D chart. Source: TradingView

The heavy engagement with memecoins could be a sign of the market’s prevailing greed and speculative momentum, which took over the organic development. Combined with declined Bitcoin’s volatility and its $60,000-$72,000 steady range, which did not meet the investors’ expectations, this created a perfect opportunity for memecoins to thrive. This only proves that investors ought to be patient and watch out for the range formations instead of getting caught out by abrupt breakouts.

Read Also: Memecoins Taking Centre Stage: How Long Will Rally Prevail?