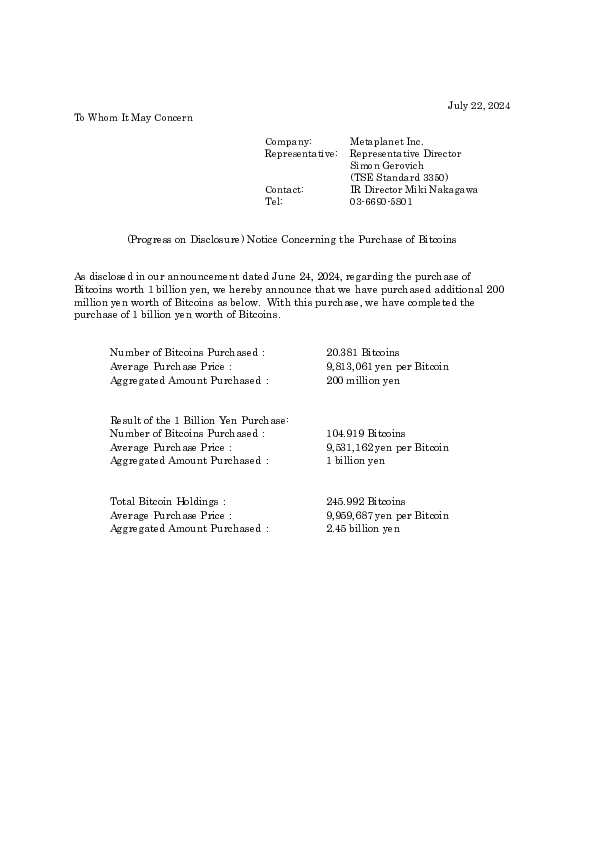

In a recent development, Metaplanet Inc. has completed its planned Bitcoin acquisition, totaling 1 billion yen. This purchase follows an announcement on June 24, 2024, wherein the company disclosed its intention to invest heavily in Bitcoin. Metaplanet now possesses a substantial amount of digital assets after purchasing an extra 200 million yen in Bitcoin. This strategic investment comes at a time when Bitcoin is navigating significant market resistance and volatility.

Metaplanet purchased 20.381 Bitcoins for an average price of 9,813,061 yen per Bitcoin. This boosts the company’s total Bitcoin holdings to 245.992 bitcoins. The average buying price per Bitcoin is 9,959,687 yen, for a total investment of 2.45 billion yen. This significant buy-in reflects Metaplanet’s robust confidence in the future potential of Bitcoin, despite its current trading challenges.

Source: Metaplanet

Also Read: Metaplanet Inc. Increases Bitcoin Holdings Amid Economic Challenges

Bitcoin Faces Critical Resistance Level

Bitcoin has been experiencing a consolidation phase within a Descending Broadening Wedge since March, which typically signals an accumulation period before a breakout. It trades below a critical technical level of $70,000, where market analysts and traders actively observe conformity with this level. If Bitcoin is to go upwards, it should easily break above $70,000, thus opening the market for even more value increase.

The market response to Metaplanet’s significant investment is yet to be fully observed; however, such a substantial institutional purchase often boosts market sentiment. It signals to other potential investors that confidence in Bitcoin remains strong among large-scale entities. This could encourage more institutional and retail investors to consider increasing their exposure to Bitcoin.

Metaplanet’s current investment in the highly popular Bitcoin fits nicely into the pattern exhibited by other corporations and organizations. Increasing numbers of organizations use cryptocurrencies as an investment because this diversifies the range of products they offer. This is an excellent measure to protect against conventional business risks and ensures that these companies are at the forefront of tapping into the fast-emerging digital finance revolution.

As Bitcoin approaches the $70,000 resistance level, the market eagerly awaits a potential breakthrough. Analysts believe Bitcoin will have substantial upward momentum if it breaches this level. Market players, especially investors and traders, should closely monitor developments in the market since the following weeks may prove critical for the future of Bitcoin’s value.

Conclusion

In conclusion, Metaplanet Inc.’s substantial investment in Bitcoin underscores its confidence in its future potential. Nevertheless, the -market movements prove that the company’s action aligns with the constantly emerging trend of institutional integration of digital assets. The highly anticipated break above the critical $70k could signal a new BTC bull run, enabling more traders to embrace the cryptocurrency.

Also Read: Metaplanet Inc. Announces Major Bitcoin Purchase Through Bond Issuance