Last updated on March 25th, 2025 at 07:50 am

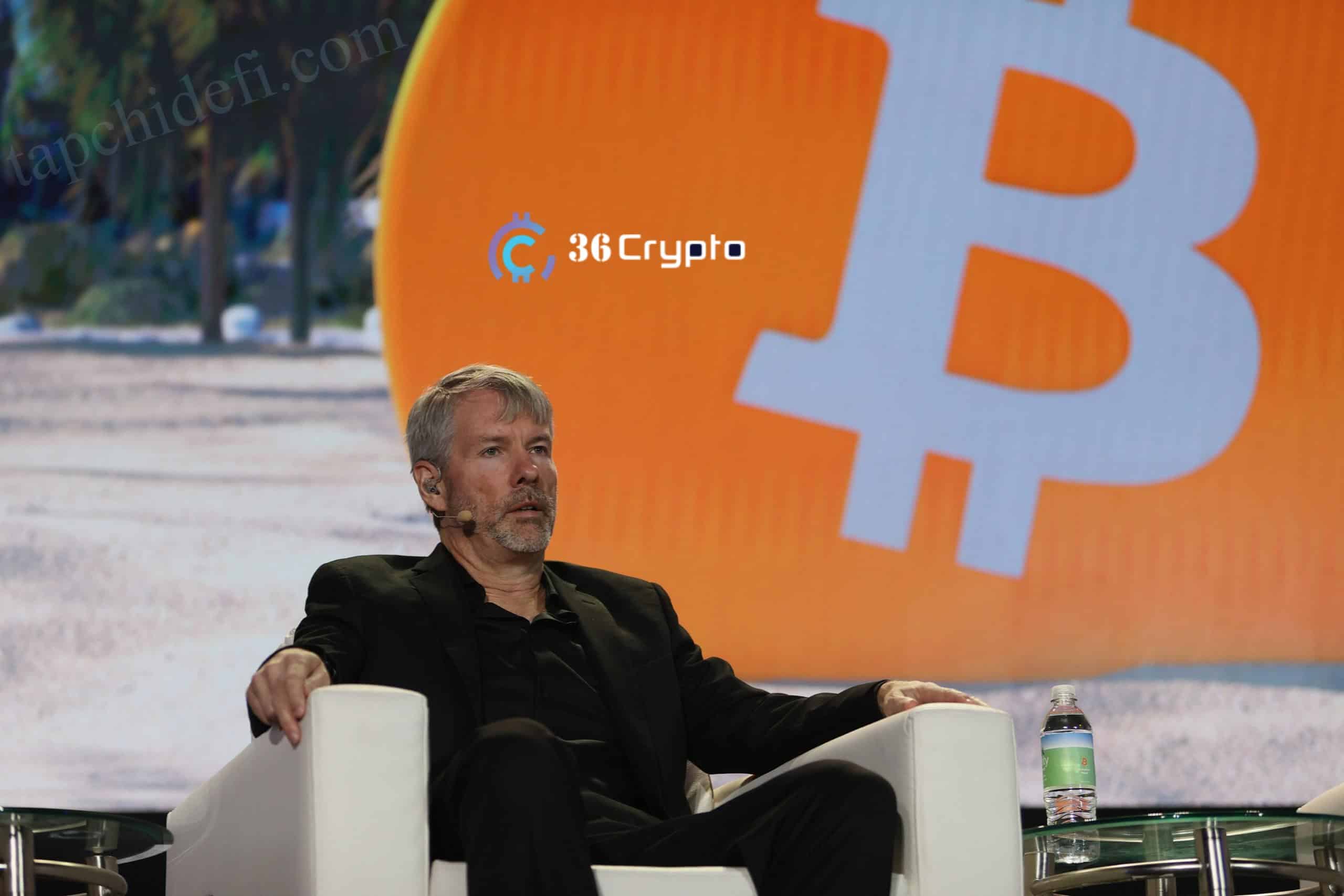

One of the most prominent personalities within the crypto sphere – Michael Saylor – does not doubt that BTC occupies the top position on the market. He said this while appearing on the Fox Business channel’s Unbreakable Investor program, and he sought to insist on the investment value of Bitcoin and how its performance outstrips all other conventional stocks and assets.

Read Also: Shiba Inu Sees Surge in Activity as 3.5 Trillion in SHIB Tokens traded in 24 hours

Saylor’s Enduring Support for Bitcoin

This is an old trend that Saylor has been supporting since the beginning and is based on the understanding that Bitcoin is a limited-edition, decentralized digital currency. He argues that Bitcoin is a preferable method to retain value, as opposed to holding a physical monetary value, since the latter is intrinsically prone to inflation. This conviction has driven his company, MicroStrategy, to accumulate a substantial portfolio of Bitcoin. Consequently, MicroStrategy has emerged as one of the largest corporate holders of Bitcoin, reflecting Saylor’s unwavering confidence in the digital currency’s prospects.

Bitcoin’s Current Market Dynamics and Institutional Interest

Over the past decade, Bitcoin has consistently outperformed other significant asset classes, a trend that was prominently highlighted during Saylor’s discussion on Fox Business. He expanded on the high growth rates of Bitcoin investment and increased trust in the coin as a secure and effective means of making transactions. Market information gathered in the recent market supports his optimistic observation that Bitcoin has remained most robust and continues to grow, giving investors the confidence they need.

This means that Bitcoin is currently trading at around $65,203 based on the latest market charts, signifying the continuous rally observed in the general market coupled with the growing interest from institutions. There are many more potent drivers for an increase in the bitcoin price. In the coming week, we may see approval for an Ethereum ETF; this, coupled with the regulated selling pressure from Mt Gox, looks to put more upward pressure on the price of Bitcoin.

Thus, the existence of a strategic investment plan can be seen, for example, based on the results of Saylor’s activity with Bitcoin, which is estimated at $14.79 billion. The mean market price of the above holdings was $ 65,187, which shows the high and increasing adoption of Bitcoin over the years, supporting Saylor’s investment theory and his ability to forecast future uses of digital currency.

Conclusion

Michael Saylor’s unequivocal promotion of Bitcoin as the best investment in the market can be viewed as the best confirmation of its functions as the best form of saving and as an investment vehicle with the highest possible return. The huge Bitcoin reserves of his company, along with the general business-like metallic standards and images, make one believe he is more specific about the future of Bitcoin. Thus, with more changes occurring in the market environment, the further establishment of Bitcoin as the dominant financial asset indicates a more solid place in the modern economic world.

Read Also: Ripple CEO Warns U.S. Risks Lagging in Global Crypto Race Amid Regulatory Uncertainty