MicroStrategy increased its Bitcoin holdings to reach 423,650 BTC following the $2.1B purchase. Moreover, wallets holding over 100 BTC in the market show growing institutional interest in cryptocurrencies as analysts highlight Bitcoin as being about financial sovereignty and long-term viability.

In total, MicroStrategy has added 21,550 Bitcoins to its holdings, which now amount to 423,650 BTC at an average price of $60,324. That company once again, showed its confidence in the digital asset as reflected in the $2.1 billion spent on its most recent purchase.

MicroStrategy is still a major institutional player in the cryptocurrency space, with a year-to-date Bitcoin yield of 68.7%. The latest purchase cements MicroStrategy’s ranking as the largest corporation to hold digital assets.

Also Read: MicroStrategy Makes Largest Bitcoin Purchase, Boosting Holdings to 386,700 BTC

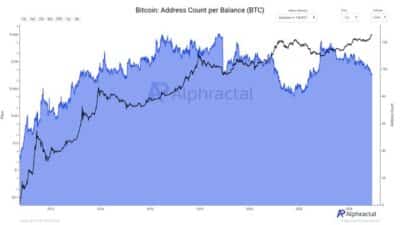

Bitcoin Addresses Holding 100+ BTC Surge Amid Institutional Interest

A rapid ramp-up in the number of Bitcoin addresses holding more than 100 BTC is a signal of increasing institutional activity. At the same time as these dramatic increases, addresses with over 10,000 BTC have decreased, pointing to a rehashing of holdings. As Bitcoin continues to verge on the $100,000 milestone, demand from midsized players is on the rise, hence the shift.

This is a pattern where smaller but significant entities like miners and institutional buyers have a growing role. This could be due to strategic reallocation by different market participants from large to smaller wallets. These are indications of a change in Bitcoin’s ownership structure where different market players are adopting the digital currency.

The mechanism of redistribution of Bitcoin holdings provides a glimpse into how major stakeholders in the Bitcoin market behave. Moreover, the trend also shows that institutions and mid-sized companies are changing the distribution landscape of the market. The data shows that Bitcoin may be of more interest to a wider variety of market participants.

Bitcoin Defines True Ownership of Money

According to Saifedean Ammous, Bitcoin is a unique financial tool that allows you to own and be financially sovereign. Bitcoin opens up space for people to hold their wealth in ways not possible in the traditional system. As a revolutionary way to manage assets, Bitcoin is argued as a decentralized means of doing so.

Ammous explains that with Bitcoin, users have freedom unparalleled to that of fiat, enabling them to handle their funds without the need for centralized authority. This particular characteristic makes Bitcoin a vital solution for anyone who wants to own their financial assets themselves. Bitcoin’s role in global finance is adding increased weight to the ongoing discussion on the subject.

From this angle, Bitcoin is conceived as a way to reach financial independence and oppose traditional systems. Bitcoin’s power over external controllers allows people to secure their wealth in a new way. The remarks highlight the role of Bitcoin in the constantly changing financial landscape.

Titan Crypto Dismisses Bull Market Top, Sees More Bitcoin Upside

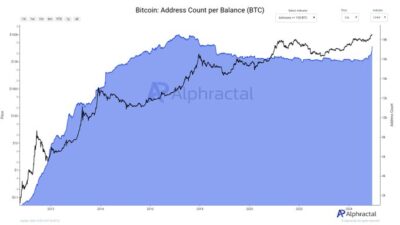

One red candle following weeks of upward movement has led some to claim Bitcoin’s bull market is over, something Titan Crypto rejected in a tweet. According to the analyst, we’re in the normal part of a bullish cycle, a consolidation phase of the pullback. The trend to upward traction of Bitcoin is still strong, and the gains are expected to continue.

Source: @Alphractal

According to the Wyckoff accumulation model, Titan Crypto placed Bitcoin at the “Test and Accumulation” stage. Whenever we price into this phase, it is typically indicative of a bullish market-building momentum prior to the next big increase in price. This analysis shows that this dip is not a reversal, simply a part of the normal market cycle.

The general advice for traders is to keep their focus on the broader trend of Bitcoin and not the short-term noise. From this perspective, the market continues to be bullish, and reinforcement of the bull run is based mainly on CFR. What the analyst sees matches historical priorities shown during previous Bitcoin bull cycles.

Also Read: MicroStrategy Executes Historic Bitcoin Purchase of 51,780 BTC Worth $4.6 Billion