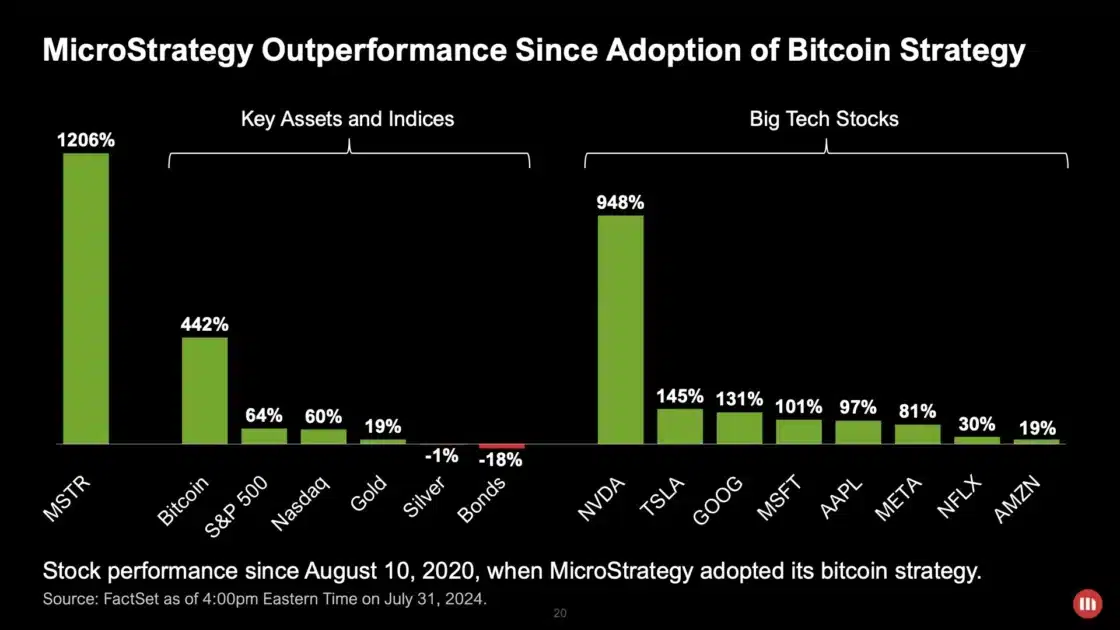

Michael Saylor, co-founder of MicroStrategy, has showcased the company’s impressive performance metrics, attributing much of its success to its substantial Bitcoin holdings. Saylor’s latest tweet includes a diagram highlighting how MicroStrategy has outpaced major global technology firms by leveraging Bitcoin. According to the data available since buying Bitcoin by MicroStrategy on August 10, 2020, the cryptocurrency rate has increased by 442% compared to the most famous traditional market indexes. Interest on the S&P 500 has inflated to 64%, whereas the Nasdaq 100 has inflated to 60%, while we’ve seen a return on gold at 19%, silver at -1%, while bonds have deflated at 18%.

Read Also: Shiba Inu’s Deflationary Strategy and New Game Launch

MicroStrategy’s Stellar Stock Performance

The diagram also compares MicroStrategy’s stock against other technology companies. At this writing, MicroStrategy’s share price soared to an astonishing 1,206%, just slightly over Nvidia’s 948%, Teslas’ 145%, Google’s131 % and Microsoft’s 101%.

Source: Michael Saylor/X

In addition, other key tech companies like Meta, Netflix, and Amazon have failed to deliver MicroStrategy’s performance. Such exceptional returns have been driven by the company’s ability to amass Bitcoins, which the company considers a material and integral balance sheet item. Further, MicroStrategy has often bought Bitcoin using the money from convertible senior notes sold to investors, and such scenarios have happened twice in the current year.

Bitcoin Price Dynamics and Federal Reserve Influence

Bitcoin’s price has recently returned to the $65,000 level and even touched $65,300, but it fell slightly. In the present day, the trading value of Bitcoin is around $66,480. This particular price movement is recent, following the Fed’s policy of holding current interest rates intact. This year, in March, the Chairman of the Federal Reserve Board, Jerome Powell, spoke about the likelihood of further rate cuts, which affects the Bitcoin trends.

Saylor’s consistent promotion of Bitcoin through social media, specifically on X, highlights his commitment to the cryptocurrency. These are relatively frequent, often containing illustrations generated with the help of AI and calls to embrace Bitcoin.

MicroStrategy’s strategic Bitcoin investments have set it apart from its tech industry peers, demonstrating the potential of cryptocurrency in enhancing company performance and shareholder value.

Read Also: Michael Saylor Declares Bitcoin the Top Asset, Citing Superior Performance and Value Storage