Defunct cryptocurrency exchange, Mt. Gox, transferred a massive amount of Bitcoin, up to the tune of $2.71 billion earlier today in preparations for creditor repayments scheduled to take place this month. The large transfer sent shockwaves through the crypto market as the price of Bitcoin went crashing to $54k.

Mt Gox transfers over 47,000 $BTC ($2.71 billion) from its cold storage to a new wallet in preparation for creditor repayment. This has been confirmed as the second-largest #Bitcoin liquidation event in history, following the #FTX collapse in 2022.

— 36crypto – Crypto News (@36Crypto2) July 5, 2024

Read Also: Mt. Gox Transfers $24 Bitcoin to Activate Wallet Ahead of Customer Repayments

Investors have previously raised concerns about the possible negative impact this repayment event would have on the price of Bitcoin, and it looks like these worries are beginning to materialize. Following the transfer, the price of BTC dropped slightly to the $53,000 mark, however, at the time of writing, the price has recovered and is now trading above $54k.

Mt. Gox Sends Over 47,000 BTC to New Wallet

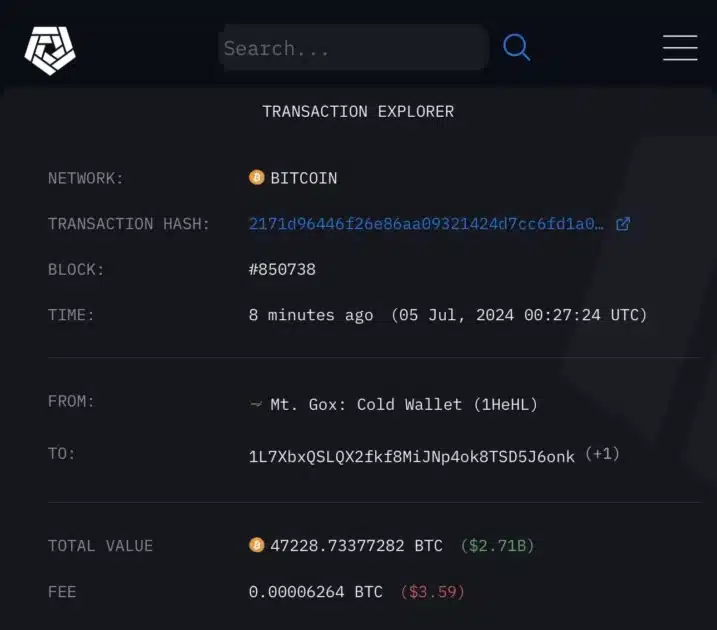

Arkham Intelligence, a sophisticated blockchain transaction tracker, revealed that the former Japan-based crypto exchange moved exactly 47,228 BTC, valued at $2.71 billion from its cold storage to a new unidentified wallet. The transaction was initiated at 00:27:24 UTC. Even though the identity of the new wallet is not known, it is safe to say that it might be associated with one of the five exchanges selected to help with the reimbursements including Bitstamp, Bitbank, Bitgo, Kraken, and SBI VC Trade.

Source: Arkham Intelligence

This transfer came less than 24 hours after the exchange carried out a test transfer on July 4. 36crypto previously reported that Mt. Gox made a mere $24 worth of BTC transfer to an address associated with Bitbank, one of the partnered crypto exchanges, to activate the wallet. Notably, the over 47,000 Bitcoin transfers made by Mt. Gox have been confirmed as the second-largest Bitcoin liquidation event in history, following the collapse of FTX in November 2022, where more than $9 billion was lost to customers and investors.

Mt. Gox previously announced that it would start repayments in early July, and since the announcement, Bitcoin has suffered heightened selling pressure from investors who are worried about a significant price crash after repayments are complete. Recall that Bitcoin was trading at around $600 when Mt. Collapsed in 2014, compared to the current price, investors will get over 100x their initial holdings. With this, speculations abound about creditors quickly selling off their repayments to cash in on the realized profits. While this possibility is not confirmed, it has created tension across the market and plunged the price of BTC to a low not seen since February 26.

Analysts Clarifies FUD, Says Market Can Handle the Pressure

Meanwhile, several prominent crypto analysts have tried to calm the situation and clarify the FUD (fear, uncertainty, and doubt) by investors. They have stressed that even if a sizeable number of the creditors sell their coins, the market can handle the pressure and the impact will not be as significant as expected.

Ash Crypto, a prominent crypto trader took to his X (formerly Twitter) account to explain how this will happen in detail. He said that the reason why Bitcoin is crashing at the moment is a result of an overestimation of the Mt. Gox selling, as people are thinking that Bitcoin might fall further to $40k or $45k. According to his analysis, Mt. Gox will distribute BTC in three phases; early payments (from July to October), intermediate payments (final creditors), and final payment (years later).

He stressed that the early payments, which involve 71,403 BTC, will target different types of investors including individual creditors, credit funds, and cryptocurrency exchanges. He highlighted that we are already in a bull market so the selling impact will be significantly less. Additionally, he stated that the market can handle 6K–10K BTC sell pressure as a result of low ETF inflows. However, during high ETF inflows, the market can handle as much as 15K to 25K of daily BTC sell pressure.

Per his analysis, a 35,700 BTC sell-off won’t hurt the market as badly as people portray. Ultimately, he says that Bitcoin will find its support around the $44k to $52k zone and that only a significant world event like a war or pandemic could push the price of Bitcoin further below that. At the time of writing, Bitcoin is trading at $54,123, representing a 5.94% decline in the last 24 hours.

Read Also: Shiba Inu Dips 9% with New Support Range Identified as Market Faces $321M Liquidations in 24 Hours