Mt. Gox, the defunct cryptocurrency exchange, has transferred $709.44 million worth of Bitcoin to Bitstamp, according to data provided by cryptocurrency analytics platform Lookonchain. This was, however, achieved as part of the continuing exercise to pay back various creditors, which started in early July. After the collapse in 2014, Mt. Gox started refunding the creditors in Bitcoin and Bitcoin Cash.

Also Read: Mt. Gox Prepares to Distribute Remaining $2 Billion in Bitcoin to Creditors

Ongoing Repayments and Market Reactions

Last month, creditors began collecting long-awaited repayments on exchanges such as BitGo, Bitstamp, and Kraken. The revelation of these repayments sparked a significant sell-off in Bitcoin, raising fears about the market’s probable downturn.

A recent poll on the r/mtgoxinsolvency subreddit indicates that over half of the creditors do not plan to sell their Bitcoin holdings immediately. A relatively small proportion of only 14% of the respondents stated that they had plans to sell off their assets. However, considering these factors, observers have taken the poll results with a pinch of salt. One Reddit user rightly pointed out that the decision to sell depends on the amount of Bitcoin each creditor holds, thus making it difficult to determine the effect on the market conclusively.

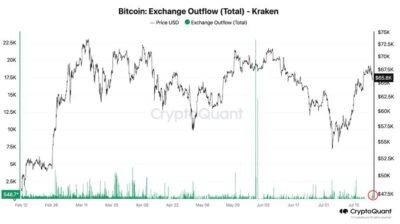

Furthermore, even more signs support the sentiment that Mt. Gox creditors aren’t unloading their Bitcoin. Ki Young Ju, the CEO of CryptoQuant, stated that there was not much activity of Bitcoin flow out from the Kraken exchange after the transfers to the creditors in late July. These facts also suggest that the planned massive sell-offs may not have happened as has been widely expected.

Source: Ki Young Ju/X

Conclusion

The transfer of $709.44 million in Bitcoin by Mt. Gox to Bitstamp marks a crucial step in the ongoing repayment process. Despite these, initial concerns of a bearish market reaction were observed; at the moment, most of the creditors are retaining their assets. Nevertheless, it’s essential to consider the possible consequences for cryptocurrencies as the repayment process continues.

Also Read: Mt Gox Set to Distribute Bitcoin and Bitcoin Cash to Creditors in July 2024