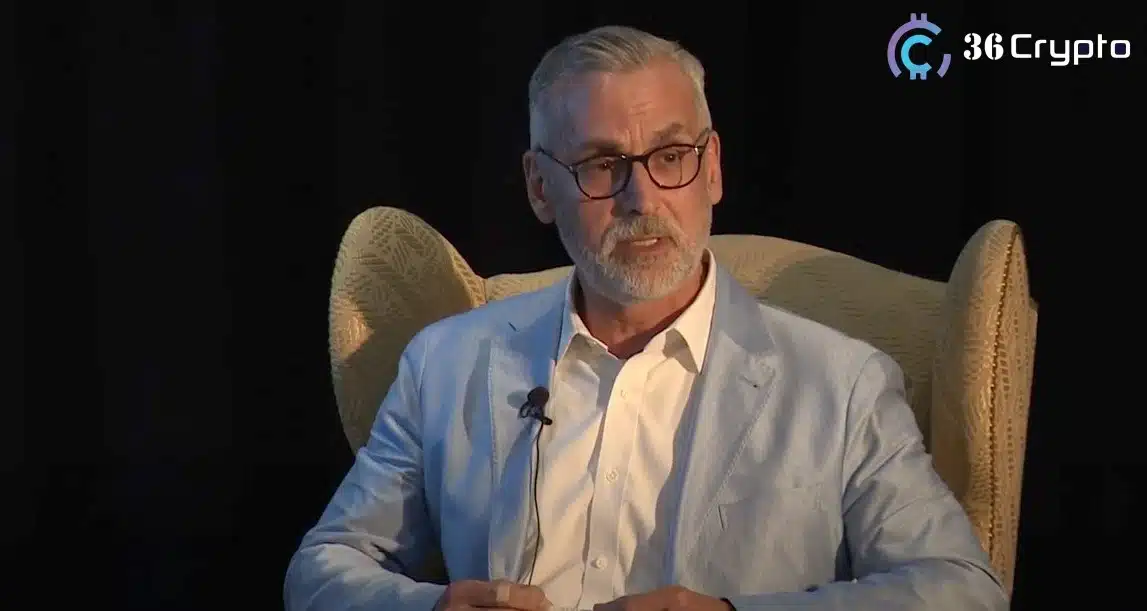

Stuart Alderoty, Ripple CLO in a recent interview described how the recent XRP ruling will favor Binance and Coinbase in their ongoing legal battle with the SEC. The Chief Legal Officer gave his opinion in a July 25 interview with TechCrunch.

Recall that earlier this month, District Judge Analisa Torres issued a ruling in favor of the blockchain company declaring that XRP is not a security. The ruling implies that Ripple and its executives did not break any federal law and did not offer unregistered securities in XRP.

Stuart Alderoty who was a guest on TechCrunch’s Chain Reaction spoke extensively on the impact of the ruling by Judge Torres in respect to the ongoing case between Binance, Coinbase, and the Securities and Exchange Commission.

According to him,

“I think that ruling will play well in the Coinbase case and … equally well … in the Binance case.”

Related Reading: Ripple CTO Warns Users About Fake Website Promoting XRP Airdrop

Furthermore, he explained that the relationship between sellers and buyers is central to securities cases per the Ripple ruling. Also, he stressed that if the regulatory watchdog continues to claim that assets are securities in their own right, then it will lose cases. In addition, he asserted that the outcome of the ruling implies that the Commission does not have control over exchange trades.

According to him, the SEC shouldn’t be surprised when they are told that an asset is not a security, rather they should they should exit the conversation because they lack the jurisdiction.

Even though Alderoty is optimistic about the ruling, he still believes that the Securities and Exchange Commission will not cease trying to regulate the crypto industry.

He admitted that the SEC may take more action with regard to institutional sales of XRP, but he insisted that this had no bearing on XRP’s classification as a security. As was previously reported, he also spoke about the potential for the SEC to challenge other aspects of the case.

During the interview, Alderoty highlighted Ripple’s isolation from XRP, claiming that although the business utilizes the coin, it did not develop or issue it.