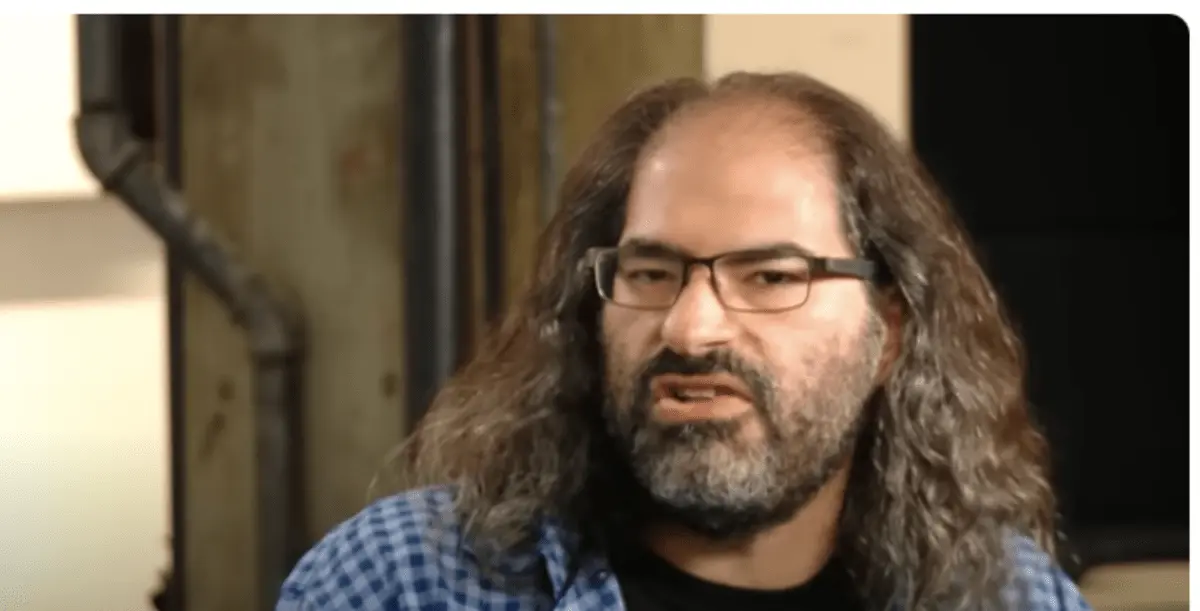

Ripple CTO David Schwartz addressed ongoing speculation surrounding co-founder Jed McCaleb’s absence in the SEC’s lawsuit against Ripple. On social media platform X, crypto commentator “Digital Asset Investor” questioned why the lawsuit did not include McCaleb. The inquiry followed a post by Andrew De Vilbis, who shared insights into McCaleb’s current work with Stellar, a blockchain venture he co-founded after parting ways with Ripple.

Joining the discussion, Schwartz hinted that McCaleb’s early departure and limited involvement with Ripple could have influenced the SEC’s decision. “Adding him into the suit would not give the SEC any of what the SEC was hoping to gain,” he said, implying that McCaleb had little role to play in the case pursued by the SEC.

Also Read: SEC vs. Ripple as Court Sets January 2025 Deadline for SEC’s Appeal in High-Stakes Legal Battle

SEC Renews Focus on Ripple Executives Amid Appeal

The SEC has continued to target Ripple CEO Brad Garlinghouse and Executive Chairman Chris Larsen. The case, filed in December 2020, alleges that the executives have secured $1.3 billion since 2013 from what the SEC described as an unauthorized issuance of securities in the form of XRP. The agency accused Garlinghouse and Larsen of helping Ripple violate federal securities laws in the two states.

The legal case reached a turning point in July 2023 when a court declared that XRP is not a security; the SEC settled with Garlinghouse and Larsen for a while. Garlinghouse struggled to address such development and termed the case as having political motives and being in line with a political endeavor. Larsen also shared similar sentiments, though he felt the verdict was a victory. However, the case is still pending.

On October 17, the SEC reignited its legal battle with Ripple, filing an appeal against the decision on XRP’s programmatic sales and reintroducing claims of aiding and abetting against Garlinghouse and Larsen. This renewed focus suggests the SEC aims to increase potential penalties. Legal expert Jeremy Hogan commented on the move, describing it as an effort to pressure Ripple’s top executives more.

Conclusion

The ongoing SEC vs. Ripple case continues to unfold, with each legal maneuver influencing Ripple’s top leadership and shaping the future of digital asset regulation. With the SEC now challenging previous rulings, the case remains pivotal for the cryptocurrency industry, impacting Ripple’s key figures and the regulatory landscape for crypto assets.

Also Read: Ripple vs. SEC Case Intensifies with New January Deadline, Industry Eyes High-Stakes Outcome