- Ripple CTO slams Forbes for defending convicted FTX founder SBF.

- Schwartz says lobbying can’t excuse Sam Bankman-Fried’s criminal actions.

- Crypto community rejects efforts to justify fraud as innovation strategy.

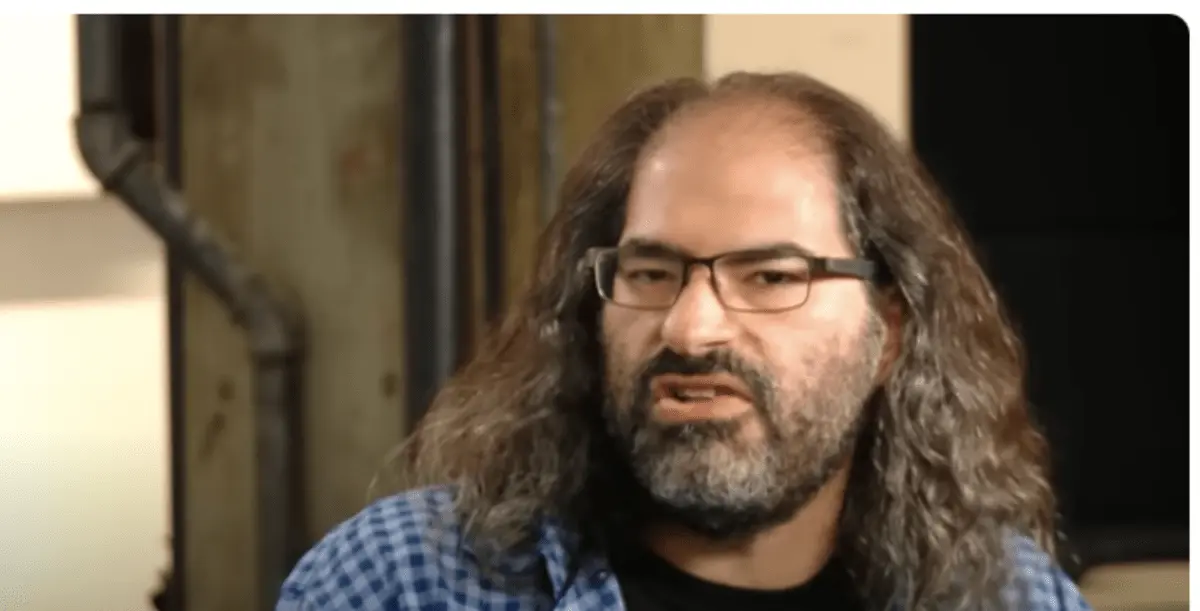

Ripple’s Chief Technology Officer, David Schwartz, has strongly criticized Forbes for publishing a piece that appeared to downplay the criminal conviction of former FTX CEO Sam Bankman-Fried. The article suggested that Bankman-Fried’s lobbying efforts in Washington should be considered as justification for his actions, a stance that Schwartz labeled as entirely unacceptable.

The Forbes article portrayed Bankman-Fried as a misunderstood figure whose influence in pushing for cryptocurrency regulation was ultimately in the public interest. It claimed that his stay in Washington did not serve his ideology and financial needs since the programs were to establish a superior crypto framework.

In response, Schwartz dismissed this reasoning outright and branded it an effort to rewrite history. As he put it, the article that argued in favor of SBF overlooked the severity of the fraud committed. He emphasized that nothing can eliminate the fact of stealing and misusing client money due to any kind of lobbying or innovative processes.

Also Read: BONE Powers SHIB Burns and Community Governance Behind the Scenes

What was covered in the article evoked instant reactions on the Internet. Neeraj Agrawal of Coin Center posted the article on Twitter and launched a discussion within the crypto community. The tweet indicated that the leadership of the industry wondered how there could be any credibility in attempting to justify fraud using the regulatory process.

Responding to it, Schwartz stressed that the criminal process should never allow any legal responsibility to be tried. He explained that Bankman-Fried’s conviction for using the funds paid by customers to compensate for losses is a gross abuse of trust and the law, no matter what additional input.

Community Rejects Efforts to Redefine Fraud Through Influence

In an attempt to soften the perception of wrongdoing, the Forbes article described FTT tokens as profit-sharing tools rather than conventional currency. This interpretation implied that SBF’s actions were a form of investor strategy, not criminal misconduct.

Such an attitude was not well accepted by Schwartz or the crypto community in general. It cautioned that pumping such narratives would normalize fraud in the name of innovation and would hence destroy confidence in the field.

The article even speculated that SBF’s political participation could earn a future presidential pardon. Schwartz refuted this notion, and it was clear that leadership in the industry would have to be judged by ethical and legal standards.

His comments reflect a growing consensus within the crypto sector. Issues of power and connections of leaders are often emphasized now, even when it comes to this scandalous situation: misappropriation of client funds cannot be justified by lobbying, attempts at regulation, or the media discourse.

David Schwartz’s public takedown of Forbes’s defense of Sam Bankman-Fried highlights a broader demand for accountability in crypto. The Ripple CTO made it clear that regulation and innovation cannot protect those who break the law.

Also Read: SYRUP Token Skyrockets 33% After Upbit Listing and Buyback Vote Buzz