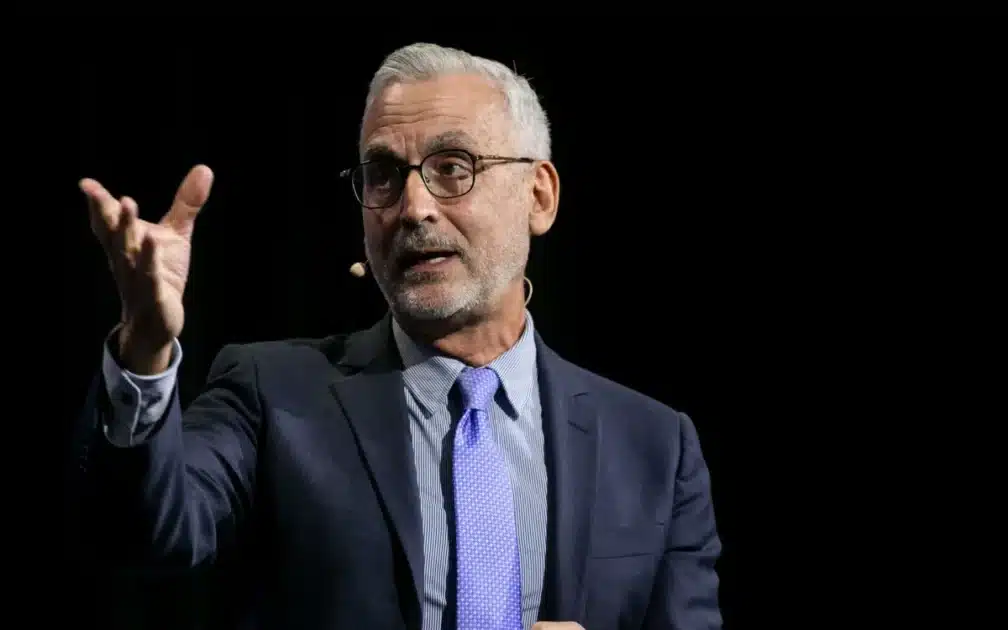

Ripple’s chief legal officer, Stuart Alderoty, recently addressed the ongoing misunderstanding of associating cryptos with the world’s money laundering problems. On X, Alderoty shared a link from the Wall Street Journal on how the US dollar fits into a major money laundering case, demonstrating that fiat currencies, especially the US dollar, are at the core of these issues.

Also Read: Ripple CTO David Schwartz Warns Users of New Crypto Scam Targeting Unstoppable Domains

Alderoty’s Focus on US Dollar’s Role in Money Laundering

Alderoty referred to a case with Ali Ghulam, often referred to as the ‘dollar king of Iraq,’ who allegedly laundered millions through three of his banks. These banks have engaged in such practices as wiring large sums of money to some bogus vendors in Iraq based on fake invoices. CIA and other US agents estimated the Ghulam had been linked to more than two and a half dozen banks thought to have been transferring money to Iran and its allied militias. Earlier this year, The Wall Street Journal report indicated that these banks used front companies and fake documents to overcome the sanctions. For instance, auditors uncovered that about $200 million out of the $250 million daily experimental wire transfers are characterized as unimpeachable; thus, funds could be wired to IRGC and other known terrorist organizations.

Reinforcing Crypto’s Potential in the Fight Against Financial Crimes

Alderoty’s analysis adds to the arguments made by several crypto stakeholders, who believe the link between cryptocurrencies and money laundering is overstated. They state that most present-day money laundering problems originate from fiat operations, where the US dollar occupies a special place. However, defenders of cryptocurrencies argue that the pseudo-anonymity is not as severe as opponents make it out to be. Anonymity also diminishes control over transactions, and since blockchain technology provides a transparent paper trail, cryptocurrency can be seen as a means of reducing international money laundering rather than facilitating it.

Altogether, it may be asserted that Alderoty’s position disrupts the narratives attributing money laundering to cryptocurrencies. He, however, points out that large-scale financial crimes continue to use fiat currencies such as the US dollar, raising questions about the place of crypto in mainstream finance.

Also Read: Indodax Exchange Suffers $22 Million Security Breach, 9 Billion SHIB Stolen