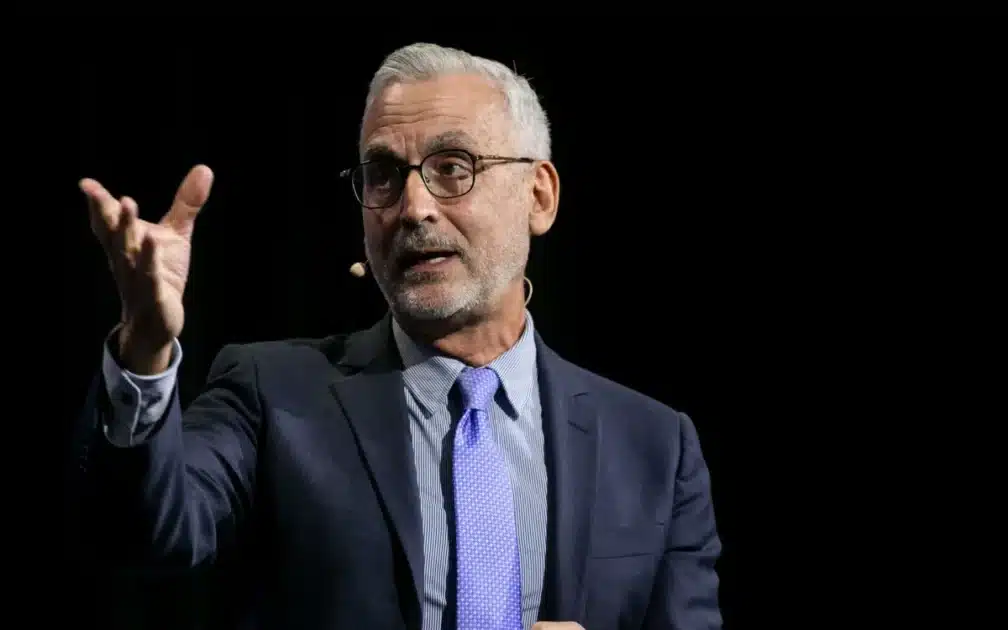

Stuart Alderoty, Ripple’s Chief Legal Officer, has laid out a series of principles he believes the U.S. Securities and Exchange Commission (SEC) must adhere to in 2025. His remarks come amidst growing criticism of the SEC’s regulatory practices concerning cryptocurrency assets.

Alderoty has reiterated that the SEC’s jurisdiction is limited to security transactions, emphasizing that it cannot extend its authority to simple asset sales. He explained this distinction with an example, stating that selling a gold bar tied to rights in a gold mine may qualify as a security transaction. However, selling the same gold bar without post-sale obligations is merely an asset sale, which the SEC cannot regulate.

The Ripple executive has also dismissed the idea of using key concepts known as ‘transformation’ whereby some digital tokens identified as securities can alter to non-securities at some time later. According to Alderoty, this concept is legally baseless and lacks any support in existing law.

Also Read: Sonic Foundation Announces Tokenomics Details and Final Airdrop Opportunity Ahead of Mainnet Launch

Alderoty’s Recommendations for the SEC Transition

In a November 21, 2024 tweet, Alderoty shared his recommendations for the incoming SEC leadership. They are the complete cessation of all non-fraud-related cryptocurrency litigation and coming to work with other financial authorities, as well as the improvement of crypto legislation with the assistance of Congress.

He called on the SEC to reject traditional approaches, including the Hinman speech of August 2018 and the investment contract test from June 2019. Other recommendations he made encompassed transparency and accountability within the agency and issues related to FOIA.

Still, Alderoty, in his December 31, 2024 tweet, extended his views further and shed more light on principles. He pointed out that it cannot be a situation where the SEC extends its arms toward whoever the agency deems needs more disclosures. He has also said that although tokens can participate in security transactions, they should not be considered securities.

Anticipated Regulatory Shifts

The SEC’s current regulatory approach, often described as “regulation by enforcement,” is expected to shift with the departure of SEC Chair Gary Gensler. Paul Atkins, who is set to replace Gensler, is seen as likely to adopt a more collaborative stance toward the cryptocurrency industry.

Despite this, a recent New York Post report cautions that the SEC may maintain a firm approach to crypto-related issues.

Conclusion

As Ripple’s legal battles with the SEC continue to shape the crypto regulatory landscape, Alderoty’s remarks underscore the need for clear and fair rules. The proposed reforms aim to balance innovation with regulatory oversight, setting the stage for potential industry-wide changes in 2025.

Also Read: Big Move For XRP: Almost All Japanese Banks to Utilize XRP For Cross-Border Payment in 2025