On December 14, the cryptocurrency giant, Bitcoin (BTC) surprised investors by surpassing the $43,000 mark. Other cryptocurrencies followed suit, taking cues from it.

One of the driving forces behind this trend is the U.S. Securities and Exchange Commission (SEC) and other global regulators, which continue to take stringent measures regarding digital assets.

All investor attention is focused on Bitcoin and alternative cryptocurrencies, as there is a possibility that the SEC may soon approve the first cryptocurrency spot exchange-traded fund (ETF) for trading on a major U.S. exchange.

We can also observe regulators cleaning up the cryptocurrency industry by addressing some leaders, including Sam Bankman-Fried of FTX and Changpeng Zhao of Binance.

Evaluation of the prospects of various altcoins

The potential decline in Bitcoin dominance from approximately 54% to a retested support level of around 40% further strengthens the optimistic outlook for Ether, Solana, and WBT.

The significant rise in BTC that began in October was substantial, with the leading cryptocurrency increasing its value by approximately $10,000 in just the last month.

Another crypto analyst, Hitesh.eth, emphasizes the BTC growth after a six-month stagnation period, pointing to an effective change in market trends.

Ethereum (ETH)

In December, Ethereum (ETH) pleased investors by reaching $2,200, as they are confident that the potential approval of a Bitcoin spot ETF will also open doors for a spot ETF on Ethereum.

Two scenarios for Ethereum’s forecast:

- According to analysts at Cointribune, the asset could reach new highs, with a price expectation ranging from $2,300 to $2,500. If the upward trend continues, it may surpass $3,000 in 2024, increasing by approximately +32%.

- However, failure to overcome the $2,300 mark could lead to a return to $2,000, representing a potential decline of around -12%.

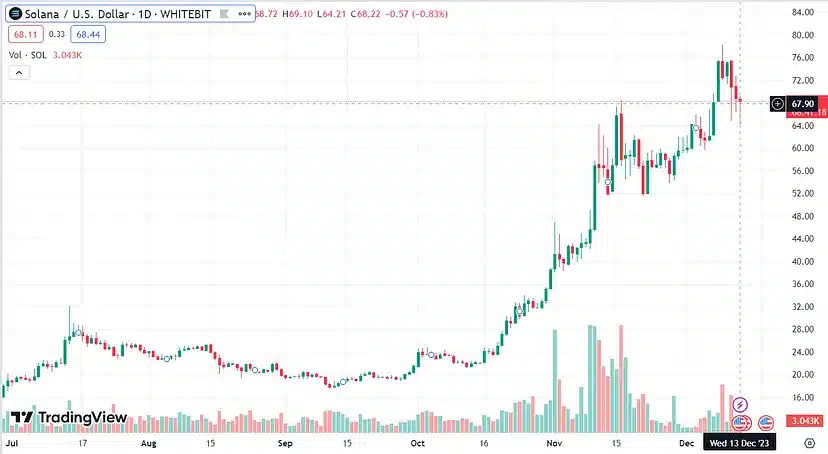

Solana (SOL)

Solana’s (SOL) price increased by 15% in a month, likely influenced by comments from Ark Invest’s CEO, Cathie Wood, who praised its high speed and low cost compared to Ethereum.

SOL Price. Source: TradingView

Two scenarios for Solana’s forecast:

- According to analysts from Changelly, Solana’s price is expected to range from $64.48 to $70.97 by the end of 2023.

- Analyticsinsight.net analysts believe Solana remains the best choice among altcoins in 2024, aiming for $100.

Bitcoin(BTC)

Despite a significant recovery in Bitcoins’ price since the beginning of the year, it is still over 45% below its historical peak of around $68,790 in November 2021.

Bitcoin’s price increased by over 8% in November and about 120% since the beginning of the year. Ethereum prices rose by approximately 12% monthly and 56% in 2023 overall.

BTC Price. Source: TradingView

Two scenarios for Bitcoin’s forecast:

- Many analysts and enthusiasts believe the coming Bitcoin halving will impact its value. MicroStrategy’s co-founder, Michael Saylor, believes that demand for BTC could grow tenfold by 2024.

- However, there are also bearish views, with investor Mark Mobius predicting a significant drop in 2022, suggesting Bitcoin could fall to $10,000.

WhiteBIT Coin (WBT)

WhiteBIT Coin (WBT) — native asset, one of the largest European cryptocurrency exchanges — WhiteBIT. WBT’s price has grown by over 35% in a year, currently standing at $5.69.

Stable price growth is attributed to bullish sentiments and the exchange’s development, introducing new features such as Web3 wallet integration.

WBT Price. Source: TradingView

Two scenarios for WBT’s forecast:

- According to Ambcrypto analysts, long-term sentiments remain optimistic, and WBT could reach $9.25 in 2024, with a price range of $5 to $5.82 and an average price of around $5.5.

- Coincodex analysts believe WBT’s price will decrease by -4.27%, reaching $5.47 by the end of December. WBT has recorded 18 out of 30 (60%) green days, with a price volatility of 1.89% in the last 30 days. According to our forecast, now is a good time to buy WhiteBIT Coin.

Stablecoins play a crucial role in the cryptocurrency market.

The CertiK team has released an update titled “Rise of Stablecoins in Unstable Times.” According to CertiK’s statement, the market share of stablecoins has steadily increased over the past five years, now accounting for approximately 80% of cryptocurrency trading volume, compared to 40% in 2018.

Apart from mitigating price volatility inherent in the cryptocurrency market, stablecoins serve “an even more important purpose for millions of people: providing financial refuge during periods of economic and political instability.”

In the CertiK update, it is mentioned that

“in conditions of war, political upheaval, economic downturn, or repressive tax-budget policies, stablecoins offer an increasingly attractive shield against financial volatility.”

CertiK also provides information about the

“major types of stablecoins and how they maintain their pegs.”

Concept of Stablecoins

The idea behind stablecoins is to provide benefits for both fiat currency and the cryptocurrency world. Currently, stablecoins are primarily used as a hedge against the high volatility of cryptocurrency markets.

However, depending on the context, they can also be used as a stable currency, providing increased transparency and decentralization.

Moreover, compared to traditional fiat currencies, they enable faster transactions and lower fees, making them highly useful for everyday payments and international transfers.

TOP 3 of the most well-known stablecoins

1. USD Coin (USDC) — Regulated Player

The USD Coin, created in 2018 by the Consortium Center (Circle and Coinbase), is pegged to the US dollar. It is known for its regulatory compliance, transparency, and the involvement of financial institutions such as the Bank of New York Mellon and BlackRock in managing its reserves.

USDC has demonstrated significant growth, especially in the decentralized finance (DeFi) sector, boasting flexibility in the use of various blockchain protocols. Currently, USDC is the second-largest stablecoin by market capitalization at $24 billion.

Some experts believe that USDC could eventually surpass USDT in market capitalization, reflecting its growing strength and influence in the DeFi sector.

2. BiLira (TRYB) Becomes the Second-Largest Stablecoin

The Ethereum-based TRYB stablecoin from Turkish fintech company BiLira is pegged to the Turkish lira, allowing users to issue and exchange 1 TRYB for 1 TRY. According to Coingecko data, TRYB’s market capitalization has grown by 325% to $136.10 million in three weeks. TRYB has become the second-largest non-USD-pegged stablecoin globally.

TRYB seems to be gaining traction in Turkey, especially after the launch of the USDT/TRY pair on the largest Turkish crypto exchange BtcTurk, with trading volume reaching $12.3 million, constituting 18% of the overall exchange activity.

3. UAHg Stablecoin

UAHg is a digital asset issued and circulated on popular public network infrastructures (currently Ethereum, BNB chain, and TRON).

Digital assets offer advantages such as transaction convenience, accessibility, and inclusivity. Additionally, the essence of the token ensures the application of UAHg as a carrier of the market, rather than a speculative, value.

According to the Whitepaper, UAHg opens up new horizons for the use of cryptocurrency in Ukraine, providing a stable and reliable mechanism for various transactions.

UAHg becomes an ideal tool for both experienced cryptocurrency users and those taking their first steps in this direction.

Starting on December 18th, users will have the opportunity to trade this new digital asset based on the information published by WhiteBIT on X (formerly known as Twitter).

Stablecoins have the potential to bring stability, transparency, and efficiency to economies, especially in times of economic and political challenges. The adoption and use of stablecoins can empower individuals and contribute to the evolution of financial systems in various countries.

Conclusion

In the ever-evolving landscape of the cryptocurrency market, the recent surge in Bitcoin and alternative cryptocurrencies has captivated investor attention.

Stablecoins emerged as an important force and a crucial role in providing financial refuge during turbulent times.

The concept of stablecoins, offering the best of both fiat and crypto worlds, presents a compelling narrative for their continued growth and adoption.

As we navigate the intricate dynamics of the cryptocurrency realm, the future holds exciting possibilities. Whether it’s the potential approval of a Bitcoin spot ETF, the rise of specific altcoins, or the transformative impact of stablecoins on global economies, the cryptocurrency market remains a dynamic and influential force shaping the financial landscape.