- Treasury Secretary Bessent confirms no additional Bitcoin purchases by U.S. government.

- U.S. Bitcoin reserves grow to over $15 billion, says Bessent.

- Treasury explores budget-neutral methods for Bitcoin acquisition, confirms Scott Bessent.

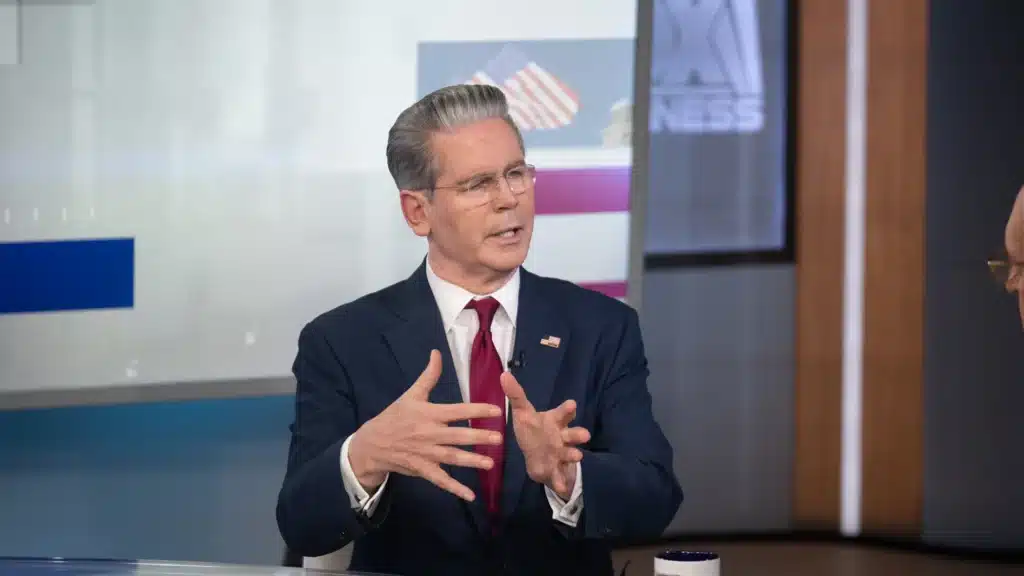

During a recent testimony before Congress, U.S. Treasury Secretary Scott Bessent made it clear that the government has no intention of acquiring additional Bitcoin. He confirmed that the U.S. will continue to retain Bitcoin seized through asset forfeitures but will not instruct private banks to buy more BTC, even in the event of a market downturn.

California Congressman Brad Sherman, a strong critic of Bitcoin, questioned Bessent on the Treasury’s involvement with the cryptocurrency. He asked whether the Treasury or the Federal Open Market Committee had the authority to intervene in the Bitcoin market.

Specifically, Sherman inquired whether the U.S. government would direct private banks to acquire more Bitcoin or other cryptocurrencies, such as “Trump Coin.” Bessent firmly responded, stating, “I do not have the authority to do that, and as chair of the Financial Stability Oversight Council (FSOC), I do not have that authority.”

Also Read: Epstein Files: More XRP Questions Arising, This Time, With Coinbase – What You Should Know

Bessent’s comments come as part of an ongoing conversation about the U.S. government’s strategy regarding Bitcoin. He also revealed that the $500 million worth of Bitcoin seized by the government has grown to over $15 billion in value since being taken into custody.

This testimony marks the latest update on the Bitcoin strategic reserve initiative, which was established by former President Donald Trump through an executive order in March 2025. The initiative aimed to build a Bitcoin reserve for the U.S. government, but it has faced criticism from some Bitcoin advocates who believe the order did not go far enough.

Budget-Neutral Acquisition Strategy

Under Trump’s executive order, the U.S. is allowed to acquire more Bitcoin only through budget-neutral methods or asset forfeiture cases. This approach ensures that no new spending is added to the national budget. It includes converting other existing reserves, such as precious metals or petroleum, into Bitcoin. As a result, the U.S. government will not be purchasing additional Bitcoin from the open market, despite calls from some in the Bitcoin community.

Secretary Bessent confirmed that the Treasury Department is exploring further budget-neutral ways to acquire Bitcoin, in line with the original strategy. This approach aligns with the government’s goal of maintaining financial stability while cautiously adding digital assets to its reserves.

The limited scope of Bitcoin acquisition has sparked ongoing debates within the Bitcoin community. While some hope for more aggressive government involvement, others see the current strategy as a responsible way to integrate digital assets without disrupting the broader financial system.

The U.S. government’s careful handling of Bitcoin and its strategic reserve initiative reflects its broader efforts to stay ahead of global financial trends while ensuring fiscal responsibility. As the role of digital currencies continues to evolve, the Treasury will likely face ongoing scrutiny and calls for further action.

Also Read: Ripple’s RLUSD Stablecoin Hits New Milestone with $35 Million Minted