President-elect Donald Trump’s World Liberty Financial (WLFI) has made strategic moves during the recent market downturn, investing $12 million in Ethereum (ETH), Chainlink (LINK), and Aave (AAVE). These investments have already shown positive returns as the market has begun to recover over the past 24 hours.

According to Spot On Chain, WLFI purchased 2,631 ETH for $10 million at an average price of $3,801 per token. The company also acquired 3,357 AAVE for $1 million at $297.80 per token and 41,335 LINK for $1 million at $24.19 per coin. These assets have seen significant gains, with the total value of WLFI’s crypto holdings reaching $64.3 million.

Also Read: Donald Trump Rekindles Dream of Turning the U.S into A Crypto Hub

Strategic Expansion into DeFi Tokens

WLFI’s crypto portfolio now includes 14,573 ETH, 3.108 million USDT, 1.515 million USDC, 41,335 LINK, and 3,357 AAVE. The company has also diversified into smaller amounts of other cryptocurrencies such as LimeWire (LMWR), Alchemy Pay (ACH), Wrapped Ether (WETH), Safe (SAFE), and Uniswap (UNI).

This marks WLFI’s first acquisitions of AAVE and LINK, signaling a strategic expansion into decentralized finance (DeFi) tokens.

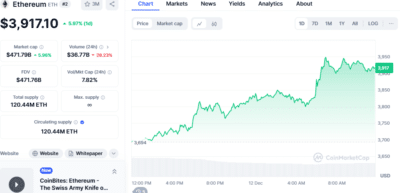

Crypto investments for WLFI remain anchored in ETH, with the company investing 30 million USDC in the last 12 days to acquire 8,105 ETH at an average cost of $3,701. At the moment, ETH is priced at $3,917.10, up 5.97% in the last 24 hours, and while still 19.44% below its cyclical high of $4,891.70, recent market movement suggests the cryptocurrency is likely to increase further.

Source: CoinMarketCap

Even from the technical analysis of ETH, one can identify bullish factors related to the market. Our current Relative Strength Index (RSI) is 63.28, which shows that the rate of buying is on the up and that the general sentiment in the market is bullish. Using such indicators, ETH could sustain its upward trend, which will add to WLFI’s crypto assets.

WLFI’s recent investments reflect an apparent belief in the long-term value of ETH, LINK, and AAVE and a well-timed approach to the volatile crypto market. The company’s diversified portfolio positions it to benefit from both Ethereum’s continued dominance and the growing DeFi ecosystem.

Also Read: Donald Trump Discusses Crypto Policies and Debt Reduction Strategies