In a major development that could reshape the future of XRP and restore clarity to crypto regulation in the U.S., Ripple Labs and the Securities and Exchange Commission (SEC) have reached a long-anticipated settlement.

The parties formally informed the U.S. District Court for the Southern District of New York of the agreement on Monday, setting off a final sequence of legal steps that could dissolve the long-standing injunction and free over $75 million in escrowed funds.

SEC Greenlights Settlement Terms After Lengthy Internal Deliberation

The deal was officially approved by SEC commissioners following a closed-door meeting that had been on the agency’s calendar since late April.

Under the revised terms, Ripple will pay a $50 million civil penalty, a sharp reduction from the originally imposed $125 million, and the permanent injunction blocking institutional XRP sales will be vacated pending court approval.

Notably, the SEC’s move to approve the terms marks a shift in tone from the aggressive enforcement strategy that dominated crypto policy through 2023. The settlement also brings Ripple’s top executives—Brad Garlinghouse and Chris Larsen—out of the legal spotlight, absolving them of further personal liability.

Also Read: Ripple vs. SEC: Here’s Why Today is Very Important for the XRP Lawsuit

Request for Indicative Ruling Puts Spotlight on Judge Analisa Torres

Following the commission’s approval, Ripple and the SEC filed a joint letter with Judge Analisa Torres, requesting what’s known as an indicative ruling. If granted, the judge would signal her willingness to lift the injunction and authorize the disbursement of funds currently held in escrow.

The proposed division of the escrowed amount is as follows:

-

$50 million to the SEC, representing the final agreed-upon fine

-

$75 million returned to Ripple, closing the financial chapter of the case

This unusual procedural step is necessary because the case is currently on hold at the Second Circuit Court of Appeals, where both Ripple and the SEC filed cross-appeals last year.

An indicative ruling would allow the parties to seek a limited remand—a temporary return of jurisdiction to Judge Torres so she can enter final orders implementing the deal.

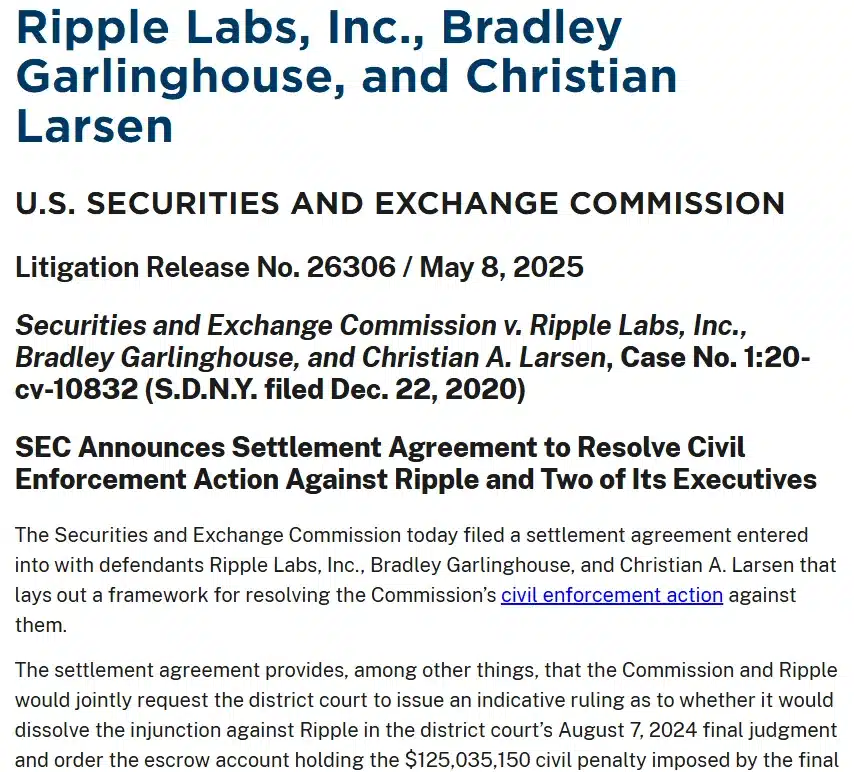

Excerpt from SEC announcement | Source: SEC website

Meanwhile, prominent legal analyst and former federal prosecutor James K. Filan explained that if Judge Torres grants the indicative ruling, Ripple and the SEC will jointly request the Second Circuit to remand the case for enforcement of the settlement.

Torres would then vacate the injunction and oversee the escrow disbursement before the case is formally closed at the appellate level.

This process, while procedural, is critical: it marks the final step toward full regulatory closure for Ripple and sets a precedent for future SEC settlements involving digital assets.

John Deaton: “This Agreement Makes Perfect Sense”

Pro-XRP attorney John Deaton, known for his outspoken defense of XRP holders throughout the case, expressed strong confidence in the outcome. Deaton emphasized that the structure of the agreement is not only legally sound but also practically unavoidable.

“I don’t want to jinx anything,” Deaton wrote, “but the agreement below makes perfect sense, and it’s difficult to see it not going through.”

His sentiment echoes that of much of the XRP community, which has waited nearly four years for this case to reach its final act.

Ripple’s Newfound Momentum and Market Impact

With the settlement terms in place, attention is now turning to how this legal clarity could reinvigorate XRP’s market position. The asset, which once peaked above $3.55 in 2018, has been largely constrained by uncertainty over its legal classification.

Now, institutional interest may return in earnest, especially with Ripple expanding global operations and exploring tokenized asset markets. At the time of writing, XRP was trading at $2.31, representing a 6% increase in the last 24 hours.

Ripple has recently pushed deeper into stablecoin development, announced upcoming pilot programs with central banks, and acquired infrastructure providers to bolster liquidity solutions. These moves, coupled with the impending dismissal of the lawsuit, could reignite demand for XRP in cross-border finance and digital asset settlements.

What Comes Next?

-

Judge Torres must decide whether to issue an indicative ruling, likely within days

-

The Second Circuit will need to approve the remand, enabling Judge Torres to formally dissolve the injunction and reallocate escrowed funds

-

The appeal and cross-appeal would then be dismissed, concluding the litigation

While a precise timeline remains fluid, legal observers agree that the road to resolution is now clearly mapped out.

The final pieces of the Ripple-SEC saga are falling into place. With regulatory storm clouds parting, XRP may be preparing for a second act, this time, on institutional terms.

Also Read: XRP Eyes Key Technical Breakout as Bulls Attempt Shift in Market Structure