With the popularization of cryptocurrencies around the world, it is important to keep track of and understand the most relevant news in this area. Weekly, we follow the cryptocurrency news, trends, and events that shape the modern cryptocurrency landscape. And this week is no exception. What events will surprise us this time? Let’s talk about it further.

The “Cambrian Explosion” of Memecoins

Jesse Pollak, the creator of the Base blockchain, believes that memecoins will be key to attracting users to his Coinbase-adjacent layer-2 network, which has already tripled its total value locked (TVL) since March.

During one of the memecoin hackathons, Pollak claimed that the coins are an important part of the blockchain economy and that he is “excited to see more based memes proliferate to help bring the world on-chain.”

“One thing that has stood out to us is that we’re seeing these memes today onboard thousands and thousands of people into this new economy.” said the creator.

The growth in the number of memecoins and transactions on the Base is attributed to the latest Ethereum Dencun update, which reduced fees on Level 2 networks. According to DefiLlama, TVL Base has grown by almost 250% since the beginning of March, reaching an all-time high of $1.61 billion on April 21.

Pollak says that in addition to speculation, meme creators on the Base have also developed countless new ways to engage people in their communities.

“And what that’s creating is this kind of Cambrian explosion of onboarding experiments where people are taking tons and tons of shots on goal to say ‘how do we get our culture into the hands of more people,” he says.

Jesse Pollack is also convinced that shortly, we will see these coins attract millions more people to the Base network. “They’re going to be one of the biggest drivers because they’re doing that work constantly to onboard more and more folks through that in a creative way”

Currently, the most popular memecoin on Base is BRETT, with a market capitalization of $567 million and a price increase of 7,780% since the beginning of March. Recently, blockchains such as Solana and Base have become a kind of attractor for memecoins due to their high throughput and low fees.

However, Cointelegraph recently conducted an investigation that showed that 16.7% of new projects on Base were fraudulent, and more than 90% of them had vulnerabilities.

Therefore, do not forget to do your research before investing in digital assets. The following news is another reminder of the importance of this rule.

Read Also: PEPE Memecoin: The new king of the memes?

12 Solana Presale Memecoins Have Been Abandoned

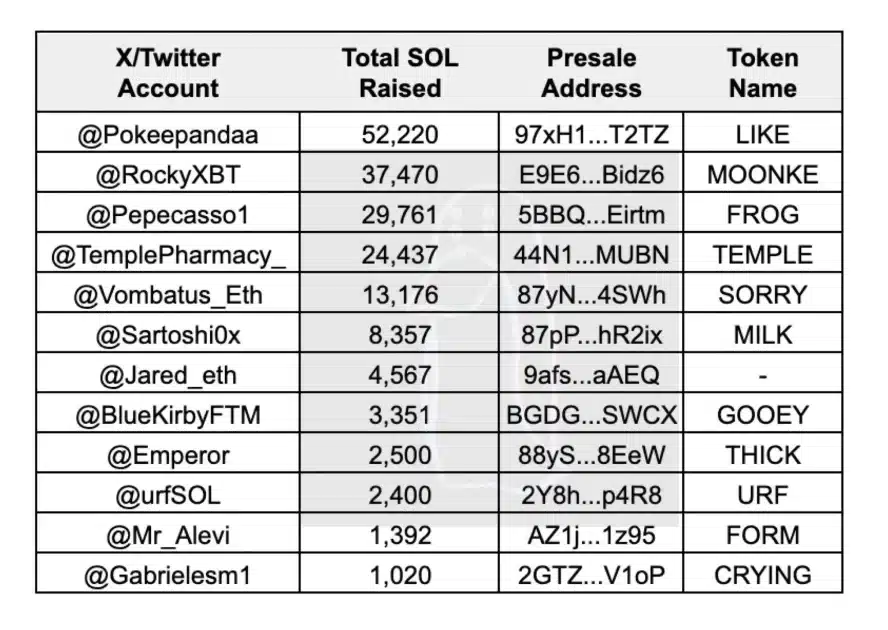

As mentioned above, the popularity of memecoins has increased recently, and this is exactly what fraudsters are taking advantage of. Blockchain researcher ZachXBT posted on his X that at least 12 Solana memecoins have been “abandoned” in the last 30 days after investors raised $26.7 million. He identified 12 projects that raised funds through pre-sales, most of which dropped significantly after launch and one that did not issue any tokens at all.

Source: ZachXBT/X

According to the researcher, the most expensive “abandoned” project was a memecoin called “I like this coin” with the LIKE ticker. The founder is a user under the pseudonym pokeee.eth, who collected 52,220 SOL tokens ($7.7 million) and launched the coin on March 17 with a market capitalization of $577 million. However, in the first eight hours, the value of the coin fell by more than 90%. In particular, the official X page has not had a single new post since March 31, and the founder has not mentioned the coin since then.

The second-largest project is the MOONKE token, founded by RockyXBT. The asset fell by more than 99% in a matter of hours. CoinGecko’s data shows that market enthusiasm for memecoins has declined slightly. Since April 1, the value of most tokens, including Dogwifhat (WIF), has dropped significantly.

Binance is Removed from Apple and Google Stores in the Philippines

The Philippine Securities and Exchange Commission has ordered Google and Apple to remove the Binance app from their app stores for users in the Philippines.

According to the SEC’s press release, they are working with major tech companies to remove “programs operated by cryptocurrency giant Binance.” It is also reported that the companies have received letters asking them to remove these programs in local markets.

“The SEC has identified [Binance] and concluded that the public’s continued access to these websites/apps poses a threat to the security of the funds of investing Filipinos,” the SEC noted.

According to SEC head Emilio B. Aquino, selling or offering unregistered securities to locals and operating as an “unregistered broker” is a violation of the country’s securities laws. He also noted that by removing Binance apps from app stores, these companies will help “prevent the further spread of illegal activities in the country,” emphasizing that otherwise, it could have a “detrimental” impact on the local economy.

Since November 2023, the SEC has been actively warning the public against using Binance for investing. They emphasize that the crypto exchange has not yet received a license to attract investments from citizens and operate an exchange for the purchase and sale of securities.

The Philippines is not the only country to block Binance due to unregistered activities. The exchange is known for numerous open cases in different countries due to regulatory issues, including the controversial situation with Nigeria, which is still gaining momentum.

Read Also: Binance Faces Charges in Nigeria Following Executive’s Escape

Satoshi Nakamoto’s Early Vision of Bitcoin

Marty Malmi, one of the first collaborators in the development of Bitcoin, has once again published a series of letters from the founder of the main cryptocurrency. This time, they shed light on the initial philosophy of the digital currency and the first operational problems. The letters were first discovered during a lawsuit involving Craig Wright, who claims to be Satoshi Nakamoto.

The discovered emails show that the founder of Bitcoin had some reservations about the cryptocurrency being classified primarily as an investment. This view emphasizes his understanding of Bitcoin as a means of payment, not just a speculative instrument.

The importance of this clarification is that it emphasizes the usefulness of cryptocurrency for making transactions without the need for a trusted third party, which is a fundamental feature of its creation. Nakamoto was reportedly careful with the public presentation of Bitcoin to avoid misinterpretation of its original purpose.

Another important focus of the conversation is Nakamoto’s attitude to anonymity. Contrary to the popular belief that Bitcoin itself is an anonymous network, Nakamoto urged caution about anonymity. He suggested that although the asset offers the possibility of using pseudonyms, the community should take into account its shortcomings in this regard.

In his letters, he presented a well-thought-out privacy concept that included the real presence of these technologies, including their capabilities and limitations. In doing so, he not only eliminated possible legal and moral complications but also helped build a quality user base.

The emails between Nakamoto and Malmi reveal the team spirit that characterized the early stages of Bitcoin’s development. Nakamoto often asked for help in developing the site’s content and communicated with Malmi on many technical issues, which demonstrated his ability to share tasks and work together, which allowed him to improve the platform and make it more popular.

Is it a coincidence that the new series of letters was published right after the Bitcoin halving? Such an event was highly significant in the crypto industry, and many enthusiasts were looking forward to it. Several cryptocurrency exchanges, such as OKX, Binance, WhiteBIT, and others, took advantage of this and organized certain activities for their users related to this event.

Advertising Phishing Sites from Google

The phishing problem is now at a very critical level, and it seems that companies should be interested in fighting these attacks. However, tech giant Google has taken a different approach and started advertising malicious cryptocurrency websites, exposing users to phishing.

According to a report by BleepingComputer, the attackers used Google Ads to advertise a fake version of Whales Market, an OTC cryptocurrency platform that allows airdrop tokens to be traded.

While the ad contains a seemingly legitimate domain address, it redirects users to a fraudulent website when they interact with it. The report states that the attackers registered several domains targeting the Whales Market, and only one of them was inactive.

The clone of the site replicates the interface of the legitimate version, deceiving users and forcing them to link their digital wallets. This is another case in a series of similar ones where fraudsters use Google’s platform to promote fraudulent services.

Read Also: Approval Phishing Scams Sees Explosive Boost, With $347 Million Stolen in 2023 – Chainalysis