Defunct crypto exchange, Mt.Gox, has reportedly activated one of the wallet addresses to be used for customer repayments by sending a mere $24 worth of Bitcoin to it. This update has raised the hopes of eligible customers who are patiently awaiting the payment date. As the failed exchange prepares for the big day, test transfers and measures are being taken to ensure a smooth and successful repayment.

Mt. Gox had previously announced that it would commence the debt repayment of about $9 billion in Bitcoin (BTC) and Bitcoin Cash (BCH). Significantly, this comes amid Bitcoin and the global crypto market crash. Investors are concerned about Bitcoin’s future price trajectory as repaid clients could instantly sell off their holdings to cash in on realized gains. Notably, in the last 24 hours, Bitcoin has traded as low as $57,071.

Read Also: Shiba Inu Dips 9% with New Support Range Identified as Market Faces $321M Liquidations in 24 Hours

Mt. Gox Prepares for Repayment

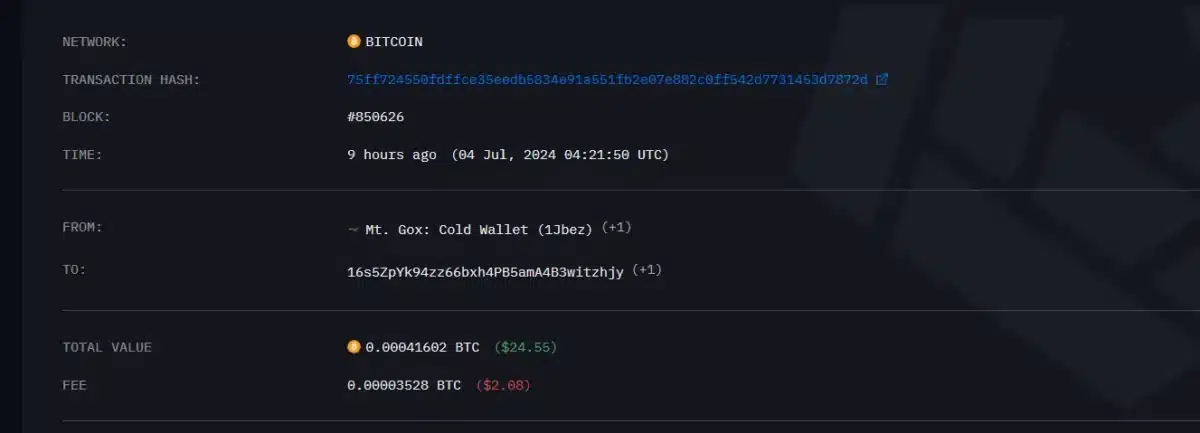

According to data from Arkham Intelligence, a sophisticated blockchain intelligence platform, Mt. Gox initiated this transfer at about 04:21:50 UTC, sending 0.00041602 BTC (valued at $25.55) from its cold wallet to a wallet identified as ’16s5…zhjy’ reportedly associated with the Bitbank exchange.

Source: Arkham Intelligence

It is important to note that Bitbank is one of the exchanges from which Mt. Gox will be making repayments. Other crypto exchanges partnered for this purpose include Bitstamp, Kraken, SBI VC Trade, and Bitgo. Instead of sending funds directly to creditors, Mt. Gox will distribute the assets to the aforementioned exchanges to ensure a smooth disbursement to eligible customers.

The Rehabilitation Trustee has assured users that their repayments will be processed in early July, however, a definite date has not been communicated. Also, the crypto exchanges have assured creditors that their funds will be made available within 3 months (90 days) of receipt. The small transactions initiated by Mt. Gox further raise the question about a possible test run in preparation for the nig day. A close look at Mt. Gox’s balance reveals that the collapsed exchange holds 141.687K BTC (valued at $8.17 billion) which will be distributed at the set time.

The expectation of the repayment along with increased whale activities including large government transfers have contributed to the current Bitcoin price plunge over the last week. Notably, the United States government and the German government have been sending substantial amounts of Bitcoin to several crypto exchanges further igniting speculations and dashing hopes of a potential price rally.

Just In: Mt. Gox Transfers $24 #Bitcoin to Activate Wallet Ahead of Customer Repayments#cryptonewstoday #MtGox #MtGoxRepayments #ThursdayWisdom

— 36crypto – Crypto News (@36Crypto2) July 4, 2024

Implication for Bitcoin Price

The $9 billion worth of Bitcoin to be used for repayment represents about 0.7% of the 19.7 million BTC in circulation. Market participants have been voicing concerns about the impact this will have on the price of the coin if paid creditors decide to sell. Understand that when Mt. Gox crashed ten years ago, the price of Bitcoin was around $600, fast-forward to today, Bitcoin is selling at an average of $57,000.

This means that creditor might realize over 195x profit from their initial holdings. These statistics might lead to a wide sell-off which will trigger a significant nosedive for the price of the flagship asset. At the time of writing, Bitcoin is currently changing hands at $56,937 representing a 5.89% decrease in the last 24 hours. Moreover, its 24-hour trading volume has surged by 37% to $38 billion.

Read Also: US Government’s Strategic Bitcoin Movement to Coinbase Sparks Market Speculation