Mt.Gox repayments shock pacifies as the market enters the ‘Greed’ zone. But will upticks endure?

Defying the Mt.Gox sell-off, Bitcoin managed to break the crucial $60,000 barrier on Monday, July 15. The market reacted with an array of green candles, as the Fear & Greed index is approaching the rate of 70. How the German government nudged Bitcoin’s recovery and what is awaiting altcoins – in the article below.

Will Bitcoin Score $70K?

Trading for $64,413 at the writing time, Bitcoin (BTC) recorded an 8.8% upswing from July 15 to July 17. Still, the chart switched to bullish at the end of the previous week – just at the time when the German government cleared its $50,000 Bitcoin supply. The move seems to become crucial for the long-term bullish perspective for Bitcoin, as can be evidenced by both metrics and the chart.

Specifically, according to the Pi Cycle Top indicator, Bitcoin has been approaching a $65,000 mark, crossing the $64K market bottom. As per the graph, given the constancy of an upward movement, BTC has all the chances to touch its market top of over $89,000 in the coming months.

BTC: Pi Cycle Top Indicator. Source: Glassnode

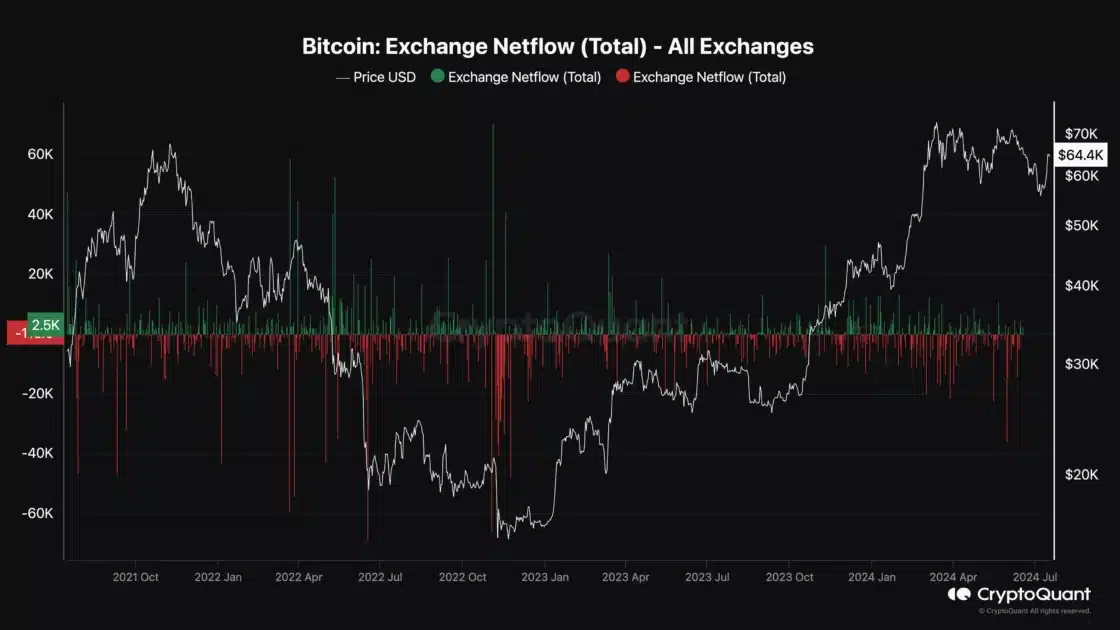

The bullish predictions become more probable as Bitcoin is experiencing increased buying pressure. According to CryptoQuant’s data, Bitcoin’s net deposit on exchanges decreased in 7 days, proving the aforementioned point.

Bitcoin (BTC) total exchange netflow. Source: CryptoQuant

Apart from that, Bitcoin’s Funding Rate was also high, suggesting that long-position traders dominated over the bears. As per the weekly BTC/USDT chart, the price has achieved the major resistance at $64,000, making the $69,000 mark the next target for the bulls. A bullish weekly confirmation above $65,000 may clear the hurdle to reach $70,000.

BTC/USDT 1W chart. Source: WhiteBIT TradingView

Crucially, similar price action has also occurred back in 2021. After making a new all-time high (ATH) at $64,854, Bitcoin faced a sharp pullback close to $30,000 and kept on consolidating for a couple of months. Further, the price broke out of the pattern and led to a 60% upswing to mark a new ATH close to $69,000.

Currently, the price appears to be at the foothill of a major explosion as the price is heading towards the upper resistance of the expanding pattern, aiming to clear the levels. Therefore, all the fractals indicate a huge probability of triggering a fresh bull rally, which may not only lift the levels to $75,000 but may find a new ATH much higher than this. The BTC price faced only a 25% correction, just half of that it faced in 2021, and hence the upper limit is also expected to remain higher than before.

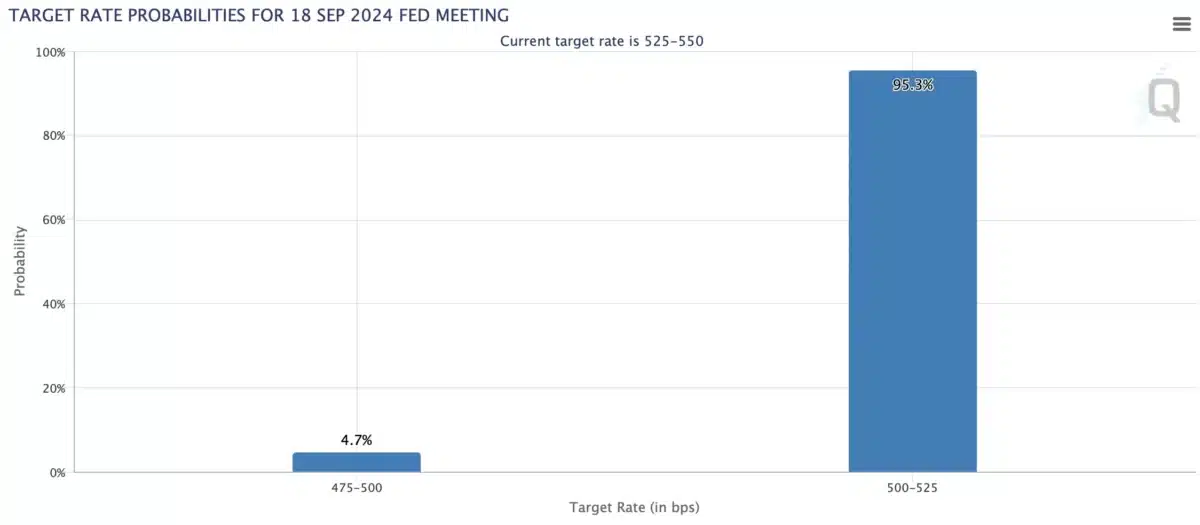

What is more, the sentiment may also favor the bulls in the long-term perspective, as 90% of interest rate traders expect the U.S. Federal Reserve (Fed) interest rate cuts in September, which could fuel risk assets, including Bitcoin and other cryptocurrencies.

Target rate probabilities for the 18 September Fed meeting. Source: CME Group

Ton Is Restrained; Rebound Is Possible

Following the overall market sentiment, altcoins have mainly recorded decent upticks. While Pepe (PEPE), dogwifhat (WIF), and Notcoin (NOT) marked roughly 20% increases, some of the assets indicated a separation from the trend. One of such cryptocurrencies turned out to be Toncoin (TON). The previous week appeared bullish for TON, mainly due to the coin’s listing on the WhiteBIT cryptocurrency exchange. From July 8 to July 15, the asset marked a 10% price increase.

Still, the daily chart revealed that TON has been trading within a rising wedge ever since it reversed the trend from the lows below $5. This served as a reason for a pullback, even though the lower support zone between $6.97 and $7.11 has held the levels rather strongly.

TON/USDT 1D chart. Source: TradingView

The technical indicators also hint at the bearish perspective, as moving average convergence divergence (MACD) registered a strong downtick and the relative strength index (RSI) stood in the descending consolidation zone.

Crucially, indicators mark that TON’s selling pressure has slowly increased. Thus, until the TON price sustains above the support zone, the bulls may trigger a rebound, which may raise the levels back above $8.

XRP – Week’s Top Gainer

While the majority of the assets secured upward updates, Ripple’s XRP surprisingly took over the investors’ spotlight. While over 36% weekly jump took market participants aback, reasons for XRP’s bullish movement were on the surface.

Specifically, the price increase and following buying pressure were spurred by the whales’ movements. As of writing time, the large-scale investors managed to rack up 85% of the total XRP supply, marking the highest point in 11 months.

Source: Santiment

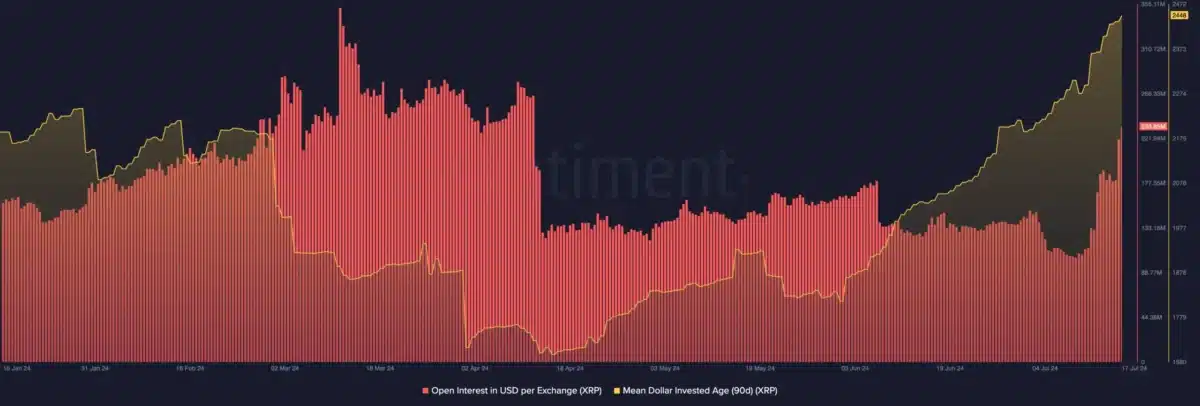

The whales’ transactions spurred stagnant XRP tokens to move. Thus, the asset’s Open Interest (OI) touched $233.85 million – the highest mark since April 12.

Ripple (XRP) Open Interest (OI) rate. Source: Santiment

The weekly chart also revealed a bullish perspective as the price reclaimed the levels within an upward pattern. The price has entered the ascending parallel channel after increasing from the lows by over 45% in just a couple of days.

XRP/USDT 1W chart. Source: WhiteBIT TradingView

So far, the weekly on-balance volume (OBV) has triggered a bullish divergence while suggesting the rally has come under bullish influence. Still, after rising to the upper range of the channel, the XRP price is not expected to barge in through the upper resistance but to maintain a healthy consolidation between the upper and the middle bands.

If the bulls maintain a healthy consolidation for the rest of the year, the Ripple (XRP) price may reach the $1 milestone before the end of Q3 2024 or early Q4. While the market radiates a bullish trend, investors should be cautious due to the risks of selling pressure.