Last updated on August 26th, 2024 at 12:44 pm

Recently, the interest in Bitcoin as buyers in the United States reached its highest point in 39 days, as the signals appeared that the U.S. Federal Reserve could restore interest rate cuts. This increase in demand is linked hand in hand with the Fed’s signals of the change in its monetary policy, which implies that a string of lower interest rates may soon ensue. Bitcoin accumulation surged following Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium. Powell hinted at upcoming policy changes, though he did not specify the timing of the rate cuts.

Also Read: Michael Saylor Reacts as Bitcoin Surges Past $61,000, Calls It “The Answer”

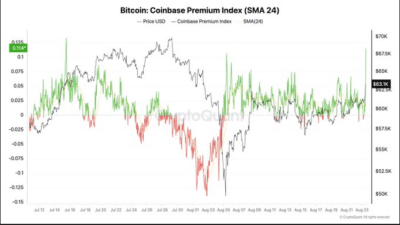

Coinbase Premium Index Reflects U.S. Bitcoin Buying Pressure

August 23 also broke out as the Coinbase Premium Index of the difference in price of Bitcoin on Coinbase Pro and Binance. The index rose to the highest level since the middle of July, reaching 0. 0114. It is more commonly applied to compare U.S. investors’ demand to the global market, with the positive readings showing that the buying pressure has risen. An increase in this index can be observed in recent years, reflecting the renewed activity of U.S. investors, which coincided in time with Powell’s speech, which raised hope for a change in the policy of the Federal Reserve on interest rates.

Source: Julio Moreno

This idea has been due to the already existing hints at possible Interest Rate Cuts by the Central Bank to improve the economic environment for the purchase of bitcoins, thus increasing the cryptocurrency market. As the Federal Reserve’s policy direction becomes more apparent, Bitcoin demand is expected to respond to further signals from the Central Bank.

The latest rise in the Coinbase Premium Index shows that activities within the Federal Reserve positively correlate with the cryptocurrency market. Since fund holders keep responding to signals of policy shifts, variability is also expected of the price and demand of Bitcoin. Possible lower interest rates could impose quite a change in the market and put up more demand for bitcoins, which is related to problems of the traditional economy.

Also Read: Mt. Gox Transfers $709.44 Million in Bitcoin to Bitstamp Amid Repayment Process