South Korean authorities are investigating local cryptocurrency exchanges as Binance’s market dominance raises concerns over fair competition. Binance’s trading volume currently outpaces all South Korean exchanges combined by a factor of 22, prompting regulatory scrutiny to address potential anti-monopoly issues and ensure a level playing field in the country’s cryptocurrency sector.

The Financial Services Commission (FSC) in South Korea, in conjunction with the Korea Fair Trade Commission (KFTC), has launched an investigation to assess whether local exchanges adhere to anti-monopoly regulations and to evaluate if the market structure limits opportunities for other players. The authorities are also looking into the role and reach of Binance in South Korea, seeking to create a more level playing ground for both domestic and international actors. The step clearly shows the government’s readiness to determine fairness as the digital currency market advances, attracting investors and authorities.

Also Read: South Korea Boosts Crypto Crime Fight with New Investigation Division and Strict User Protection Law

Binance’s Trading Volume Highlights Market Disparity

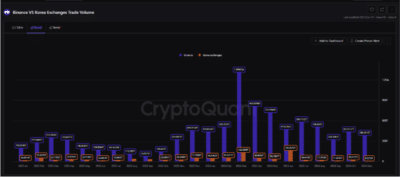

According to recent data from a report by “burakkesmeci” on CryptoQuant, Binance’s trading volume has consistently eclipsed that of all South Korean exchanges combined over the past six months. In May, Binance reported a volume of $514 billion, compared to the $23 billion generated by Korean exchanges collectively.

This pattern persisted through the summer, with Binance’s volume in June reaching $337 billion while South Korean exchanges recorded $115 billion. In July and August, Binance saw volumes of $415 billion and $361 billion, while Korean exchanges trailed significantly at $12.8 billion and $12.09 billion, respectively. September and October reflected a similar gap, with Binance’s trading volume at $230 billion and $310 billion, while Korean exchanges tallied only $7.82 billion and $17.78 billion.

Source: CryptoQuant

This volume differential has spurred regulators to investigate competitive activities and see whether regulatory deficiencies impact Binance’s dominance in South Korea’s cryptocurrency sector. South Korean exchanges, which confront worldwide competition and severe regulatory requirements, may benefit from more control of major global companies such as Binance. The current inquiry will likely establish if additional regulations are required to promote fair competition and avoid anti-competitive behavior.

South Korean officials have yet to set a completion date for the probe, but they have emphasized their commitment to protecting both local exchanges and investors from possible market imbalances produced by unrestrained dominance.

Also Read: South Korean National Assembly Investigates AVAIL Token for Price Manipulation