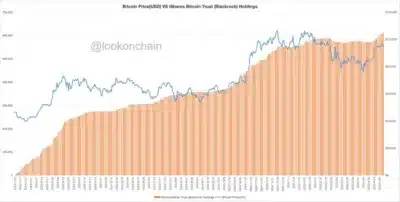

BlackRock has taken the lead in corporate Bitcoin holdings after adding over 41,000 BTC to its portfolio within two weeks. According to analytics platform @lookonchain on social media platform X, the firm’s spot Bitcoin ETF, IBIT, now holds 614,639 BTC.

This recent acquisition is valued at nearly $4 billion, bringing BlackRock’s total Bitcoin holdings to approximately $58.07 billion. The sharp increase places the asset management firm ahead of Strategy, formerly known as MicroStrategy, in total Bitcoin value.

Also Read: Ethereum on Edge—Why Coinbase Suddenly Locked ETH Transfers Today

ETF Inflows Drive Acceleration in BTC Holdings

The pace and volume of BlackRock’s accumulation have significantly shifted the landscape. Its ETF structure allows it to absorb massive investor inflows, which are then used to purchase and hold Bitcoin on behalf of clients.

This mechanism has enabled BlackRock to grow its holdings faster than companies relying on internal capital or fundraising. Meanwhile, Strategy has remained active in its Bitcoin strategy, continuing its regular acquisition model.

Michael Saylor’s strategic move resulted in Strategy’s $1.2 billion purchase of Bitcoins last week. On Monday, Strategy expanded its BTC holdings by purchasing an additional 1,895 BTC worth roughly $180 million.

Strategy’s Bitcoin ownership has reached 555450 tokens totaling approximately $38 billion, although its BTC acquisition momentum continues. BlackRock’s current position surpasses $20 billion in value.

BlackRock is achieving success through growing institutional and retail investor interest in regulated spot Bitcoin ETFs. Institutional and retail investors keep entering the crypto market through these channels, which drives IBIT to show consistent expansion.

This development underscores the rising influence of traditional financial institutions in cryptocurrency. BlackRock’s rapid climb past Strategy signals a changing tide in how Bitcoin is being adopted at the highest levels of finance.

Conclusion

BlackRock’s swift Bitcoin accumulation strategy has redefined the leaderboard among corporate holders. With $58 billion in BTC, it now firmly holds the top spot over Strategy, reshaping the narrative in institutional crypto investment.

Also Read: Big News for Ripple: RLUSD Scores Major Listing on Gemini Exchange