XRP’s journey toward a fully regulated spot ETF in the United States may have taken a major step forward following a significant move by the Securities and Exchange Commission. The SEC has approved Grayscale’s request to convert its Digital Large Cap Fund (GDLC) into a spot ETF, and XRP is one of the five digital assets included.

This approval gives XRP its first presence in a U.S.-regulated spot ETF that directly holds the token. Previously, XRP was not included in ETFs other than futures-based ETFs that fail to provide direct exposure. Now that GDLC has launched on NYSE Arca, investors have the opportunity to attain a secondary exposure to XRP in the form of a fully regulated investment product.

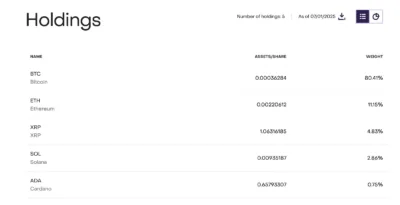

The innovation will become a new stage in the history of XRP’s impact on the traditional financial system. GDLC currently manages more than 750 million dollars in assets, and XRP occupies 4.8 percent of the portfolio. Bitcoin, with 80.4%, and Ethereum, with 11.15%, take the first two positions, followed by Solana and Cardano.

Source: NYSE Arca

Also Read: Bitcoin Holds Above $106K as ETH, XRP, SOL, and DOGE See Minor Pullbacks

Pressure Mounts on SEC Amid Rising Demand for XRP Spot ETFs

This move also comes after XRP’s regulatory clarity improved following the resolution of Ripple’s long-standing legal dispute with the SEC. As XRP becomes part of a fund already approved by the commission, the argument for dedicated XRP spot ETFs becomes harder to dismiss.

Asset management providers Grayscale, Bitwise, and Franklin Templeton, among others, have all filed applications to offer an XRP-related spot ETF. At least ten active filings are pending the SEC on a case-by-case basis. Since the commission has already approved a product that incorporates XRP, observers are now of the view that the approval of a standalone XRP ETF is a possibility going forward.

Moreover, Bitwise has also filed an application to transform its Crypto Index Fund, which contains XRP, into a spot ETF. If this is approved, it would increase XRP’s presence in the regulated market and make it available to more institutions.

Set against an October 2025 deadline, the SEC’s decision on XRP ETF applications could be influenced by Grayscale’s achievement in adding XRP to GDLC, which has now set a significant regulatory precedent.

The green light has further fueled a market drive to bring XRP ETFs a step closer to reality.

With XRP already part of an approved spot ETF, market pressure is growing for the SEC to extend similar treatment to standalone XRP funds. The latest development has brought XRP spot ETFs one step closer to approval.

Also Read: Dogecoin Futures Surge as $1.77B Open Interest Sparks Breakout Hopes