- Bitcoin’s $90B trading volume spike marks a cycle-defining top.

- Bearish sentiment rises as institutional Bitcoin ETF holdings hit records.

- Fear and Greed Index shifts after Bitcoin rebounds above $114,000.

An explosive surge in trading activity marked Bitcoin’s rally to a fresh all-time high in August. Santiment data indicates that the week of August 12 registered a huge weekly trading volume of $90B as the asset reached a high of $124,290. This peak in activity is one that now retrospectively appears as a warning that the market had reached its peak before the prices started to fall.

In April, Bitcoin experienced a similar volume-driven event, as weekly activity increased to $84.08 earlier in the month. That rush occurred in a sharp market decline, which would turn out to be the bottom of the cycle and lead to the subsequent rally.

Also Read: DBS Bank Launches $1,000 Tokenized Crypto Notes on Ethereum for Investors

Bearish Sentiment Clashes With Institutional Demand

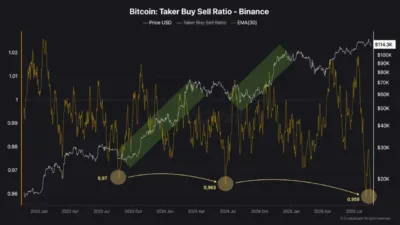

Additionally, derivatives data has highlighted a growing shift in sentiment. Analyst Darkfost reported that the Binance taker buy-sell ratio weakened to 0.95, the lowest point of this cycle. A ratio less than one indicates greater selling pressure, which indicates a bearish tone in the market.

Recoveries have always followed past declines in this ratio, and so the current scenario looks contrarian. Meanwhile, institutional involvement is high as the spot Bitcoin ETF holdings reached a new high of 1.25M BTC, as seen on the chart.

Fear and Greed Index Reflects Market Uncertainty

Market movements have reflected these opposing forces. Bitcoin fell to $112,350, its lowest price level in almost two months, before rising to $114,500. The subsequent rebound pushed the Fear and Greed Index up to a neutral reading of 50.

Macro factors still exist, which affect investors’ behaviour. The total market capitalization of cryptocurrency has recovered to 3.96T. Nonetheless, traders are wary before the Jackson Hole conference, where Fed Chair Jerome Powell will address issues, and this could influence the anticipation of an interest cut in September.

The spike in volume to a record high of $90.90 billion, which happened along with the record high in Bitcoin, is now a warning sign. With bearish sentiment building but institutional demand still at record strength, volatility is expected to remain high in the weeks ahead.

Also Read: FOMC Minutes Just Dropped: Here’s What it Means for XRP, Could be Explosive