- Bitcoin trades below $120,000 as breakout pressure rapidly builds.

- Technical indicators signal tight consolidation before next major move.

- Market volume drops as traders await direction with caution.

Bitcoin remains locked below the $120,000 resistance level as market tension rises and price movement tightens. The asset is trading at $119,060, hovering within a narrow band as traders prepare for a possible breakout or breakdown.

The daily chart shows Bitcoin respecting an ascending trendline that started in early May. In spite of the recurrent resistance testing at $123,000, the price has not managed to rise. This rejection has repeatedly happened, subsequently resulting in short-term profit-taking, imposing pressure on the positive movement.

A symmetrical triangle pattern has emerged on the 1-hour chart, with Bitcoin now squeezed between rising support and descending resistance. This structure shows that the market is very close to a position of making a decision, and in this case, the price is trading between $118,000 and $120,000.

Source: Tradingview

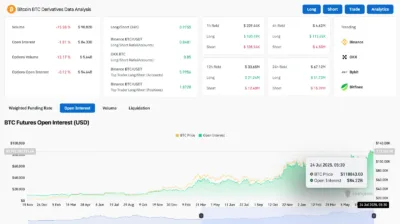

Volatility has also been slowed down in major exchanges, where a cautious mood was indicated. According to Coinglass data, the volume of trading fell by 15 percent to $90.8 billion. The open interest has also declined by 1.81 percent to $84.22 billion.

Such values indicate that traders are closing positions and waiting to be sure about the next big move.

Source: Coinglass

Also Read: Ghana Orders Crypto Firms to Register by Aug 15 or Face Penalties

Technical Indicators Signal Imminent Market Shift

On the technical side, compression continues to dominate. The 4-hour chart shows price activity just above the 20 and 50 EMAs, while the 100 EMA provides deeper support near $116,890. Bollinger bands are being flattened, and thus, volatility may resume soon.

Source: Tradingview

At the same time, the Parabolic SAR is over the current candles, which indicates indecision. Chaikin Money Flow is trading on a positive point of +0.20, indicating that funds are yet to stream into the market, although the movement is not great.

Source: Tradingview

Usually, shorter timeframes are also indicative of a market in balance. Bitcoin’s current price action shows that it is consolidating on the 30-minute time frame above the Ichimoku cloud. Flat Tenkan-Sen and Kijun-Sen lines confirm the equilibrium.

Yet, the Stochastic RSI has now reached an overbought region, which suggests that a breakout is about to happen.

The 4-hour Supertrend is still bearish below $120,539. A powerful follow-through close over this mark may unleash fresh chances of a bullish run to $123000.

Bitcoin’s current price action shows tightening within a defined range as pressure mounts under $120,000. With volatility compressing and indicators signaling a decisive move, the market is preparing for a breakout that could shift short-term momentum sharply in either direction.

Also Read: Altcoins Explode as Bitcoin Stalls Below $120,000—Traders Shift Focus Fast