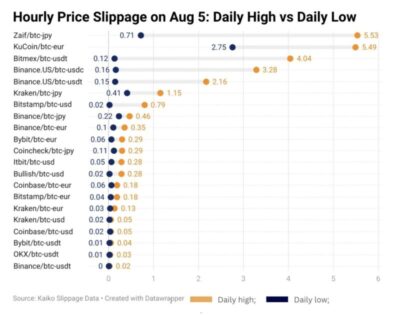

Cryptocurrencies had significant drops across major exchanges last week, as the market experienced a strong selloff, notably on BTC trading pairs. Kaiko’s most recent analysis revealed that the selloff on August 5 resulted in a significant rise in slippage, mainly on Japanese markets and less liquid pairings. This occurrence demonstrated that cryptocurrency assets continue to have liquidity issues despite signs of recovery.

Source: KaikoData

Price slippage occurs when a market order executes at a different price than expected, indicating market liquidity. According to Kaiko’s analysis on the subject, traders have been able to keep slippage disparities low, resulting in a significant discrepancy when intense market swings occur. The most substantial selloff happened on August 5; slippage increased across practically all exchanges, indicating a liquidity crisis.

Also Read: Bitcoin Touches $60,000 Due to Market Recovery

Liquidity Variability Across Platforms and Trading Pairs

Kaiko found that a $100,000 BTC trade faced higher costs on multiple platforms during the selloff due to increased slippage. Zaif experienced the highest slippage in the BTC-JPY pair, while KuCoin’s BTC-EUR pair saw slippage exceed 5%, much higher than usual. Stablecoin-quoted pairs on typically liquid platforms like BitMEX and Binance US also showed significant slippage increases, reflecting the selloff’s widespread impact.

The report emphasized that liquidity impacts vary across different trading areas and pairs. For example, Coinbase’s BTC-EUR pair has a much lower volume than its BTC-USD pair. This imbalance can cause extreme price swings during active markets. Coinbase’s BTC-EUR prices diverged sharply from the broader market in March, highlighting volatility issues as market depth declined.

Source: MikybullCrypto

Binance.US also faced liquidity challenges, with BTC prices on the platform differing from those on more liquid exchanges. This issue partly stems from reduced liquidity following the SEC’s lawsuit against Binance in June 2023. Binance.US now processes only $20 million daily trade volume, down from $400 million in early 2023.

Conclusion

Liquidity concentration has increased, particularly in BTC-USD markets on weekdays, following the launch of spot Bitcoin ETFs in the U.S. Although the crypto market’s infrastructure is improving, liquidity issues persist, making volatility a continued risk during periods of market stress.

Also Read: El Salvador Secures $1.6 Billion Deal to Transform Ports into a High-Tech Bitcoin City