- Dalio urges investors to hedge portfolios with Bitcoin and gold.

- U.S. faces $12 trillion debt load, warns Ray Dalio.

- Bitcoin lacks privacy, unlikely to be held by central banks.

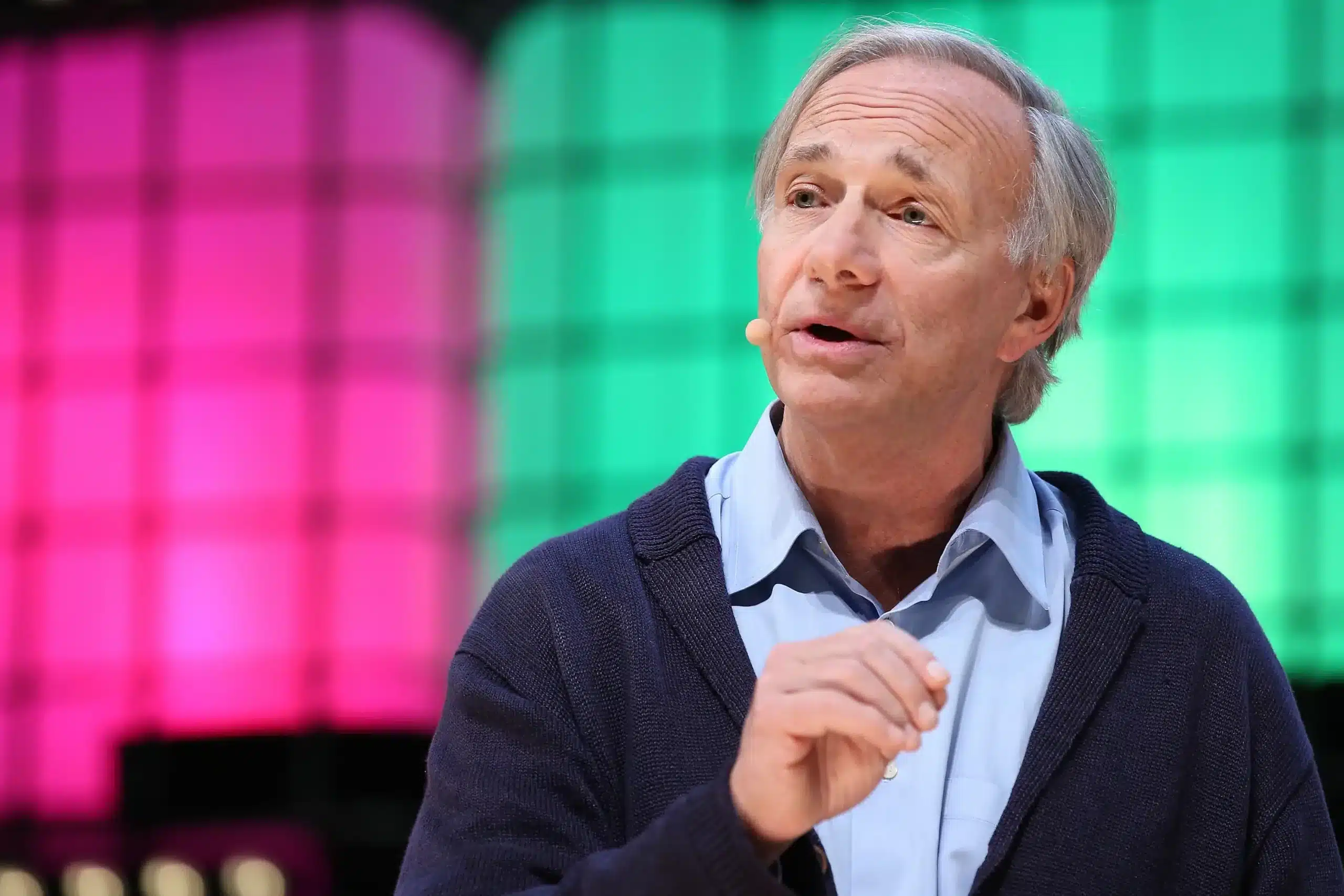

Ray Dalio, founder of Bridgewater Associates, has recommended that investors hold 15 percent of their portfolios in a mix of Bitcoin and gold. He made the statement during an appearance on the “Master Investor” podcast, which is hosted by CNBC contributor Wilfred Frost.

According to Dalio, this allocation would help achieve an optimal risk-to-return balance, especially for those who remain neutral on other asset classes. He stated that people can rely on Bitcoin and gold to defend against greater financial instability, according to the historical trends and market behavior.

Dalio specified that after buying Bitcoin, he continued to feel that gold is a long-term asset. He observed that, upon Bitcoin being perceived by many as a medium of exchange, its ability to be publicly trackable and prone to regulation will make it not the most desirable means by which central banks can hold it as a reserve.

Also Read: SHIB Price Teeters on Edge as Bulls Eye $0.000015 Amid Market Shake-Up

Among the advantages he mentioned is the limited supply and transaction abilities of Bitcoin. He was, however, asking a question on whether the code underlying the cryptocurrency can be undermined either by technological tampering or regulatory coercion, which can affect the functionality of the cryptocurrency in the future.

Soaring U.S. Debt Sparks Hedge Demand

During the discussion, Dalio also delivered a stark warning about the ballooning U.S. debt. He disclosed that the country’s total debt has become six times as much as its annual revenue, causing long-term financial difficulties.

According to his estimate, the government will need to offload around $12 trillion in new debt within the following year.

This economic trend has created apprehension among investors and analysts, as most of them have resorted to the safety of alternative investments. Dalio’s remark has added more remarkable demand for both Bitcoin and gold as hedges against possible economic shocks.

Supporters of Bitcoin have used the comments made by Dalio to market the asset as a hedge against inflation and spending sprees. The high level of debt and the lack of confidence in monetary policy are further making investors move to decentralized forms of finance.

Ray Dalio’s endorsement of Bitcoin and gold reflects growing investor concern about the U.S. debt crisis. His allocation advice underscores the need for portfolio diversification in the face of mounting economic risks.

Also Read: Metaplanet Acquires 780 More BTC, Total Holdings Now Exceed 17,000 Bitcoins