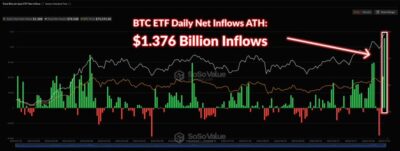

U.S. funds recently witnessed an unprecedented surge in demand for Spot Bitcoin ETFs, with daily net inflows soaring to a record $1.38 billion. This significant influx coincided with Bitcoin’s rise, as the cryptocurrency hit all-time highs for three consecutive days. Leading the inflows, BlackRock’s IBIT fund attracted $1.12 billion, underscoring growing interest in regulated Bitcoin exposure among traditional investors seeking safer ways to access digital assets.

Source:@SoSoValueCrypto

Heightened demand shows investors increasingly shifting toward regulated Bitcoin-based financial products over direct exposure. Tightly controlled and conforming to rules, these products appeal to investors seeking assurance under rules that institutional investors such as BlackRock can deliver. In this regard, Spot Bitcoin ETFs are increasingly replacing the direct adoption of Bitcoin that many investors used to avoid due to the various risks associated with Bitcoin’s volatility.

Also Read: BlackRock Bitcoin ETF Drives $870 Million Inflows Amid Market FOMO

Institutional Appeal Grows for Regulated Digital Asset Investment

Moreover, BlackRock has been on the frontline regarding the Spot Bitcoin ETF, as indicated in the assets flow into its products. In particular, specialists understand that financial institutions such as BlackRock promote the use of digital assets by providing products rooted in principles of traditional finance. Physical Bitcoin ETFs are known to be a suitable and safe choice for every investor who does not want to deal with cryptocurrency wallets or uncontrolled platforms. This shift in interest is gradually transitioning the market since more investors view Bitcoin as an investment avenue.

The large amount of trading in these ETFs has been adding to the price rise as institutions have stepped in to support Bitcoin and other digital currencies. Since more companies are interested in it, Spot Bitcoin ETFs can contribute to Bitcoin’s adoption by regular financial institutions, which will benefit its position in the financial market.

With this surge in Spot Bitcoin ETF inflows, the financial community is witnessing a pivotal shift toward regulated cryptocurrency investments. This development signals a stronger future for digital assets within the global economy, driven by the preference for secure, institutional-grade products.

Also Read: BlackRock Elevates Bitcoin to Gold Status, Expands Cryptocurrency Offerings