Brad Garlinghouse expects the crypto market to double in size, totaling $5 trillion by the end of 2024. This is larger than the market cap of Amazon and Microsoft combined.

The CEO of Ripple blockchain, Brad Garlinghouse, claimed that the combined market capitalization of the cryptocurrency market is to top $5 trillion this year, citing macroeconomic factors and upcoming Bitcoin halving.

“I’ve been around this industry for a long time, and I’ve seen these trends come and go,” Garlinghouse said in an interview with CNBC. “I’m very optimistic. I think the macro trends, the big picture things like the ETFs, they’re driving for the first time real institutional money.”

“You’re seeing that drives demand, and at the same time demand is increasing, supply is decreasing,” Garlinghouse further clarified. “That doesn’t take an economics major to tell you what happens when supply contracts and demand expands.”

Diving into the Context

The first U.S. spot Bitcoin ETFs were approved on January 10 by the U.S. Securities and Exchange Commission. This allowed institutions and retail investors to gain exposure to Bitcoin without directly owning the underlying asset via cryptocurrency exchanges.

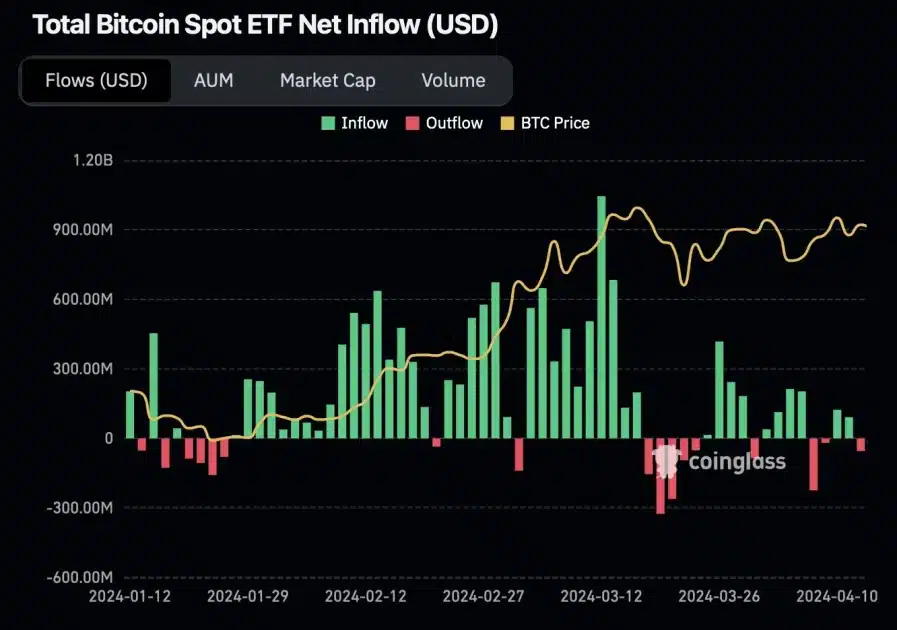

Since the approval, Bitcoin’s (BTC) price increased by over 59%, reaching an all-time high of over $73,000, according to CoinGecko data. Among the metrics that spurred the growth, many cite peak exchange-traded funds’ inflows at the surge time.

Total Bitcoin spot ETF inflow (USD). Source: Coinglass

Apart from macroeconomic impact, exchange-traded funds moved crypto into the spotlight of the traditional financial dimension, adding to a greater adoption of decentralized-based solutions.

This explains the exponential growth of the Web3 projects within the first quarter and the increased attention to the altcoins. Namely, one of them, Tensor (TNSR), managed to quickly achieve listings on WhiteBIT, Binance, and other top exchanges – just like Celestia (TIA) and Near Protocol (NEAR) did in the last year.

Among the factors outlined by Garlinghouse, halving stands out. This technical event takes place roughly every four years in Bitcoin’s history and is set to half the total mining reward for BTC miners, who verify transactions and mint new coins with the use of stark computing powers.

Also Read: Arbitrum Bounded Liquidity Latency Launch Sends Green Candles Amid Test Net Stage

Crucially, every halving marked Bitcoin’s price upsoar – mainly due to the increased scarcity of the asset that the event brings. Analogically, the fourth halving is expected to push BTC prices further north, which will drive the cryptocurrency market by and large.

The last halving took place in 2020, causing Bitcoin to reach an already-beaten milestone of over $69,000.

“The overall market cap of the crypto industry … is easily predicted to double by the end of this year … (as it’s) impacted by all of these macro factors,” Garlinghouse said.

At the time of writing, the total capitalization of the crypto market counts up to over $2.4 trillion, meaning that Garlinghouse sees it to cross the $5 trillion range by the end of the year.

Optimism in the U.S. Crypto Regulation

One of the other factors that Garlinghouse sees pushing the crypto market to new highs is the possibility of positive regulatory momentum in the United States.

“The U.S. is still the largest economy in the world, and it’s unfortunately been one of the more hostile crypto markets. And I think that’s going to start to change, also,” Garlinghouse said.

In recent years, the U.S. civil service vertical has been indicating enforced policy towards decentralized assets and their operators. The Securities and Exchange Commission (SEC) under Gary Gensler has been the hallmark of such policy, targeting Binance, Coinbase, and Ripple itself.

Despite this, Ripple’s CEO shares optimistic outlooks on the U.S. regulatory spotlight, which holds great significance for other states’ crypto legislation frameworks.

“One of the things I’ll say on the macro tailwinds for the industry: I think we will get more clarity in the United States,” Garlinghouse said.

The hopes for the U.S. officials to slacken the bonds are emphasized due to this year’s presidential election. Crypto hopefuls expect that the next administration will be more accommodating to the crypto industry with its policy focus.

Read Also: Ripple vs SEC Latest News: Countdown to Settlement?