Last updated on May 18th, 2024 at 12:57 pm

Wednesday morning, August 30th, started with a news feed about Bitcoin. As you may have noticed, Bitcoin has grown by approximately 65% this year, although it’s still far from its late 2021 peak exceeding $68,000. The price of Bitcoin (BTC) at the time of writing is $27,251.

The asset’s price has increased by 5.48% over the last 24 hours, and the trading volume has reached a record $22,576,717,489. This figure has grown by 172.30% compared to the data from the previous day, indicating recent market activity growth.

Bitcoin Price Chart (BTC). Source: WhiteBIT

Legal and Regulatory Developments in the Crypto Industry

As per CNN Business analysts, the court’s ruling represents a pivotal juncture for cryptocurrency investors and poses a setback for the Securities and Exchange Commission (SEC) in its efforts to oversee the digital asset sector. Moreover, the Columbia District Court of Appeals has invalidated the Securities and Exchange Commission’s (SEC) prior refusal to grant Grayscale Investments the authorization to introduce a Bitcoin-focused ETF. The Commission’s insufficient explanation for rejecting the company’s proposal is evident in this overturning.

Judge Neomi Rao.

“The denial of Grayscale’s proposal was arbitrary and capricious, as the Commission was unable to explain its differing treatment of similar products,” commented Judge Neomi Rao.

Grayscale is among a group of companies that have submitted applications for a spot in Bitcoin ETF. In the preceding months, firms such as BlackRock, Fidelity, and Invesco have also sought authorization to introduce their individual Bitcoin funds.

Bitwise

September 1st holds significant importance for Bitwise and the ultimate trajectory of cryptocurrencies in the United States. This Friday, the investment firm Bitwise will ascertain the outcome of its spot BTC ETF proposal. Meanwhile, BlackRock, VanEck, Fidelity, Invesco, and WisdomTree are in anticipation of the SEC’s decision concerning their respective funds, which is slated for September 2nd, as outlined across various SEC documents. Additionally, we can also anticipate a surge in the value of BTC following this court decision, as we have observed previously.

The fact that spot BTC ETFs exist in other regions, such as Canada and Europe, along with the subsequent influx of applications from other asset managers, including Vanguard and Fidelity, are also factors to take note of, according to one of the users.

Related Reading: Shiba Inu Comes Back to Spotlight As Burn Rate Surges Again

What Does Bitcoin Spot ETF Mean?

Bitcoin ETFs for investors are usually ‘spot Bitcoin ETFs’. A Bitcoin exchange-traded fund is an investment vehicle that seeks to track the price of Bitcoin. Bitcoin ETFs are traded on traditional regulated securities exchanges and are not available on cryptocurrency exchanges.

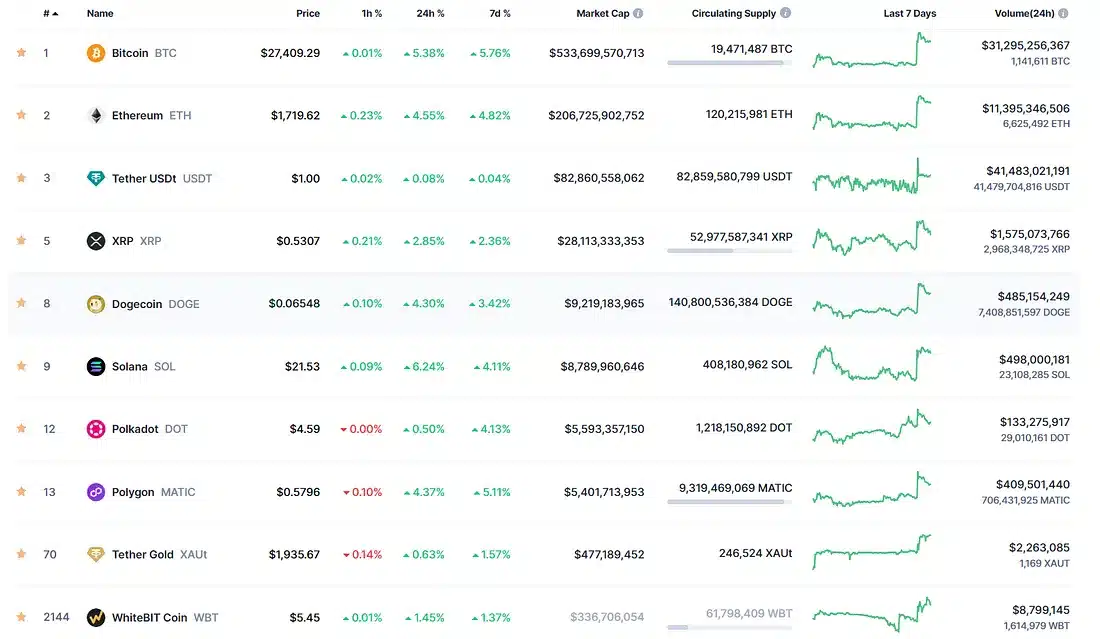

A representative from the SEC stated on August 29th that the agency is “reviewing the court’s decision to determine next steps.” We can see that the value of Bitcoin has changed significantly within this short period. Additionally, the court’s decision has clearly impacted the value of the crypto giant, as well as altcoins. You can even observe this on the price chart of some of them below.

Changes in price over the day for some. Source: CoinMarketCap

Analysis of Bitcoin Investment Products and SEC Approval

Grayscale, argued that this proposal closely resembled other approved Bitcoin investment products by the SEC. Two other Bitcoin products from crypto firms Valkyrie and Teucrium hold futures contracts on the Chicago Mercantile Exchange. Judges stated that Grayscale presented “undisputed evidence” that the underlying assets — Bitcoin and Bitcoin futures — are virtually identical.

A spot Bitcoin ETF would enable traditional investors to have exposure to the digital asset without actually owning it.

Michael Sonnenshein, CEO of Grayscale.

“This is a historic milestone for American investors, the Bitcoin ecosystem, and all those advocating for Bitcoin access through the additional protective wrapper of an ETF,” stated Michael Sonnenshein, CEO of Grayscale. “It’s incredibly exciting that we’re one step closer to making a spot Bitcoin ETF a reality in the U.S.”

Bitcoin Price Prediction

According to analysts from CoinDCX, the price of Bitcoin is expected to range from $41,650 to $42,000 by the end of 2023. Analysts at Binance are confident that the value of the crypto giant will surpass $26,000 by the end of 2023, while Standard Chartered suggests that the price of BTC in dollars could reach $50,000.

Of course, there are analysts who believe that the price of Bitcoin might experience a slight dip in September. However, considering the long-term analysis from many other sources, it can be expected that the asset will remain within a favorable price range. This means that September can be considered a good opportunity for investors who wish to profit not only from Bitcoin but also from other altcoins, as it has been repeatedly confirmed that Bitcoin’s pump also affects the value of other assets.

Conclusion

The year has seen Bitcoin’s price surge by approximately 65%, albeit still below its peak in late 2021. As of the time of writing, BTC stands at $27,251, showing a recent 5.48% increase within 24 hours and signaling a growing market activity.

The recent landmark court decision regarding Grayscale Investments’ Bitcoin-oriented ETF application has marked a breakthrough moment for crypto investors while posing challenges for the Securities and Exchange Commission (SEC) in regulating the digital asset industry. The court’s ruling that the SEC’s denial was arbitrary and inconsistent underscores the intricacies of the regulatory landscape. The upcoming pivotal dates of September 1st and 2nd carry immense significance for both Bitwise and the broader fate of cryptocurrencies in the US.

In this intricate dance of price movement, regulation, and investor sentiment, the spotlight on Bitcoin’s legal and regulatory journey continues to illuminate the path forward for the cryptocurrency industry.

Disclaimer: Always conduct your own research and seek advice from reliable sources before making any decisions.

Read More: Ethereum Foundation Introduces Ethereum Execution Layer Specification (EELS)