Last updated on June 4th, 2025 at 06:52 am

Many enthusiasts are convinced that 2024 promises to be a sensational year for cryptocurrencies and other blockchain projects. The market is again experiencing volatile sentiments due to the upcoming Bitcoin halving and confirmed rumors about the approval of a Bitcoin ETF.

Old blockchains and coins in the cryptocurrency market have already been well-studied. We all know what BTC and Ethereum (ETH) are capable of and what to expect from their development plans in 2024. We know that in 2023, many new blockchains were launched, including WB Network and BASE.

While headlines in 2023 were dominated by Layer 2 Ethereum, zero-knowledge proof, and Bitcoin’s ordinal numbers, what significant stories can we expect to see in 2024?

The rapid growth of Solana (SOL) towards the end of 2023, alongside the expansion of the Cosmos (ATOM) ecosystem through chains like Injective Protocol (INJ), suggests that the era of Ethereum dominance may be coming to an end.

Despite the success of non-Ethereum Virtual Machine (EVM) chains, smart contracts, and decentralized applications based on Ethereum continue to dominate, attracting the highest developer activity and Total Value Locked (TVL) statistics.

While non-EVM chains will thrive, platforms that find ways to leverage Ethereum-based architecture will automatically gain good user adoption opportunities.

Meanwhile, the gravitational pull of Bitcoin cannot be ignored. With only a few months left until the next halving and the countdown timer affirming the positive impact of approving a spot Bitcoin-ETF, things look promising for the king of digital assets.

Bitcoin-Fi is already on the horizon, and tokens like Ordinals and BRC-20 may have just been the beginning. Let’s now turn our attention to blockchain projects that deserve your consideration.

Cryptocurrency Security 2023: Industry Advancements in the Face of Reduced Threats

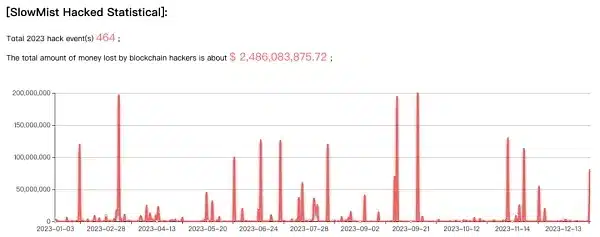

In 2023, the focus on security increased, based on the report from SlowMist Technology’s “Annual Report on Blockchain Security and Anti-Money Laundering for 2023.”

According to the data, a total of 464 security incidents occurred in 2023, resulting in losses of $2.486 billion. Compared to 2022, losses decreased by 34.2% on an annual basis.

The cryptocurrency industry has experienced ups and downs amid a tumultuous “crypto winter” and bear market. Governments and international organizations have adopted a more cautious stance, and cryptocurrency regulation policies in various countries are still gradually taking shape.

The attention of cybercriminals towards the crypto industry necessitates a diligent and careful approach to security measures. To minimize threats, users should:

- Choose platforms that undergo security audits. For instance, Hacken has awarded one of the largest crypto exchanges, WhiteBIT, a high AAA security rating, conducting timely checks for Binance, KuCoin, and other platforms. Additionally, experts at CER.live have included these platforms in the Top Crypto Exchanges.

- Opt for secure platforms that store assets in safe storage. Specifically, WhiteBIT stores 96% of digital assets in cold wallets, Coinbase keeps 98% of assets offline in safes and physical storage worldwide, and Gemini stores 95% of assets in wallets with cold storage.

- Check URLs for phishing attempts (the use of fake websites to obtain user credentials). For example, on WhiteBIT and Binance, there is a service to verify official project channels, as well as an “Anti-Phishing” feature ensuring the authenticity of emails from the exchange.

TOP 5 New Blockchain Projects and Protocols

The cryptocurrency market is largely driven by speculation and hype. As a result, new and innovative protocols often outperform established platforms that we are already familiar with.

At the same time, this excitement and speculation make these new crypto assets much more volatile and high-risk. They may not be suitable for low-risk investment strategies.

Let’s explore some of the most interesting and new blockchain projects that we can expect to see in 2024.

Monad

Monad is a new Layer 1 blockchain that promises to deliver what any other Layer 1 blockchain promises. Like many others, it utilizes a Proof-of-Stake network, claiming greater scalability, security, and decentralization than its Web3 competitors.

Monad Features:

- Monad distinguishes itself with its network architecture. Similar to Aptos (APT), Monad uses pipeline processing and parallel execution mechanisms to achieve transaction throughput of up to 10,000 TPS (transactions per second).

- Monad boasts a 1-second block time and finality in a single slot, ensuring the blockchain can handle massive traffic volumes.

- Monad is fully compatible with EVM, allowing developers and users to interact with the Monad network as easily as with any Ethereum-based network.

- While Monad has not been launched yet, the Testnet is expected to be released in the first quarter of 2024. With support from Dragonfly Capital and other influential firms, Monad is one to watch in 2024.

Celestia

The main Celestia network, code-named Lemon Mint, was launched on October 31, 2023, successfully raising $55 million from venture capitalists, including Spartan Group, Jump Crypto, Blockchain Capital, and Polychain Capital.

Celestia Features:

- Celestia, an addition to the thriving Cosmos ecosystem, reimagines blockchain architecture. Modular networks like Celestia, as opposed to monolithic blockchains like Ethereum, work by separating consensus and transaction execution, ensuring seamless and diversified operations.

- Developers can easily launch their blockchain using Celestia, utilizing various existing virtual machines, including EVM-based or Cosmos-based platforms.

- The ability to manage lightweight nodes of Celestia from their mobile phones helps decentralize and secure the network on the go.

- Celestia’s blockchain, along with its TIA token, was launched in the last quarter of 2023 and is currently trading on many platforms, including one of the largest crypto exchanges in Europe WhiteBIT, also on Binance and OKX.

- Although technically not a “new” chain launched in 2024, the ecosystem is evolving and still largely unknown to many crypto enthusiasts, earning it a place on this list.

LayerZero

Functional compatibility has been one of the significant challenges facing cryptocurrency for many years. Connecting digital assets across chains can sometimes be a nightmare, associated with high fees, slippage costs, and a plethora of exploits and hacks.

LayerZero Features:

- LayerZero aims to solve this monumental task by providing the necessary infrastructure for different blockchains to interact efficiently.

- There is a high demand for LayerZero’s services and products, and interchain bridges like Stargate simplify the movement of stablecoins and other liquidity sources across more than 50 networks in just a few quick steps.

- Having already moved crypto assets worth over $50 billion across dozens of chains, LayerZero is just getting started. With a generous airdrop expected in 2024, LayerZero is a coin to add to your watch list.

Inscriptions

The Ordinals’ protocol is a system for numbering satoshis, assigning a serial number to each satoshi and tracking them through transactions.

In simpler terms, ordinals allow users to make individual satoshis unique by adding additional data to them. This process is known as “inscription.”

Ordinals Features:

- Some protocols and BRC-20 providers, such as TRAC and PIPE, promise to bring Bitcoin into the future by creating their own DeFi applications on the Bitcoin network. Tokens like Inscriptions are appearing in almost every blockchain in the industry, leading to a sharp decrease in transaction fees worldwide.

- Ordinals allow users to attach additional information to individual satoshis to make them unique. Recorded data can also contain smart contracts, enabling satoshis to perform functions similar to NFTs.

- While BRC-20 tokens may play a unique role in Bitcoin, they are largely redundant in already programmable blockchains. We have yet to hear the end of Bitcoin ordinals and BRC-20 tokens.

NEON

The last on our list of blockchain projects to watch out for this year is NEON. It joins our list of new and exciting blockchain protocols to watch in 2024. NEON EVM is a unique network aiming to give us the best of both worlds and permanently dispel Layer 1 maximalism.

NEON Features:

- Like Celestia (TIA), the NEON blockchain and its native token were launched towards the end of 2023. Both assets demonstrated market capitalization growth and set new historical highs in December 2023, following the Bitcoin price.

- NEON EVM is an Ethereum-compatible blockchain built on Solana. This means users and developers can enjoy the benefits of Ethereum-based smart contracts while simultaneously conducting transactions using Solana’s industry-leading speeds and minimal gas fees.

- As part of a broader ecosystem, NEON will closely follow Solana’s price movements. However, given its smaller market capitalization, lower liquidity, and trading volume, the asset will experience much higher volatility.

- NEON takes the best fundamentals of Ethereum and Solana and blends them into one comprehensive package. Whether you’re a fan of Solana, Ethereum, or both, NEON is a cryptocurrency worth exploring in 2024.

Crypto in 2024: Pros and Challenges

Pros:

- Spot Bitcoin ETF Approval: Approval of a spot Bitcoin ETF will allow some of the world’s largest financial institutions, such as BlackRock, to start offering BTC funds to their clients. This has the potential to bring billions into the cryptocurrency market.

- Technological Advancements: Blockchain technology continues to evolve, creating numerous new use cases that were unimaginable just a few years ago.

- Real-World Adoption: Blockchains are gradually becoming better suited to handling many users. This means that these decentralized networks are finally ready for mass adoption.

Challenges:

- Issues with Cryptocurrency Exchanges: Despite growing popularity, cryptocurrency exchanges remain in a complex situation. Coinbase, Binance, and Kraken face prolonged legal disputes with everyone from the SEC to the Federal Reserve, hindering the attraction of new users.

- Institutional Resistance: The fact that BlackRock and Valkyrie are supportive does not mean that every brokerage on Wall Street wants to succeed in cryptocurrency. JPMorgan CEO Jamie Dimon has clearly expressed his anti-Bitcoin thoughts, recommending the government shut it down.

- Misuse of Technologies: While blockchain has many advantages, some argue that its features can be abused. For example, central bank digital currencies (CBDC) may give governments much greater control over your money than is currently possible.

- Halving Doesn’t Guarantee Bullish Growth: Halving Bitcoin does not automatically guarantee new bullish growth for the cryptocurrency. There is no certainty in the cryptocurrency market, so assess your risk tolerance before investing.

Conclusion

The cryptocurrency landscape is poised for new developments and challenges, fueled by anticipation surrounding the introduction of a spot Bitcoin ETF, technological advancements, and the evolution of groundbreaking projects.

Blockchain projects are increasingly prioritizing security, employing new protection methods, and creating secure spaces for users’ cryptocurrencies.

Staying informed about intriguing new blockchain projects in the crypto space is a good way to stay ahead and learn about innovations before they become mainstream, ensuring users navigate the dynamic crypto environment with confidence.

>Free Tool: Use our simple crypto profit calculator to calculate your potential profits and returns on your cryptocurrency investments.<<<

Disclaimer: This article is meant for educational purposes and should not be taken as investment advice. Please do your research before taking any action with your hard-earned money. Remember investing in cryptocurrency is speculative and you can lose all your savings if not done properly.