“Binance is a global scam!” This loud claim has recently littered the cryptocurrency media field. Reportedly, the most widely-used crypto exchange is trying to keep $BNB value amidst a reputational crisis by dumping its Bitcoin assets, which is severely jeopardizing the market and seeds doubts about the anticipated crypto bull run. But how come that credible investors turn to criticizing Binance? Let’s find out.

Context

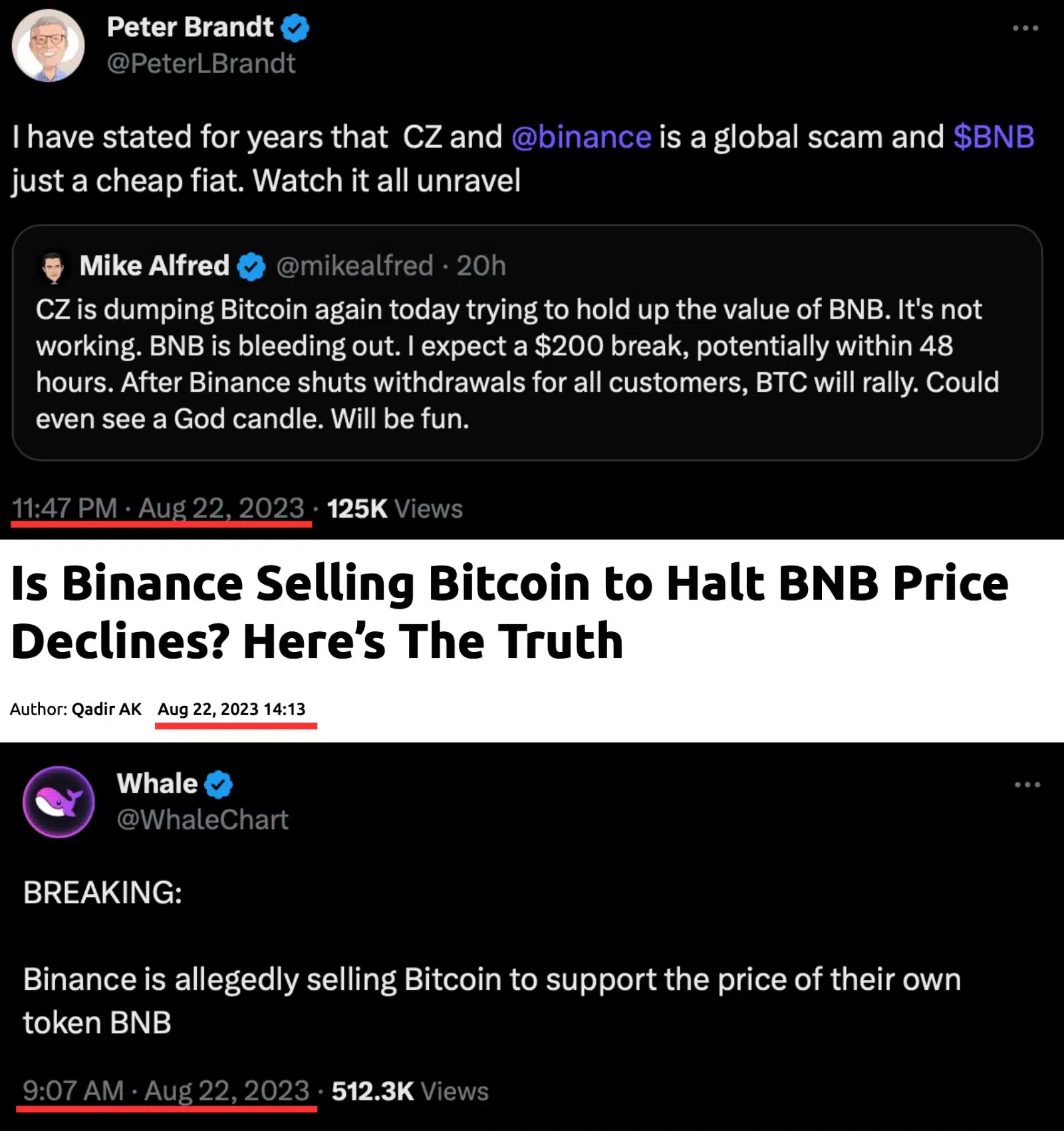

The pieces of tarnishing thesis about Binance sprouted up like mushrooms after a highly reputable investor Peter Brandt stated that “CZ (Changpeng Zhao, CEO of Binance) and Binance is a global scam”, and that $BNB currency is literally “a cheap fiat”.

Peter Brandt has been one of the most credible future traders. He is the author of books and a methodologist with a vast community of worshippers. His Twitter/X page totals almost 700k followers, and his insights are widely cited.

The statement was made via a repost of Mike Alfred’s thread. An investor and influencer, who is well-known for criticizing Binance, cited:

“CZ is dumping Bitcoin again today trying to hold up the value of BNB. It’s not working. BNB is bleeding out”

I have stated for years that CZ and @binance is a global scam and $BNB just a cheap fiat. Watch it all unravel https://t.co/B1SRFFWgY0

— Peter Brandt (@PeterLBrandt) August 22, 2023

As a matter of fact, Peter Brandt’s statement clearly indicated the drawback in Binance’s reputation. The challenging environment the crypto exchange is in clearly spurred doubts about Binance’s robustness and firmity.

For instance, a former U.S. Securities and Exchange Commission (SEC) official John Reed Stark voiced the precautious attitude to the integrity of Binance’s operability amid the fact that the crypto exchange halted euro withdrawals and deposits via the single euro payment area (SEPA) system.

At the same time, web resource Coinpedia reported concerns about Binance selling off Bitcoin to correct the declining value of $BNB, which happens as a supportive measure for the issues the exchange is going through right now, particularly regulatory obstacles.

The Basis For Claims

Let’s face the music: Although Binance is managing to keep its leading positions in the market, it has seen better days. Notably, the statements spread by the influencers have genuine insights behind them.

Binance is experiencing challenge after challenge, and each one of them is jeopardizing its activity. The litigations initiated by the SEC are, in fact, the tip of the iceberg of a larger regulatory obstacle mounted by the U.S. that directly set the trend for the European market.

As a matter of fact, the regulatory pressure also has its reasons. As Angus Berwick and Patricia Kowsmann reported for the Wall Street Journal, Binance continues scaling up its operations in Russia – just by contrast to its official statement on ceasing all financial processes with rubles since the beginning of Russia’s full-scale invasion of Ukraine. The Russian ruble itself is currently a highly volatile currency with an intensively decreased value, and these characteristics unlock the doors for Binance management to profit from the fluctuations.

Related Reading: Binance.US Adopts USDT as Base Asset, Transitions to Crypto-Only Platform

The regulatory obstacles and reputational crisis put Binance into a full circle, which consequently resulted in certain confinements with the exchange’s operability. Accordingly, it was reported that Binance limited SEPA withdrawals and lost the partnership with major UK-based payment service Checkout.com over money laundering and compliance concerns. Prior to that, Binance used to be the largest client of Checkout.com.

Yet this fact does not indicate Checkout.com’s prejudiced attitude to the crypto assets, as this company continues to cooperate with other entities that offer crypto EUR SEPA-based withdrawals, i.e. Revolut, WhiteBIT, CEX.io, etc.

It is also important to mention that Binance alongside its native blockchain BNB Chain is a foremost target for hacking attacks. Namely, as the New York Times stated, the latest hack took place in October 2022 and brought $570 million of losses, exposing Binance’s security vulnerabilities. And this attack is only one of many others that successfully hit the accounts of the crypto exchange.

From what has been stated above, one might conclude that the concerns about Binance’s prominence and stability are completely sound. Regulatory issues, reputational crises, and partnership breaks indicate that the exchange’s operability leaves much to be desired. And evidently, the state affects the $BNB prices.

But why do investors and influencers believe that $BNB’s value is regulated through manipulations with the $BTC market?

“Binance Dumping BTC for BNB Stability”: Presumption, Exaggeration, or FUD?

Let’s take a look at the bigger picture here.

The statements about Binance and Bitcoin dumping appeared at the same time – on August 22. All of the claims were not supported by any actual evidence of the original resource – neither the Coinpedia investigation nor Peter Brandt’s and Mike Alfred’s statements indicate relevant proof. And what is more significant – they are literally identical and promote the sole idea.

BREAKING:

Binance is allegedly selling Bitcoin to support the price of their own token BNB

— Whale (@WhaleChart) August 22, 2023

The claim that Binance is selling BTC to maintain BNB price could have been considered a rather exaggerated presumption if it was not shared at the same time mostly from the resources with dubious reputations or biased attitudes towards Binance.

All facts combined leave us with the presumption that all these statements are FUD.

Apparently, Binance has all right to be surrounded by concerns. It now has a tarnished reputation as a vulnerable exchange that is sunk in regulatory obstacles, malicious activity, and a lack of compliance with sanctions. Not surprisingly, its stability raises doubts, and its robustness is currently highly questionable.

I consider that this is a perfect time for launching a FUD campaign based on the presumption about Binance “being reliant on Bitcoin assets for stability” without any supporting evidence. What is more, the pieces of FUD thesis were presumably distributed just by the book – at the same time, and focusing on the main point of Binance being a “global scam”.

Still, it does not change the fact that Binance faces a lot of obstacles, and combined with the obscure pages in its workflow, there is a tiny chance that Binance might carry out market manipulations just as it does with the Russian ruble. However, the FUD will definitely remain FUD.

Read More: Investigating The FUD Around WhiteBIT: The Truth