- XRP surpassed BTC in trading volume on South Korea’s largest exchange, recording $184M (9% share) vs. Bitcoin’s $152M (7.5% share).

- Strong liquidity and investor preference in South Korea reflect growing confidence in XRP’s utility.

- Analysts see this as a sign of shifting market dynamics, with XRP gaining ground as a leading liquidity token in Asia.

In a striking shift of market momentum, XRP has overtaken Bitcoin in trading volume on South Korea’s largest cryptocurrency exchange, Upbit.

The move was highlighted by popular crypto pundit X Finance Bull, who pointed to the surge in liquidity and regional demand as a signal of growing confidence in Ripple’s digital asset.

“XRP just flipped Bitcoin in trading volume on South Korea’s largest exchange, Upbit,” he tweeted. “Liquidity is flooding in. Asia’s demand for XRP is not slowing! Every Ripple move adds fuel. Are you paying attention yet?”

Also Read: Egrag Crypto: ‘XRP Is Ready to Move, But Where?’ Here are Key Levels to Watch

JUST IN 🚨🤯 $XRP just flipped Bitcoin in trading volume on South Korea’s largest exchange, Upbit.

Let that sink in!

Liquidity is flooding in.

Asia’s demand for XRP is not slowing!

Every Ripple move adds fuel.

Are you paying attention yet? pic.twitter.com/IUjMDrVVqA

— X Finance Bull (@Xfinancebull) October 1, 2025

Market Data: XRP Leads with 9% of Volume

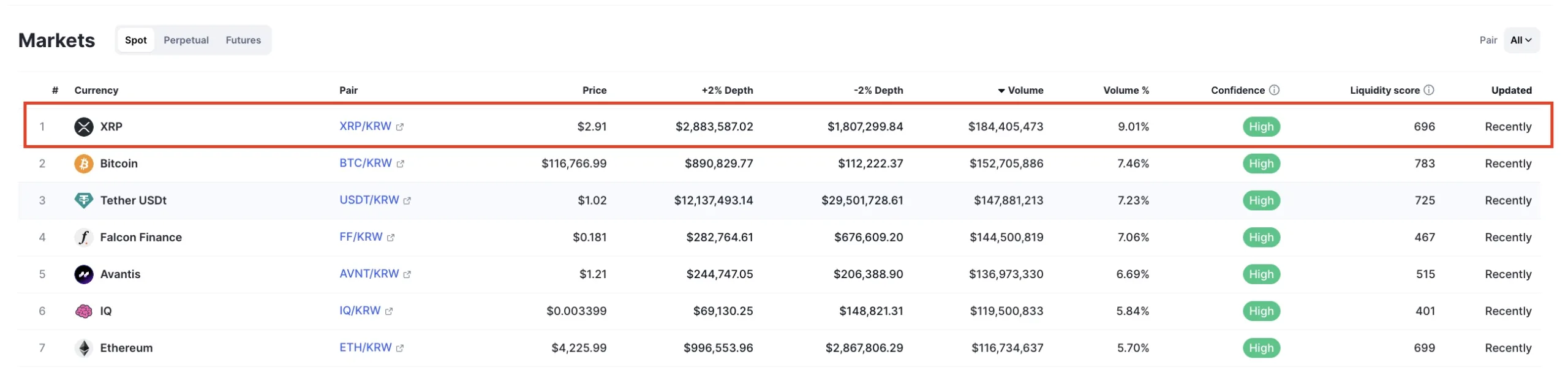

According to CoinMarketCap data, XRP’s pair against the Korean Won (XRP/KRW) on Upbit recorded a 24-hour trading volume of $184.4 million, accounting for 9.01% of total volume on the exchange.

In comparison, Bitcoin (BTC/KRW) registered $152.7 million, accounting for 7.46% of the market share. The data shows that XRP liquidity on Upbit remains strong, with a liquidity score of 696, nearly on par with Ethereum’s 699, but behind Bitcoin’s 783.

Source: Coinmarketcap

Despite this, XRP’s dominance in actual trading volume underscores its growing appeal among Korean investors.

Why South Korea Matters for XRP

South Korea has long been a hotbed for cryptocurrency adoption, with retail investors driving significant demand.

The fact that XRP has surpassed Bitcoin in local trading volume indicates a regional preference for faster settlement-based tokens, aligning with Ripple’s utility-focused narrative.

Moreover, XRP’s popularity in Asia has been reinforced by Ripple’s ongoing global partnerships with banks and payment providers, making it more than just a speculative asset in the eyes of many traders.

Analyst Outlook

Market analysts suggest that XRP’s ability to consistently compete with Bitcoin and Ethereum in exchange volume, particularly in Asia, signals shifting market dynamics.

High-volume dominance is often interpreted as a sign of strong investor conviction and liquidity depth, two critical elements for sustaining long-term price growth.

Ultimately, XRP flipping Bitcoin in Upbit’s trading volume is not just a symbolic achievement; it highlights Asia’s growing appetite for XRP and strengthens its case as a leading liquidity token in the evolving digital asset landscape.

Also Read: CoinsKid to XRP Holders: ‘Compression Leads to Expansion’ – Here’s What it Means