Last updated on November 4th, 2024 at 04:48 am

Crypto adoption and DeFi (decentralized finance) have sought progress for the last month. Or it has not?

There is so much buzz around crypto institutional adoption that it seems either promising or exaggerated. Yet it is impossible to deny the fact of its acceleration. Notably, the recent week comprehensively illustrates that.

The debates about DeFi and crypto financial integration got a second life amidst a number of loud precursors of crypto moving toward banking institutions. Among ones: PayPal introducing its stablecoin, and WhiteBIT cooperating with Visa.

But the landscape is not fully optimistic though, and SEC is the crucial reason for this. As a matter of fact, the tension between the Securities and Exchange Commission and Ripple rose again after a glimpse of hope was given to the crypto project. But let’s just take one step at a time and regard every piece of news separately.

SEC vs Ripple Confrontation Escalates

The infamous U.S. Securities and Exchange Commission is about to appeal a recent court decision involving Ripple Labs which turned out to be an impediment to the agency’s efforts to take the cryptocurrency markets under its jurisdiction.

To be more specific, in a letter on August 9, the SEC requested U.S. Manhattan District Judge Analisa Torres to let a federal appeals court review her July 13 decision, which states that the sale of Ripple’s $XRP token on public exchanges complied with federal securities legislation.

To be more specific, according to Torres’ decision, Ripple did not break the law by selling $XRP on public exchanges, because purchasers had no reasonable expectations of profiting from it.

Whereas, Reuters reported that several weeks later in contrast to Torres, U.S. District Judge ruling, Jed Rakoff – who sits on the same court determined that the SEC had a “plausible claim” that the Terra USD token supplied by Terraform Labs qualified as a security when traded on open markets.

Significantly, the SEC claimed that the outcome of an appeal had partial consequences for its ability to enforce securities.

Context:

The official position of the SEC envisages that all digital assets, inter alia cryptocurrency, are securities, hence it is in their authority to regulate them.

On the basis of that claim, the SEC has been targeting cryptocurrency exchanges with lawsuits and accusing ones of lack of registration as a broker-dealer party.

Specifically, the SEC filed a claim against Ripple Labs, its CEO Brad Garlinghouse, and co-founder and Chairman Chris Larsen in December 2020, accusing them of unregistered securities offering by selling $XRP token.

Apart from Ripple, the SEC dragged into court such crypto giants as Coinbase and Binance. You can find out more about the full circle of the SEC’s enforcement actions toward crypto entities here.

$XRP Token’s Reaction

Amidst indicating bearish sentiment within the recent month, $XRP’s decrease has been slightly accelerated as a drawback from the SEC’s appealing claim. As of August 16, 2023, the price does not surpass $0.6.

Outlooks

It has always been a foregone conclusion that the SEC does not easily step back. Gensler’s body is striving to either subordinate crypto under its mandate or put efforts into the industry to vanish. Hence, even the latest Ripple’s partial victory in court was predicted to become a trigger for the SEC to take appeal action. As it is commonly said: nothing special.

Still, every cloud has a silver lining. Ripple drew attention to itself, and despite the decreased demand for its token, the keen interest in the project will presumably soar. Besides, it is a fact of life that SECs are likely not to be initiated by national security or financial well-being concerns but only prioritize centralized regulation by limiting the originally decentralized technology. Conclusively, the aftermath of such litigations remains totally obscure.

WhiteBIT, Visa, and Scamfari Expand the Scale

On August, 11, WhiteBIT, one of the largest European crypto exchanges, and Visa, the world leader in digital payments, signed a Memorandum of Understanding to cooperate across the CEMEA region that includes Central and Eastern Europe, the Middle East, and Africa.

Thanks to this synergy of traditional financial players and the innovative crypto exchange, owners of crypto assets will have even more opportunities.

— WhiteBIT (@WhiteBit) August 11, 2023

Reportedly, the crucial aim of the cooperation is to support WhiteBIT in building sustainable relations with banks and fintech companies that are Visa partners and interested in crypto-related product implementation.

Banks and Crypto Fusion

The seemingly unexpected collaboration in fact became a foregone conclusion, as it indicates an extraordinary level of mass adoption and blockchain technologies. The institutional recognition of digital assets is closer than ever, which is, for instance, proved by Visa’s partnerships with more than 50 other leading crypto platforms, not highlighting the big picture of aforementioned tendencies.

The trends are definitely spotted. This conclusion can be made from the statement by Volodymyr Nosov, the founder, and CEO of WhiteBIT:

“The global goal and mission of our company is to achieve the mass adoption of blockchain technology. Because we are certain that humanity’s future is digital technologies, it is significant for us to have Visa as our strategic partner to achieve this goal. (…) Thanks to this synergy of traditional financial players and the innovative crypto exchange, owners of crypto assets will have even more opportunities.”

Significantly, crypto adoption does not strive one-sidedly. Yevhen Lisnyak, Visa Senior Director and Head of Strategic Partnerships, Fintech, and Ventures, voices the promising outcomes for digital assets’ massive integration as well:

“We see great potential in cryptocurrency-related products. Such solutions allow clients of providers of services related to the turnover of virtual assets to easily interact with their funds, gaining access to our payment infrastructure. (…) By signing the Memorandum with WhiteBIT, we are going to help the company jointly with banks and fintech companies to launch card programs where the relevant legislation is in place”

Apparently, the fine line between banking institutions and cryptocurrency is slowly fading out. While crypto is adapting traditional banking services, banks are adopting blockchain technologies and decentralization. WhiteBIT has also ceased the tendency and even launched its debit WhiteBIT Card, based on the Visa payment system. Currently, it offers free crypto withdrawal, and payments in GEL, EUR, and USD, however, it is only a matter of time before the WhiteBIT Card and analogs will boast more services and possibilities.

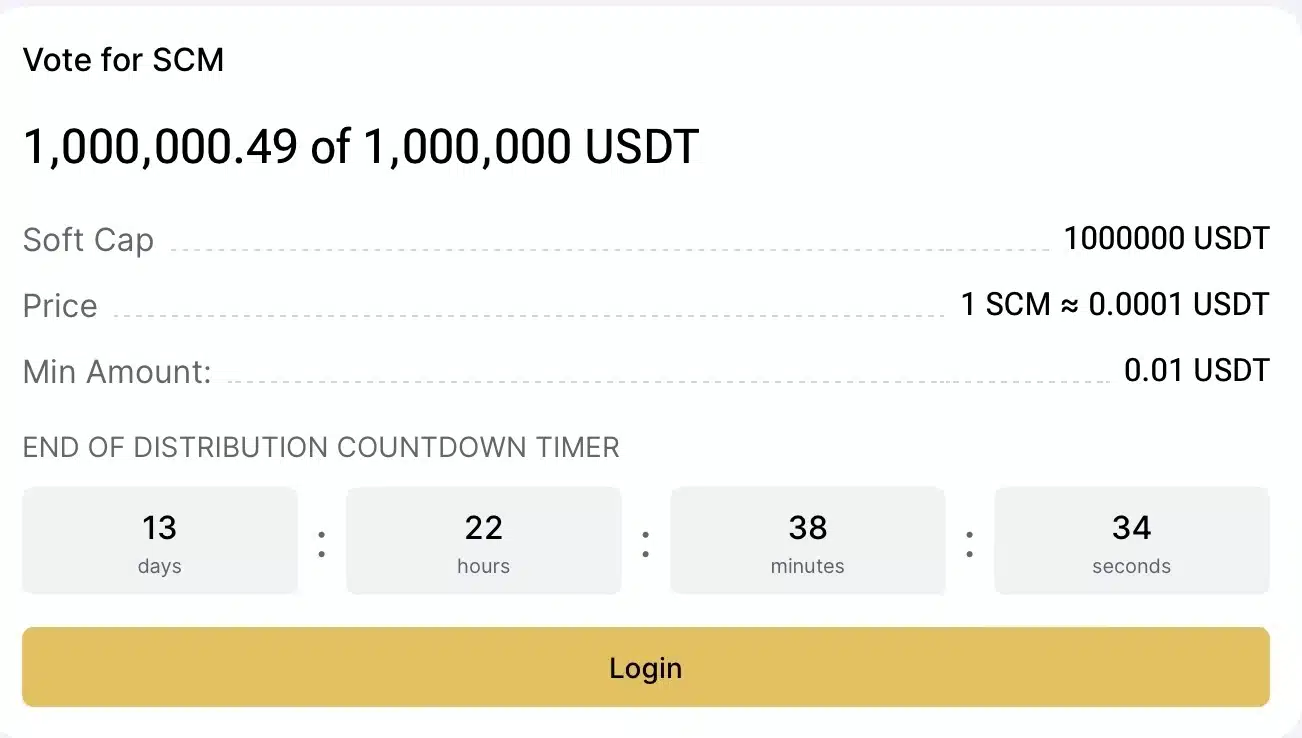

Voting for Scamfari for WhiteBIT Launchpad Ends in 8 Minutes

Still, WhiteBIT is not only aimed at crypto institutional adoption directly. In fact, it is contributing to enhancing the reputation of digital assets comprehensively.

Specifically, on August, 16, newly-emerged WhiteBIT Launchpad announced its pioneering project for hosting – Scamfari.

All Eyes on the Clock!

Get ready for real heat, as we will share the details about the first WhiteBIT Launchpad project very soon! There is already a countdown timer on the page itself. Mark the time and the date & wait for the grand premiere: https://t.co/1Hkn9EeDDG pic.twitter.com/HEIcn1L2f6

— WhiteBIT (@WhiteBit) August 14, 2023

Scamfari is an initiative by HAPI, a decentralized security protocol. The main idea of the project is to track down crypto frauds and scams, and reward users who found out the fraudulent activity in the industry.

The IEO took place on August, 21, while the community voted for $SCM, a native Scamfari token, to be listed on the WhiteBIT exchange by purchasing a certain number of tokens at a lower fixed price.

The results of Scamfari voting were shocking – 10,000,000,000 $SCM were sold in just 8 minutes, and this ensured the future token’s listing on WhiteBIT.

While the whole concept of Launchpad and Scamfari’s success is a case in point of synergy between all walks of crypto, they also indicate severe concerns about crypto security and users’ pivotal desire to solve them. Hopefully, Scamfari and HAPI will grow in order to tackle the issues with blockchain safety.

PayPal Entering the Crypto with Its Stablecoin

At the beginning of this month, the major payment system PayPal introduced its stablecoin – PayPal USD which is redeemable 1:1 for U.S. dollars and is backed by its deposits, short-term treasuries, and similar cash equivalents.

$PYUSD is promised to be a liquid asset that can be converted into a great number of fiat currencies. Significantly, the token’s first and foremost goal is to facilitate and accelerate payment processes as well as to implement more cutting-edge protection and privacy measures into the system. Still, assuming that $PYUSD was coined just as an answer for the increased demand may also be sound.

Dan Schulman, PayPal’s president, and CEO, proves my aforementioned claim:

“The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the U.S. dollar. Our commitment to responsible innovation and compliance, and our track record delivering new experiences to our customers, provides the foundation necessary to contribute to the growth of digital payments through PayPal USD.”

Overall, it is obvious that PayPal USD is sort of a bridge between fiat and Web3 customers, and this is another case in point of traditional banking slowly fusing with Web3 technologies.

Conclusion

DeFi is truly racing across the technological dimension. But what is the future of it?

There is a great chance that the institutional crypto adoption would make boundaries between banks and blockchain totally vanish, hence DeFi as an independent realm may become the new implication of the banking system, with no competitors alongside.

From a bit different perspective, traditional banking, DeFi, and crypto will continue to exist as separate industries and rarely converge. But it is impossible for us to assess the positive or negative characteristics of such predictions. The time will show.