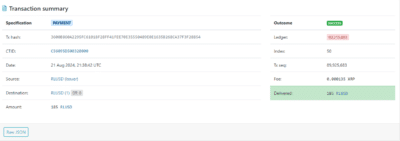

Ripple has successfully burned off all 185 RLUSD tokens initially provided during the company’s private beta stage. According to the XRP Ledger validator and data from XRPScan, this move is critical to Ripple’s gradual entry into the stablecoins market, which is expected to reach $2.8 trillion by 2028. The RLUSD stablecoin, which is planned to be released before the end of 2024, has also been thoroughly tested in a private environment.

Source: Ripple USD (RLUSD) Tracker

Reducing Uncertainty Over Time As Excitement Rises

In this testing phase, Ripple debunked fake news which mentioned that RLUSD had already launched. The leadership of the Ripple and other fans of the platform often urge users to check the information received from other sources in official sources in order to not get involved in a scam. Some members of the XRP community have speculated that RLUSD could hurt XRP. However, Ripple has clarified that RLUSD is meant to coexist with XRP in Ripple’s ecosystem.

Also Read: Ripple Case Faces Uncertain Appeal as Judges Show Support for Torres’ Ruling

Ripple’s Strategic Positioning

Looking at the RLUSD, it is evident that Ripple takes a cautious and gradual approach to entering the stablecoin industry. One can see that the burn of 185 RLUSD tokens represents an essential stage in such a process, as this shows that Ripple is keen on intensive testing and preparation. Focusing on conquering potential risks and achieving smoother continuation also reflects the company’s primary goal of creating an essential position in the stablecoin market. While RLUSD is yet to launch, the launch of new stablecoins has already surpassed $177 billion, and this may see Ripple become a strong player in this emergent market.

Conclusion

As Ripple continues to fine-tune RLUSD, the company remains focused on tackling potential challenges before the stablecoin’s public release. A successful launch of RLUSD could place Ripple in the stablecoin market and reaffirm its position in the continuously changing landscape of virtual assets. If correctly implemented, Ripple has the potential to create a significant ripple effect in the stablecoin segment of the global economy, facilitating CROSS border payment and inspiring global trade.

Also Read: Ripple and Kraken Achieve Legal Milestone as Court Rejects SEC’s Crypto Asset Security Theory